The XRP market experienced a downbeat live to January translating into a 7.05% loss over the past seven days. On the realm of future stamp actions, widespread analyst Egrag Crypto states the altcoin is at the moment at a key crossroads with an equal likelihood to transfer in either a sprint or negative direction.

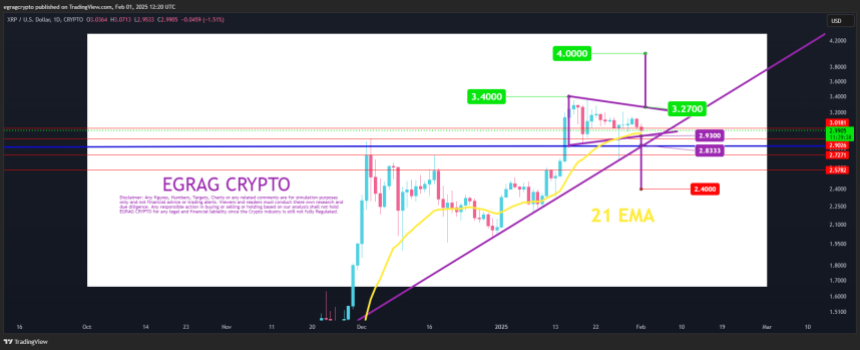

In an X post on February 1, Egrag Crypto explains that XRP’s recent go has resulted in the asset retesting two well-known levels namely the 21 EMA and and the bottom boundary of a symmetric triangle.

The exponential shifting practical (EMA) is a technical indicator that smoothens out stamp data over a interval of days (i.e. 21 on this case) whereas giving extra weight to recent costs. It’s a ways generally venerable in development affirmation with a stamp dip beneath the EMA line indicating a bearish development and vice versa for a bullish development. On the opposite hand, a symmetric triangle formed by stamp circulation signals a interval of consolidation sooner than a decisive stamp breakout.

With the rate of XRP concurrently hovering near the 21 EMA line and the lower boundary of the symmetric triangle spherical $2.93, the altcoin gifts a relatively comfortable relate to traders and traders alike. Primarily basically based mostly on Egrag Crypto, extra declines for XRP are probably. Nonetheless, costs are no longer seemingly to descend beneath $2.83 ( the ascending crimson line) which has served as a stable enhance zone in step with historical data.

Nonetheless, in step with the only prognosis of the symmetrical triangle, a rupture beneath the lower boundary would possibly presumably well also force XRP to alternate as low as $2.40. Alternatively, must mild XRP rupture above the upper boundary of the triangle, it would also straight rally to $4. Egrag Crypto warns that each breakout chances are equally weighted. Therefore, the XRP market is enviornment to excessive levels of volatility over the approaching days.

Whales Offload 70 Million XRP In 4 Days

In other news, crypto expert Ali Martinez reviews that XRP whales are at the moment on a selling spree having offloaded 70 million XRP, valued at $204.4 million, over the past day. High selling assignment in particular from whales is a bearish signal that signals uncertainty in regards to the prolonged hump profitability of an asset. Alternatively, sure prolonged-timeframe holders would possibly presumably presumably be looking out for to elevate profit.

Nonetheless, XRP retail traders would possibly presumably well also search data from extra stamp drops in the quick timeframe, barring the introduction of serious buying tension. At press time, XRP trades at $2.93 reflecting a 3.10% decline in the past day. Meanwhile, the asset trading quantity is down by 12.60% and valued at $4.06 billion.

Featured image from iStock, chart from Tradingview

Disclaimer: The data learned on NewsBTC is for educational functions

good. It would no longer recount the opinions of NewsBTC on whether to aquire, sell or lend a hand any

investments and naturally investing carries dangers. You are advised to habits your possess

analysis sooner than making any investment choices. Use data equipped on this web pages

completely at your possess threat.