The AVAX designate has been largely aloof since the originate of 2025, mirroring the native climate of the altcoin market up to now in the fresh 365 days. After reaching a local excessive of $55 in early December 2024, the Avalanche token has been in a loyal decline, reaching as low as $32.2 on Wednesday, January 29.

Traders, Gaze Out For These Designate Ranges

In a fresh put up on the X platform, accepted crypto analyst Ali Martinez revealed the important thing on-chain ranges that will trace pivotal to the long term trajectory of AVAX designate. This on-chain statement makes a speciality of the typical rate foundation of several Avalanche investors.

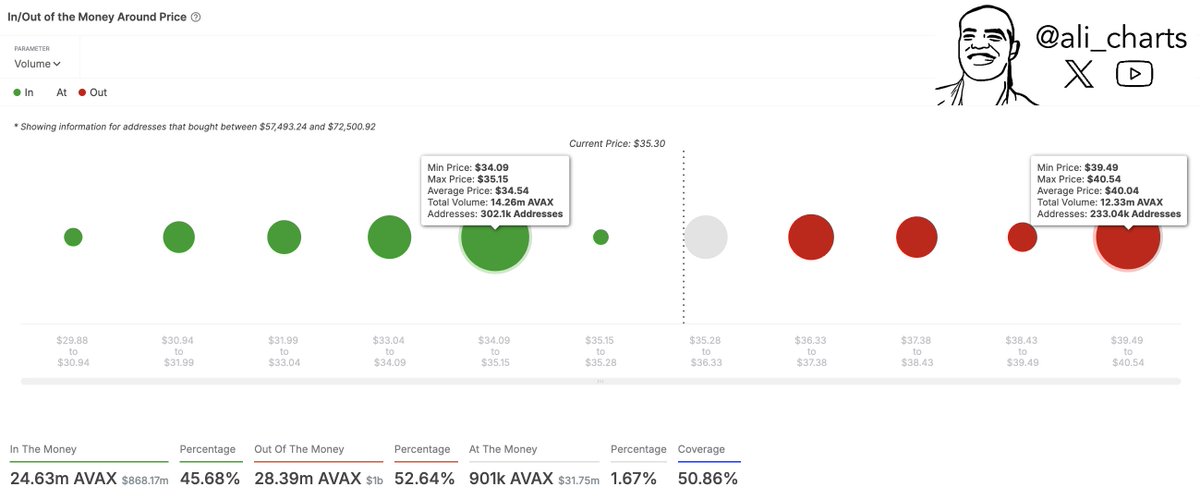

In rate-foundation analysis, a zone’s skill to lend a hand as toughen or resistance is dependent upon the full quantity of tokens closing bought by investors at the stage. As proven in the chart under, the scale of the dot represents and is straight proportional to the amount of AVAX tokens bought inner each corresponding designate vary.

Essentially based on details from IntoTheBlock, spherical 302,100 addresses bought approximately 14.26 million AVAX tokens right by the associated rate vary of $34.01 and $35.15. As highlighted by Martinez, this has led to the formation of a crucial toughen cushion inner this designate location.

The $34.5 location is interesting to act as a crucial toughen stage as a result of amount of investors with their rate foundation in and spherical it. The reason is that as soon as the AVAX designate returns to $34.5, investors with their rate foundation spherical this zone have a tendency to double down and defend their location by buying more tokens, allowing costs to hasty enhance.

Moreover, IntoTheBlock details reveals that the $39.49 – $40.54 designate bracket is for the time being thick with investors. Essentially based on details from IntoTheBlock, more than 233,000 addresses sold over 12.33 million AVAX between the associated rate vary.

Martinez infamous that this $39.49 – $40.54 designate location is a predominant resistance zone because investors are continuously more seemingly to fetch a tear when an asset returns to their rate foundation. In this scenario, investors who were in the red earlier than would possibly maybe also simply are attempting to hasty promote their holdings as soon as they enter income, which would possibly maybe location downward strain on the AVAX designate.

The designate action of the AVAX spherical two areas would possibly fetch or mar its performance over the next couple of weeks. Attributable to this truth, investors would possibly are attempting to pay extra consideration to the altcoin on every occasion it approaches these toughen and resistance zones.

AVAX Designate At A Notice

As of this writing, the worth of AVAX stands at spherical $34.8, reflecting a mere 1% develop in the previous 24 hours. The premier cryptocurrency’s performance is a long way more humdrum on better timeframes. Essentially based on details from CoinGecko, the Avalanche is down by stop to 3% in the previous seven days.

Featured image from IQ.wiki, chart from TradingView

Disclaimer: The working out realized on NewsBTC is for academic functions

entirely. It would no longer signify the opinions of NewsBTC on whether or to no longer aquire, promote or retain any

investments and naturally investing carries risks. It is possible you’ll maybe presumably also very properly be suggested to conduct your admire

review earlier than making any investment selections. Employ knowledge equipped on this web online page

entirely at your admire threat.