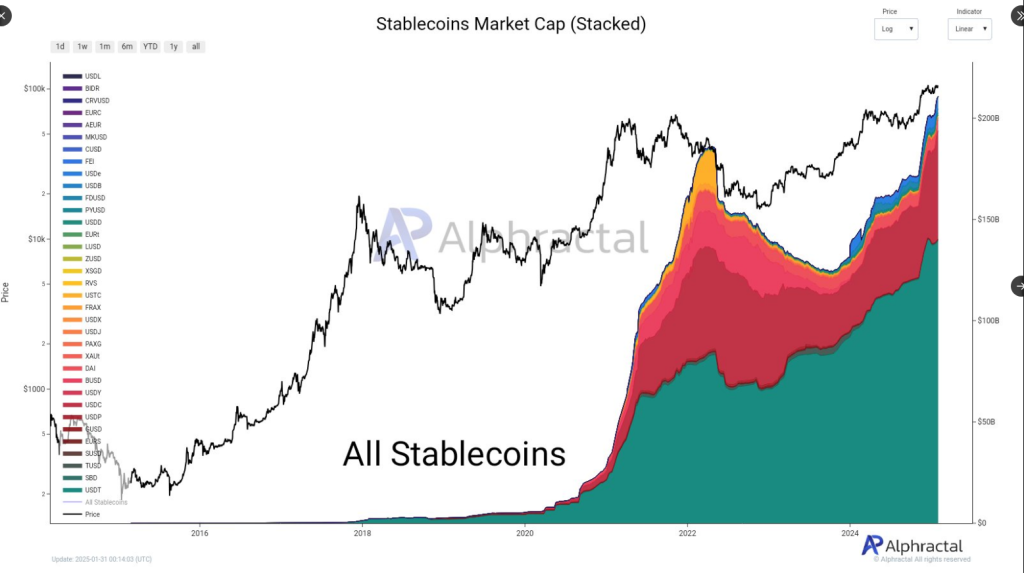

For the past few months, stablecoins hold yielded the highlight to their extra speculative counterparts, along side tokens inspired by politicians. Then as soon as more, fresh on-chain data suggests that stablecoins are lend a hand and hold surpassed the $200 billion market cap.

According to the info shared by Alphractal, the phase’s capitalization has surged to $211 billion, a story excessive, attributable to months of proper boost, which started in mid-2023.

Stablecoins‘ market capitalization grew by 73% from its August 2023 fee of $121 billion, updated data launched on January Thirty first expose. The principal driver of this phase’s boost is unexcited Tether’s USDT, then as soon as more, USDC has been gaining floor recently, which is charming.

🚨 Stablecoin Market Cap Surpasses $211B – USDC Good points Momentum!

Since 2023, the stablecoin market has grown enormously, basically pushed by USDT (Tether). Then as soon as more, recently, USDC has been gaining an edge over varied stablecoins.

This trend is going down attributable to the fresh fall in… pic.twitter.com/IRKrQErmCE

— Alphractal (@Alphractal) January 31, 2025

Tether’s USDT Stays Major Driver Of Command

Since 2023, the stablecoin market has grown regular, principally attributable to Tether’s USDT. As of now, stablecoins are price $223 billion, which is a 0.2% amplify from the day earlier than this day.

Interestingly, USDT and USDC are the latest boost drivers of stablecoins. Rather then the numbers from both coins, the stablecoins team hasn’t changed principal since 2023 and has shown regular and realistic values. Perfect now, Tether’s USDT is valued at nearly $140 billion, and USDC is at $fifty three billion.

USDC Slowly Good points Ground On Diversified Cash

Alphractal’s post on Twitter/X exhibits that USDC has been gaining floor over varied stablecoins in the market. According to the post, that is going down attributable to a fall in altcoin prices and since a tall a part of the sell-offs were swapped into USDC.

The post additionally confirmed that USDC’s dominance on this phase has hit a key resistance level, the same quantity noticed in 2021. This used to be the beginning of the endure market in 2022 when Bitcoin’s designate dropped to as low as $15,500. If this metric persists, it might perhaps most likely abet because the market’s bearish signal, impacting investors’ buying decisions. Then as soon as more, if this metric declines, it’ll additionally be USDC’s leaping board to express new highs.

What To Put a question to From The Stablecoins Segment In The Short-Timeframe

Within the final bull accelerate, USDC’s provide elevated in May perhaps also just, then reached its excessive in March 2022. The stablecoin’s market cap elevated by 170% from April 2021 to March 2022. If the latest coin provide continues to develop but designate starts to dip, then the stablecoin market would perhaps hit its top in just a few months.

Traditionally, a rising market cap for stablecoins reflects growing investors’ self belief, which indicators an amplify in capital inflows.

On the opposite, a rising stablecoin market cap is most incessantly associated with growing investor conviction, signaling the functionality for boosted capital inflows. This means that the bullish momentum would perhaps proceed for just a few extra months.

Featured image from Gemini Imagen, chart from TradingView

Disclaimer: The easy job came upon on NewsBTC is for academic functions

only. It does no longer signify the opinions of NewsBTC on whether to aquire, sell or protect any

investments and naturally investing carries risks. You are instant to conduct your possess

study earlier than making any funding decisions. Bid data supplied on this web fair

fully at your possess chance.