Motive to belief

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The supreme standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Advert discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has spent the massive majority of the past 24 hours on a well-known rally that saw it save peak at an intraday high of $94,320. This rally marks a gripping alternate from the tight consolidation range between $80,000 and $85,000 that had outlined Bitcoin’s trajectory through valuable of April.

In the help of this breakout lies a predominant uptick in institutional task through Deliver Bitcoin ETFs, which recorded their top possible day-to-day inflows since January. Apparently, this inflow surge has helped push Bitcoin into the tip five biggest resources globally, surpassing Alphabet, Silver, and Amazon in market capitalization.

Deliver Bitcoin ETFs Sees Greatest Inflows Since January

In accordance with files from SoSoValue, US-basically basically based mostly Deliver Bitcoin ETFs raked in $936.43 million in salvage inflows on Tuesday, April 22 by myself, marking their handiest single-day efficiency since January 17 when it registered $1.08 billion. Wednesday, April 23 also witnessed an identical efficiency, registering inflows of $916.91 million.

BlackRock’s iShares Bitcoin Belief (IBIT) led the potential with a staggering $643.16 million in inflows, followed closely by Ark & 21 Shares’ ARKB with $129.5 million. Furthermore, Deliver Bitcoin ETFs are in point of fact on four days of consecutive inflows of $100 million or extra. The final time such occurred became within the final week of January.

These inflows into Deliver Bitcoin ETFs apply a weeks-long dry spell in ETF task, which saw many merchants question the sustainability of institutional curiosity. On the different hand, the timing of these inflows couldn’t be extra impactful. Bitcoin’s save surged in tandem with newest ETF task, exhibiting the the exact attain these ETFs maintain come to maintain on the situation save of Bitcoin.

BTC Surpasses Amazon And Google To Turn out to be Fifth Greatest Asset Worldwide

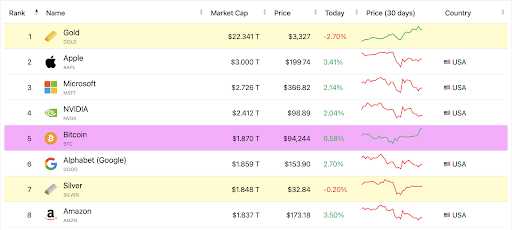

The ETF inflows lit the spark and the resulting market reaction pushed Bitcoin’s come up the realm rankings. In accordance with files from CompaniesMarketCap, Bitcoin’s total market cost climbed to over $1.87 trillion as it crossed over $94,000 for the most predominant time in eight weeks.

This attention-grabbing drag allowed it to overtake each and every Google (Alphabet) and Amazon in market cap rankings, particularly obsessed on these inventory prices were on a well-known decline in a 30-day timeframe.

This construction positions BTC no longer handiest as a number one cryptocurrency but also as a top-tier macroeconomic asset, competing on the realm stage with worn tech and commodity giants. As it stands, Bitcoin is now outperforming the NASDAQ 100, and analysts are pointing to indicators of decoupling from worn indices.

Now that Bitcoin is trading above $90,000 again, the subsequent heart of attention is on the build it goes from here. The bullish trajectory would possibly perhaps perhaps be on the $100,000 save stage, and whether BTC can break above this stage prior to the terminate of April. That acknowledged, the $94,000 build is now shaping as a lot as act as an early resistance band, and non permanent profit-taking would possibly perhaps well additionally motive pullbacks that would possibly perhaps well additionally fair liquidate aquire orders.

Featured image from Pixabay, chart from Tradingview.com

Disclaimer: The tips stumbled on on NewsBTC is for instructional purposes

handiest. It doesn’t signify the opinions of NewsBTC on whether to buy, promote or withhold any

investments and naturally investing carries dangers. It is possible you’ll perhaps perhaps perhaps additionally very neatly be told to habits your hold

learn prior to making any investment choices. Spend files offered on this web build

completely at your hold risk.