In response to the most up-to-date on-chain knowledge, the Bitcoin Community Model to Transactions (NVT) Golden Inappropriate has fallen true into a critical discipline. What could perchance well this mean for the trace of the premier cryptocurrency?

What Does The Falling NVT Golden Inappropriate Mean For Model?

In a fresh Quicktake post on the CryptoQuant platform, an analyst with the pseudonym Burakkesmeci published that the price of Bitcoin could perchance well need reached a “local bottom.” This thrilling prognosis is essentially based completely on the most up-to-date circulation by the “NVT Golden Inappropriate” metric.

For context, the “Community Model to Transactions” ratio is an on-chain indicator that estimates the adaptation between the Bitcoin market capitalization and transaction volume. Typically, a excessive NVT trace signals that an asset’s trace is excessive when in contrast to the community’s transaction volume, suggesting that the coin is overrated.

Conversely, when the price of the NVT metric is low, it implies that the coin’s market trace is diminutive relative to the transaction volume. Typically, which capacity the asset is undervalued and its trace could perchance well soundless bear room for upside circulation.

Now, the Golden Inappropriate indicator is a modified iteration of the NVT ratio, and it helps to trace unhurried aquire and sell zones in non eternal traits. In response to Burakkesmeci defined that as soon as the NVT GC exceeds 2.2 (the purple zone), it capacity that the price in a non eternal trend is overheating (and the formation of a doable local top).

On the opposite hand, the NVT Golden Inappropriate dipping below -1.6 suggests that the price decline is finishing up, signaling a doable bottom. Burakkesmeci notorious that these local tops and bottoms are regions reasonably than correct actual ranges.

As confirmed within the chart above, the NVT Golden Inappropriate has crossed beneath -1.6 and is within the period in-between around -3.3, suggesting that the Bitcoin trace is at an enviornment bottom. In response to the CryptoQuant analyst, this would perchance presumably signify a “unhurried procuring opportunity” for investors having a watch to get into the market.

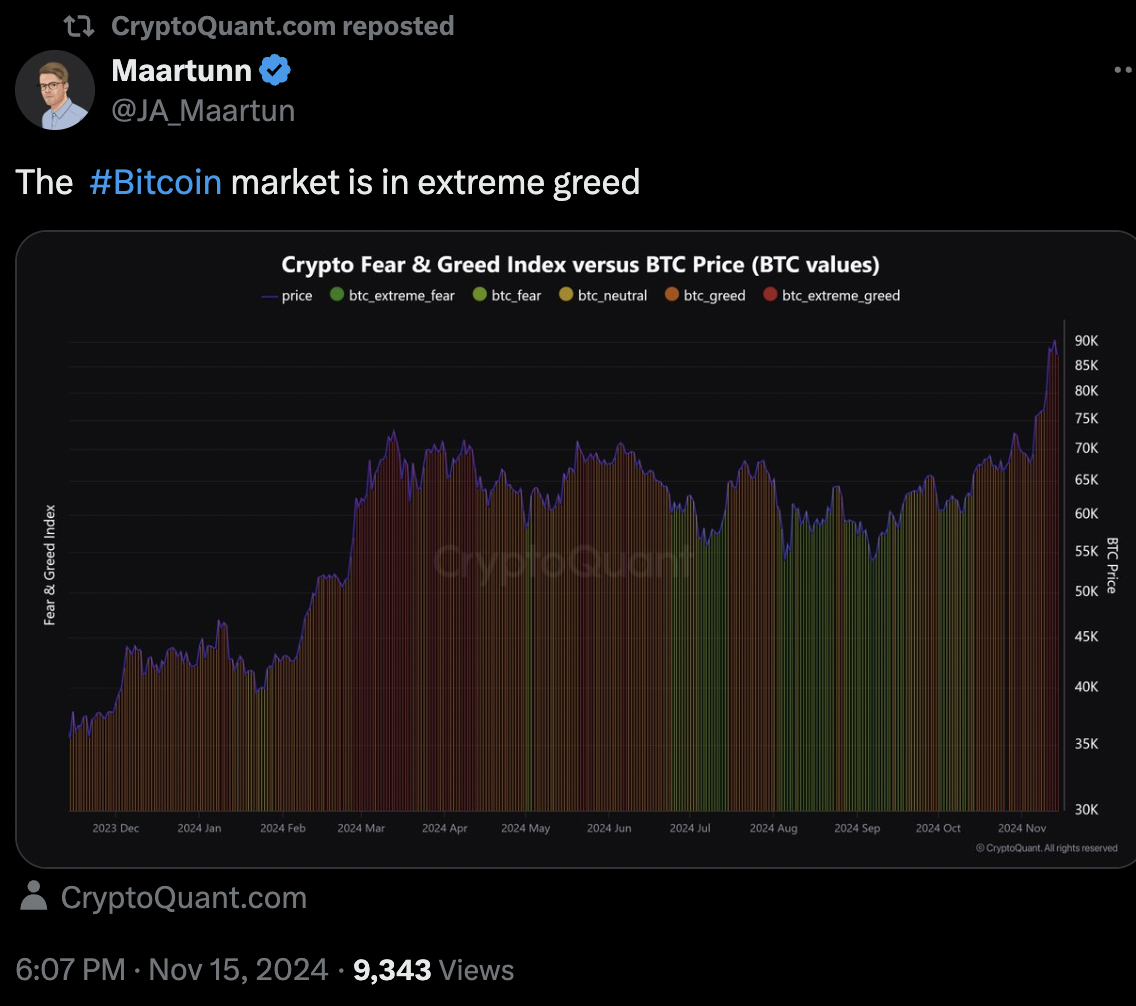

Bitcoin Market In Erroneous Greed

Investors will are making an try to proceed with warning namely as the Bitcoin market seems overheating within the very long timeframe. In response to at least one more CryptoQuant analyst, the Apprehension & Greed Index has flagged vulgar greed for the premier cryptocurrency.

Typically, when the Apprehension & Greed Index strikes toward one quit, there is a doable for market reversal looking on the sentiment. On this case, the keep the market is in vulgar greed, the Bitcoin trace could perchance well unbiased be about to stare a correction.

As of this writing, the price of BTC sits correct beneath $91,000, reflecting a 3% amplify within the past day. In response to CoinGecko knowledge, the market chief is up by a ambitious 19% within the final notice seven days.

Featured image from iStock, chart from TradingView

Disclaimer: The solutions stumbled on on NewsBTC is for academic functions

entirely. It does no longer signify the opinions of NewsBTC on whether or no longer to get, sell or retain any

investments and naturally investing carries risks. You are told to conduct your non-public

research sooner than making any investment choices. Use knowledge supplied on this internet pages

entirely at your non-public anguish.