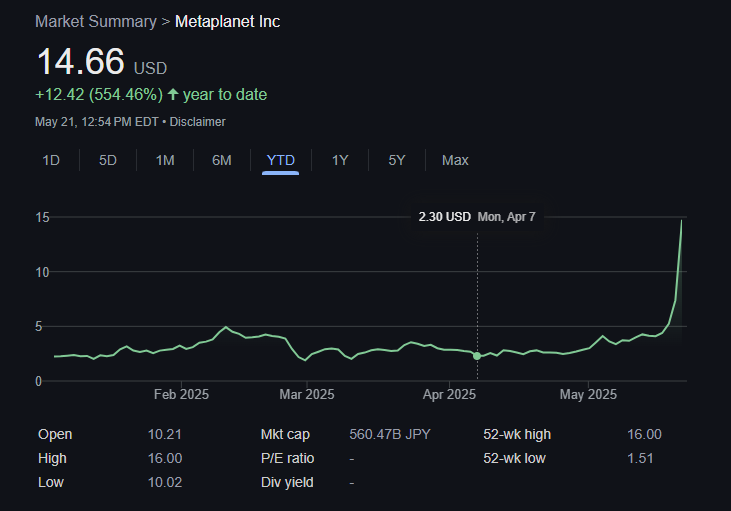

Metaplanet Inc., Japan’s main Bitcoin treasury company, surged to a contemporary all time excessive in market capitalization this week, propelled by Bitcoin’s have ancient ATH. The agency’s aggressive Bitcoin acquisition technique, modern financing, and rising investor self assurance possess pushed its valuation to ¥470.3 billion, up 554.5% year-to-date, closely tracking Bitcoin’s surge past its contemporary ATH of $109,500 at the present time.

In only over a year, Metaplanet has expanded its holdings from 98 BTC to 7,800 BTC (as of Might perchance perchance additionally 19, 2025), obtained at a median price of $103,873 per coin. That stash is now price over $800 million, as Bitcoin’s anecdote-breaking drag this year.

The most contemporary upward push followed the corporate’s announcement of completing the bulky exercise of its thirteenth to 17th sequence of stock acquisition rights below its modern “21 Million Idea.” This fairness financing campaign raised ¥93.3 billion in precisely 60 buying and selling days, fueling additional Bitcoin purchases, without diluting shareholder price. In a rare drag, these MS Warrants had been issued at a 6.8% top price over the portion price at the time.

Since announcing its listing on the OTCQX Market, Metaplanet’s development has been relentless. “We are contented to commence up buying and selling on the OTCQX Market, enabling increased entry for U.S. traders to take part in Metaplanet’s trip,” talked about the President of Metaplanet Simon Gerovich. “As Asia’s handiest devoted Bitcoin Treasury Company, this step shows our commitment to advancing Bitcoin adoption globally while enhancing shareholder price.”

Metaplanet’s development is extra than appropriate a case of staunch timing; it shows a solid, deliberate alignment with Bitcoin’s price action. Since transferring to a Bitcoin-focused technique in 2024, the corporate has posted spectacular quarterly BTC yields of 41.7%, 309.8%, 95.6%, and 47.8%. These returns possess helped pressure its find asset price up by 103.1 occasions and its market capitalization by 138.1 occasions, following Bitcoin’s quick climb.

In Q1 FY2025, Metaplanet reported its strongest monetary outcomes but. Earnings increased 8% quarter-over-quarter to ¥877 million, while running profit rose 11% to ¥593 million. Get earnings surged to ¥5.0 billion, complemented by unrealized gains of ¥13.5 billion from its Bitcoin holdings, extra strengthening the corporate’s balance sheet.

Although Bitcoin costs dipped briefly at the tip of March, causing a ¥7.4 billion valuation loss, Metaplanet without word recovered as BTC surged to contemporary anecdote stages. This solid reference to Bitcoin’s performance has led many traders to make expend of Metaplanet as an investment car to salvage Bitcoin exposure on the Tokyo Inventory Exchange.

It seems Metaplanet is the most shorted stock in Japan. Discontinuance they in point of fact deem making a bet against Bitcoin is a winning technique? pic.twitter.com/SAKsOMO4MX

— Simon Gerovich (@gerovich) Might perchance perchance additionally 21, 2025