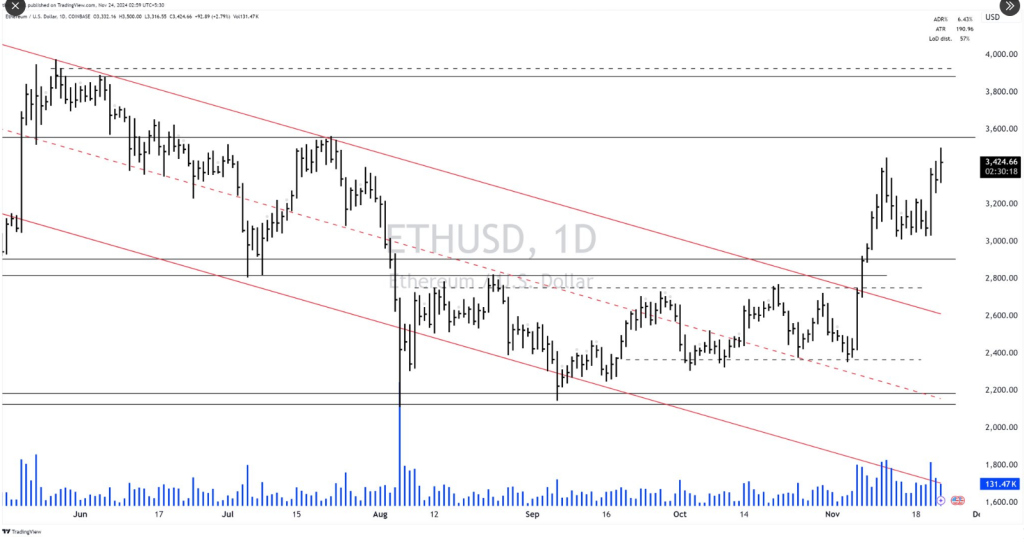

Breaking out of an eight-month downward model, Ethereum (ETH) is support within the files. This marks a main turning level for the 2d-biggest cryptocurrency by market capitalization.

The coin rose extra than 5% in a single day, reaching $3,525, and has won 38% within the closing 30 days. Analysts are buzzing, implying that ETH accumulated has plenty of upside doable as it continues to upward push.

This most up-to-date leap forward has impressed extra long-established market self assurance. ETH has risen by 10% over the final week, as a consequence of this reality confirming its dominance within the crypto scene. Technical analysts love Logical Trader mutter that this wander indicators the starting of a longer-term bullish model with medium- and long-term growth clearly evident.

What a pass in ETHUSD

Here’s how the value might perchance possibly additionally merely accumulated behave when it breaks out of the descending model channel. #crypto #Ethereum pic.twitter.com/tepsK7grmO— Logical Trader (@logicaltra6er) November 23, 2024

Bullish Technical Signals

Ethereum’s technical indicators masks a obtain upward model. The Relative Energy Index (RSI) has reached 70, indicating heavy buying stress. Furthermore, ETH has broken its 30- and 200-period exciting averages, strengthening its bullish model.

Titan of Crypto famend an racy pattern: a weekly closure elevated than the Kumo Cloud. With a probable 2d map of $4,862 might perchance possibly additionally merely accumulated momentum continue, this technical breakout initiatives ETH might perchance possibly soon check resistance stages approach $4,189.

#Altcoins #Ethereum Golden Sinister Incoming 🚀#ETH has closed above the weekly Kumo Cloud: a extremely important milestone.

This breakout might perchance possibly pave the attain to $4,100 next! 🎯 pic.twitter.com/q0eOVgxgnU

— Titan of Crypto (@Washigorira) November 25, 2024

The upside would get extra boosted with an upcoming Golden Sinister, whereby the shorter-term exciting average will rotten above the longer-term one. If truth be told, this has historically ended in very obtain tag rallies. If such bullish signs are accompanied by sustained buying exercise, ETH might perchance possibly additionally merely attain these elevated tag stages within the approach term.

Ethereum Fundamentals Stay Sturdy

Beyond the technical prowess, Ethereum shines accumulated thru its obtain dominance in decentralized finance, or DeFi, and a myriad of blockchain applications. The community holds extra than half of of the total tag locked into DeFi, so it is some distance indubitably pertinent to the ecosystem.

Furthermore, the emergence of ETH-primarily primarily based mostly layer-2 choices increases their scalability and charm to both developers and customers.

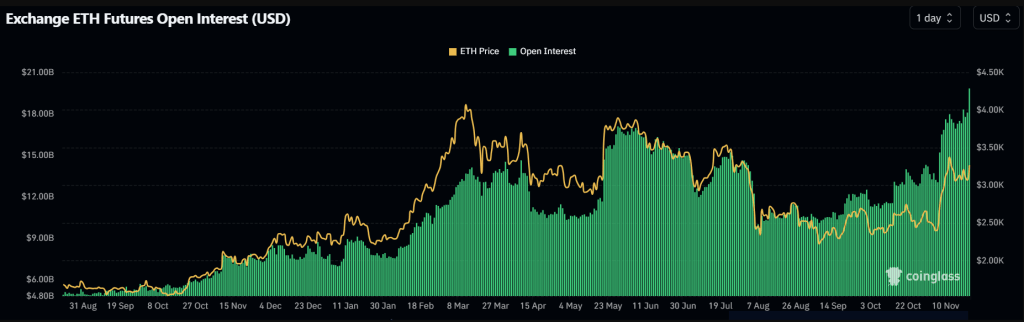

Meanwhile, exercise within the Ethereum derivatives market is soaring. Originate curiosity has topped $20 billion, with merchants eyeing $3,400 and $3,500 for choices that expire soon. Elevated transaction volumes per block are also driving up fees, lowering ETH’s circulating present and doubtlessly elevating costs even extra.

Room For development amidst optimism

Whereas Ethereum’s tag has elevated by 66% within the outdated three hundred and sixty five days, many analysts mutter it remains undervalued. Predictions of a assemble above $4,800 this cycle gift the market’s belief in ETH’s future.

On the identical time, if pro-crypto legislation passes within the US, it can probably tempo up the upward thrust of crypto great extra. Ethereum looks to be like love this might perchance possibly plug up, doubtless even to new all-time highs, as a consequence of its fundamentals are obtain, it is some distance gaining popularity, and its technical setup is nice.

Featured image from DALL-E, chart from TradingView

Disclaimer: The recommendations stumbled on on NewsBTC is for academic applications

utterly. It doesn’t signify the opinions of NewsBTC on whether to rep, sell or assign any

investments and naturally investing carries dangers. That you can additionally very neatly be urged to conduct your receive

study sooner than making any funding choices. Exercise files equipped on this web field

utterly at your receive threat.