The Bitcoin MVRV Z-Fetch has historically been one amongst the excellent instruments for figuring out market cycle tops and bottoms in Bitcoin. This day, we’re inflamed to fragment an enhancement to this metric that makes it even more insightful for this day’s dynamic market stipulations.

What Is the Bitcoin MVRV Z-Fetch?

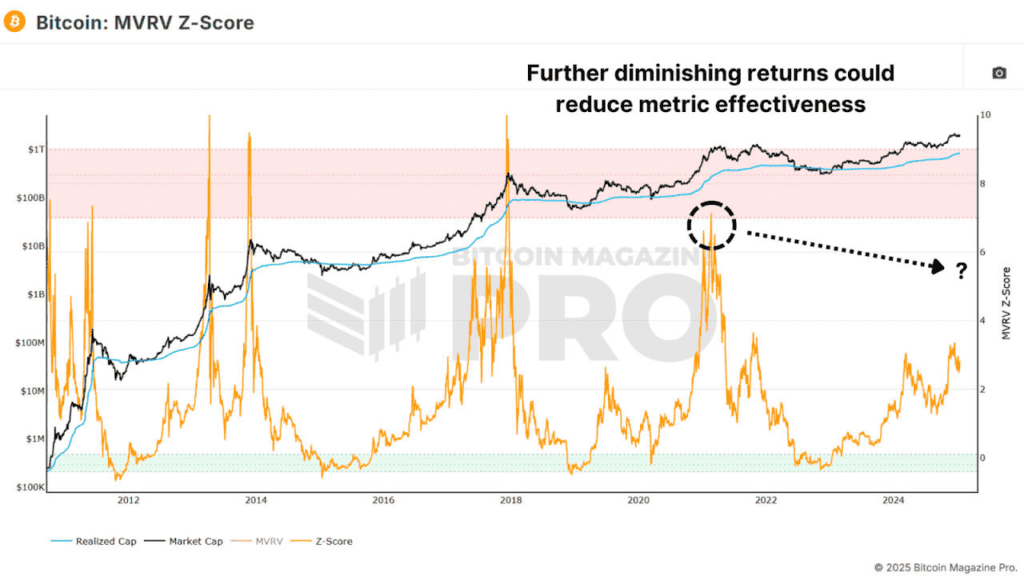

The MVRV Z-Fetch is derived by examining the ratio between Bitcoin’s realized cap (the in model acquisition model of all Bitcoin in circulation) and its market cap (present network valuation). By standardizing this ratio using Bitcoin’s model volatility (measured as the usual deviation), the Z-Fetch highlights intervals of overvaluation or undervaluation relative to historical norms.

Peaks within the red zone stamp overvaluation, suggesting optimal income-taking alternatives. Bottoms within the green zone indicate undervaluation, most ceaselessly marking stable accumulation alternatives. Historically, this metric has been remarkably appropriate in pinpointing foremost market cycle extremes.

While grand, the extinct MVRV Z-Fetch has its limitations. In past cycles, the Z-Fetch reached values of 9–10 for the length of market tops. Then once more, within the remaining cycle, the rating handiest reached round 7. This might perchance furthermore be as a result of rounded double-height cycle in reputation of the sharp blow-off high we most ceaselessly expertise. Regardless, there’s the necessity to component within the evolving market dynamics, with increasing institutional involvement and changing investor habits.

The Enhanced MVRV Z-Fetch

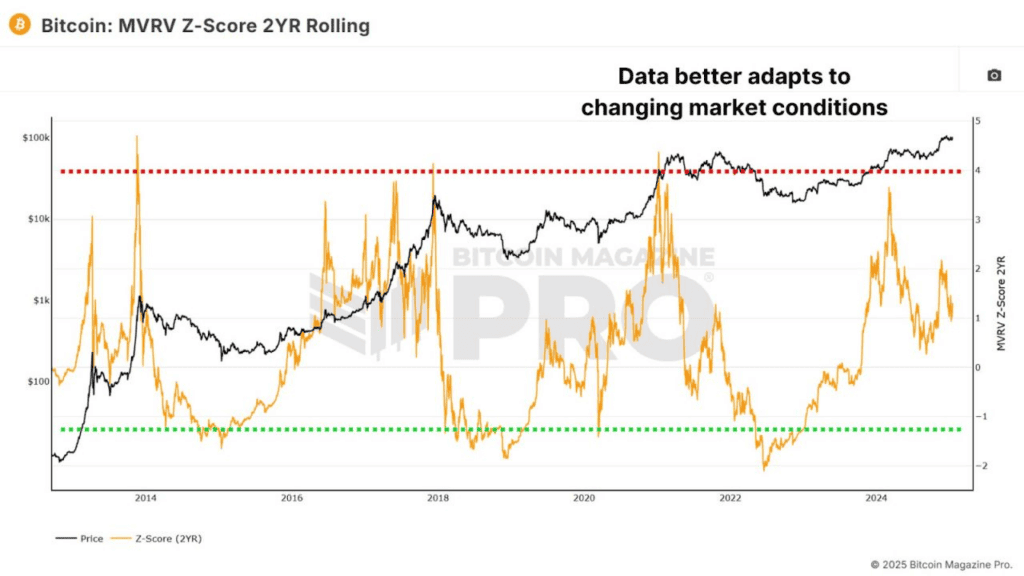

The MVRV Z-Fetch standardizes the raw MVRV files using Bitcoin’s entire model historical past, which involves the unheard of volatility of its early years. As Bitcoin matures, these early files aspects might perchance furthermore distort its relevance to present market stipulations. To tackle these challenges, we’ve developed the MVRV Z-Fetch 2YR Rolling. Other than using Bitcoin’s entire model historical past, this version calculates volatility essentially based mostly handiest on the outdated two years of files.

This variety better accounts for Bitcoin’s increasing market cap and shifting dynamics and ensures the metric adapts to more moderen trends, offering higher accuracy for contemporary market diagnosis. It serene excels at figuring out market cycle tops and bottoms nonetheless adapts to in model stipulations. In the remaining cycle, this version captured the next height price than the extinct Z-Fetch, aligning more closely with 2017’s model circulate. On the diagram back, it continues to name stable accumulation zones with high precision.

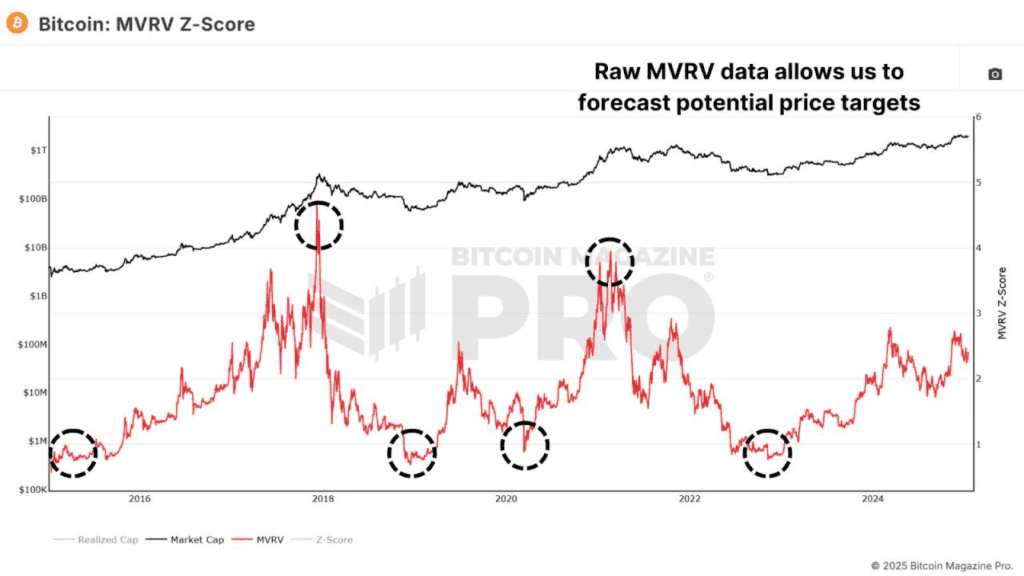

Uncooked MVRV Ratio

Yet every other complementary system involves examining the MVRV ratio without standardizing for volatility. By doing so, we can survey the outdated cycle’s MVRV ratio peaked at 3.96, in contrast to 4.72 within the cycle before that. These values indicate much less deviation, doubtlessly offering a more stable framework for projecting future model targets.

Assuming a realized model of $60,000 (factoring within the present projected lengthen over the following six months) and an MVRV ratio of three.96, a doable height model would be stop to $240,000. If diminishing returns nick encourage the ratio to three.0, the height model might perchance perchance serene attain $180,000.

Conclusion

While the MVRV Z-Fetch is serene one amongst the excellent instruments for timing market cycle peaks and bottoms, we must serene be ready for this metric doubtlessly now no longer reaching identical highs as prior cycles. By adapting this files to better component within the changing market dynamics of Bitcoin, we can fable for diminished volatility as BTC grows.

For a more in-depth uncover into this subject, compare out a contemporary YouTube video right here:

Making improvements to The Bitcoin MVRV Z-Fetch

For more detailed Bitcoin diagnosis and to fetch staunch of entry to developed aspects like are living charts, customized indicator signals, and in-depth industry reports, compare out Bitcoin Journal Educated.

Disclaimer: This text is for informational capabilities handiest and might perchance furthermore now no longer be opinion to be enterprise recommendation. Continually design your believe learn before making any funding choices.

Matt Crosbyhttps://www.bitcoinmagazinepro.com/

As Lead Analyst for Bitcoin Journal Educated, Matt looks to practice his expertise to provide precious perspectives on bitcoin’s market dynamics, most ceaselessly specializing within the intersection of on-chain diagnosis, macroeconomic trends, and broader monetary markets to provide insights into both quick and future outlooks.