Investor hobby within the set of abode Ethereum ETFs (change-traded funds) perceived to acquire waned after failing to register a procure inflow day for six consecutive days. Nevertheless, the cryptocurrency products ended the week on a excessive with a if truth be told intensive capital inflow on Friday, November 22.

This capital inflow represents a shift in investor sentiment, which has no longer notably been distinct at some stage within the last few days. Nevertheless, the market could well be hoping that this newly found momentum would persist and most likely additionally space off some bullish action for the ETH tag.

Can Ethereum ETFs Be optimistic ETH’s Label Recovery?

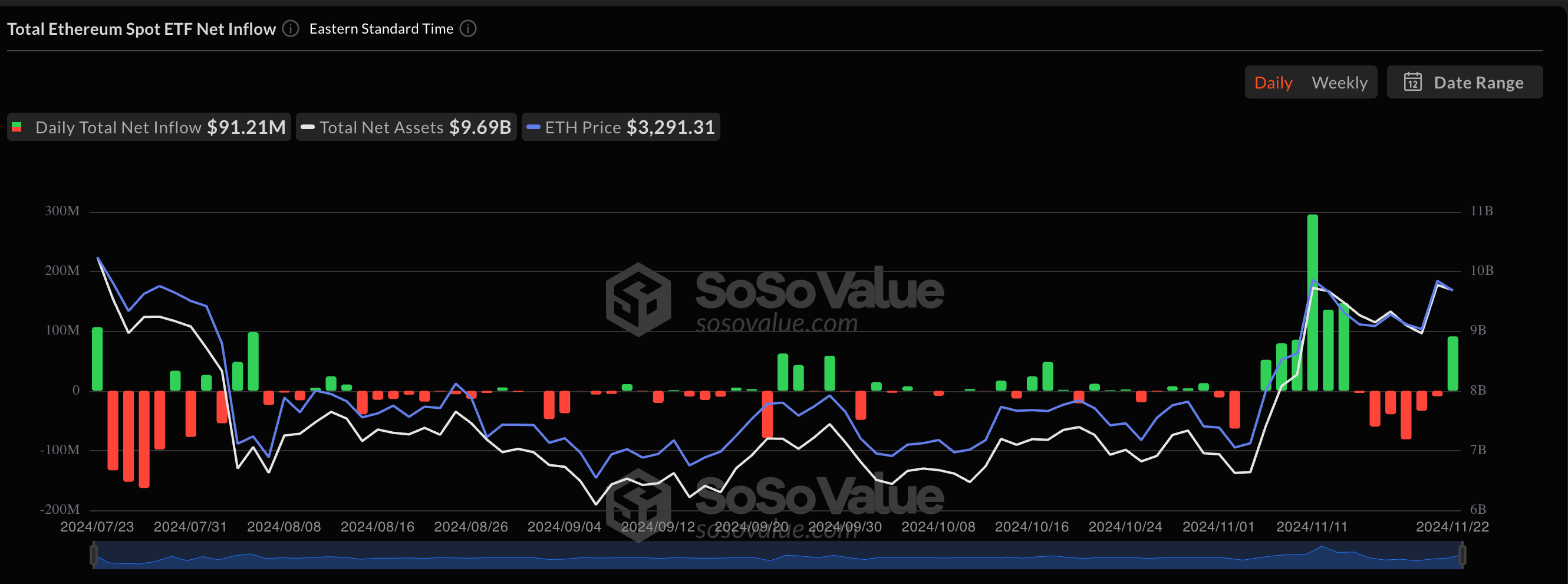

Per doubtlessly the most contemporary files from SoSoValue, the United States-essentially essentially essentially based set of abode Ethereum ETFs witnessed a procure inflow of $91.21 million on Friday. This distinct single-day efficiency represents the first procure inflow for the change-traded funds since November 13.

Market files reveals that a vital allotment of the inflows got right here from BlackRock’s iShares Ethereum Belief (with the ticker ETHA). The crypto product registered around $Ninety 9.7 million in total day to day inflows to discontinuance the earlier week.

Fidelity’s Ethereum Fund (with the ticker FETH) and Bitwise’s Ether ETF (ETHW) were the correct a couple of products to put up capital inflows on Friday, recording $5.76 million and $4.96 million, respectively. Grayscale’s ETHE and ETH registered outflows of over $18.5 million and $621,000, respectively.

As earlier talked about, Friday’s efficiency represents a return to distinct inflows for the Ethereum ETFs. Earlier than this showing, the crypto products posted six consecutive outflow days, draining a cumulative total of $225.6 million within this duration.

The price of ETH, which initially set perceived to acquire found its footing, additionally slowed down at some stage in this duration of the Ethereum ETFs outflow. This pattern highlights the vital influence of the change-traded funds on tag action — both for the arena’s finest cryptocurrency Bitcoin and Ethereum.

With the fortunes of the US-essentially essentially essentially based Ethereum ETFs reputedly turning around, the price of ETH has additionally taken an upward swing within the last couple of days. Merchants will be hoping that the distinct momentum for the Ethereum ETFs continues and interprets into the altcoin’s tag.

Ethereum Label At A Gape

As of this writing, the price of ETH stands at around $3,423, reflecting a 2.1% amplify within the past day. The altcoin is up by extra than 9% on the weekly timeframe, per files from CoinGecko.

Featured describe created by Dall-E, chart from TradingView

Disclaimer: The files found on NewsBTC is for academic functions

finest. It would now not articulate the opinions of NewsBTC on whether or no longer to aquire, sell or preserve any

investments and naturally investing carries dangers. It’s seemingly you’ll maybe well be urged to conduct your acquire

be taught sooner than making any funding selections. Use files supplied on this online page

fully at your acquire probability.