Most predominant fluctuations in the Ethereum (ETH) market the day earlier than at the present time triggered a wave of reactions across social media, with one Ethereum co-founder claiming that obvious mammoth holders—or “whales”—had been deliberately pushing the asset’s mark downward.

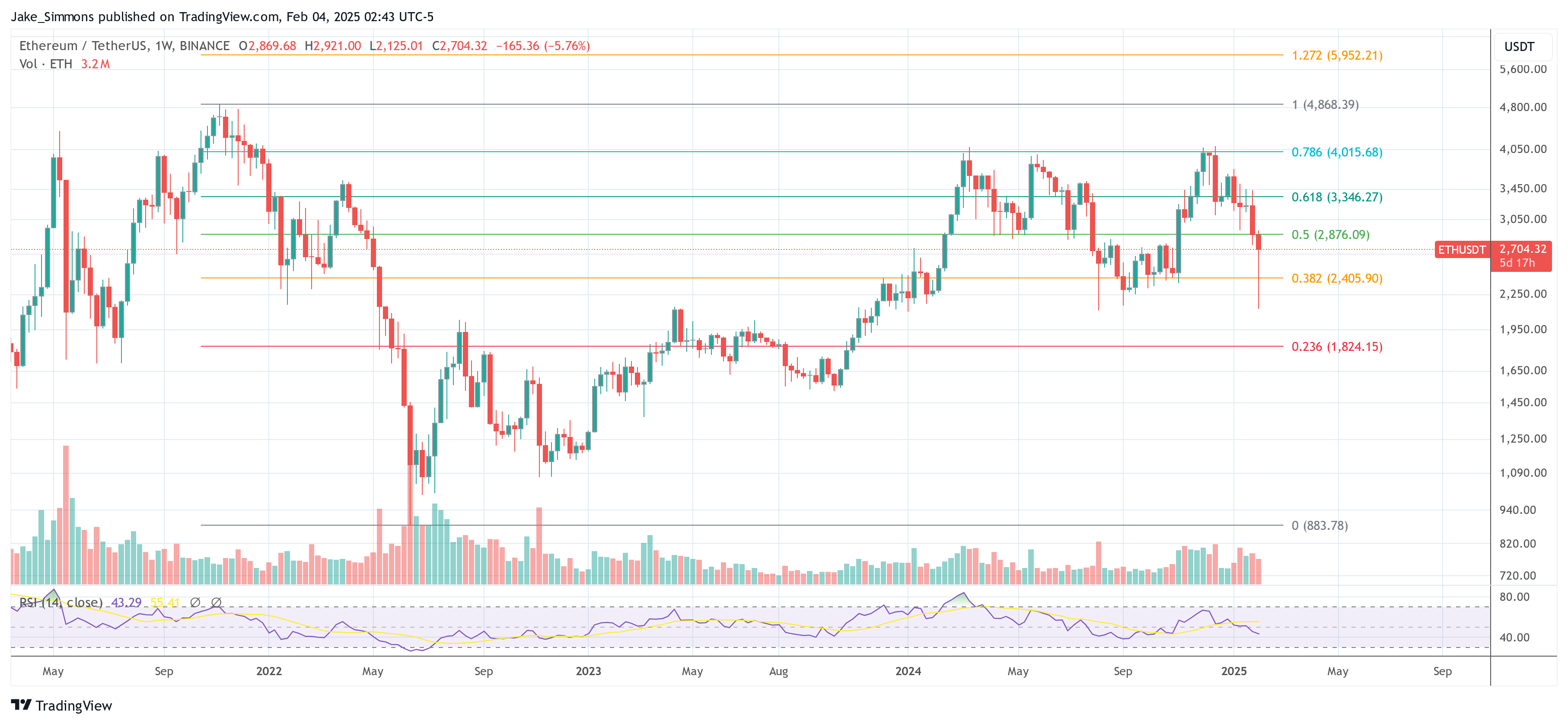

The assignment reached a fever pitch on Monday, February 4, when the ETH mark swung from around $2,900 to as diminutive as $2,120 earlier than bouncing encourage sharply. Despite the intraday drop, Ether in a roundabout contrivance closed the day wearing a 26% green wick—a conventional mark rebound in this kind of short window.

Ethereum Ticket Manipulated By Whales?

Analysts attributed the dramatic motion to external macroeconomic forces, most significantly the US substitute war below President Donald Trump. After imposing tariffs on Mexico and Canada early in the day, the president later struck an association that spurred a rapid recovery across global markets, including cryptocurrency.

The turbulence led one observer, identified simply as “intern” (@intern), the director of suppose at Monad, to put up a stark sentiment on X: “ETH is demise moral in entrance of us. actually never thought this may perhaps perhaps happen.”

In response, Ethereum co-founder and ConsenSys CEO Joseph Lubin offered a serene outlook, underscoring that a spread of those mark swings are now no longer outlandish for the digital asset: “It occurs on a conventional basis. Then it surges. What we are seeing is whales taking profit of industrial turmoil and adversarial sentiment to shake out veteran fingers, bustle stops, and then aquire encourage when they may be able to bustle that identical playbook in reverse.”

Lubin’s assertion items a cyclical working out of crypto volatility, implying that bigger gamers capitalize on market fear—continually exacerbated by macro traits—to stress less resilient patrons into selling.

Plenty of neatly-known crypto merchants additionally commented on the events, particularly on accusations of whale-led manipulation.

One correctly-identified figure, Hsaka (@HsakaTrades), told rookies now to no longer specialize in ETH’s decline was as soon as driven purely by natural market sentiment: “Pricey noobs, Ethereum is NOT naturally occurring. It’s being pushed down by assignment of whales placing spoofy promote orders on exchanges to affect noobs and risk managers promote to ‘aquire encourage decrease’. They’re stealing your bags and must affect you aquire encourage at a nearer mark.”

The notion of a concerted “spoofing” formulation—the assign mammoth promote orders are positioned and then canceled or superb in part stuffed—has long circulated within crypto communities. The method reportedly targets to field off fright sells, thereby letting so-called whales receive positions at more favorable mark levels.

Prominent vendor Pentoshi (@Pentosh1) offered a mercurial nonetheless pointed response, highlighting how ETH has underperformed relative to Bitcoin (BTC) throughout the final three years: “3 365 days shake out to this level. Hope you’re moral.”

The query of why whales would single out Ether particularly was as soon as raised by community member EVMaverick392.eth (@EVMaverick392): “Presumably I’ll sound naive, nonetheless why assemble whales affect this maneuver exclusively on ether?”

Lubin responded by drawing a parallel to primitive monetary institution robberies and suggesting that the most modern wave of unease surrounding the Ethereum ecosystem has made the asset a high purpose: “Why assemble monetary institution robbers rob banks— or primitive to? The (unjustified) FUD in direction of the Ethereum ecosystem is currently most pronounced.”

At press time, ETH traded at $2,704.

Featured image created with DALL.E, chart from TradingView.com

Disclaimer: The certainty chanced on on NewsBTC is for tutorial functions

superb. It does now no longer explain the opinions of NewsBTC on whether to aquire, promote or support any

investments and naturally investing carries dangers. You are told to conduct your like

research earlier than making any investment decisions. Dispute knowledge supplied on this web field

fully at your like risk.