- Berachain surged 12% to $4.71 but fell to $3.85 as bears dominated.

- The Relative Energy Index (RSI), the ADX, and the MACD signal bearish momentum.

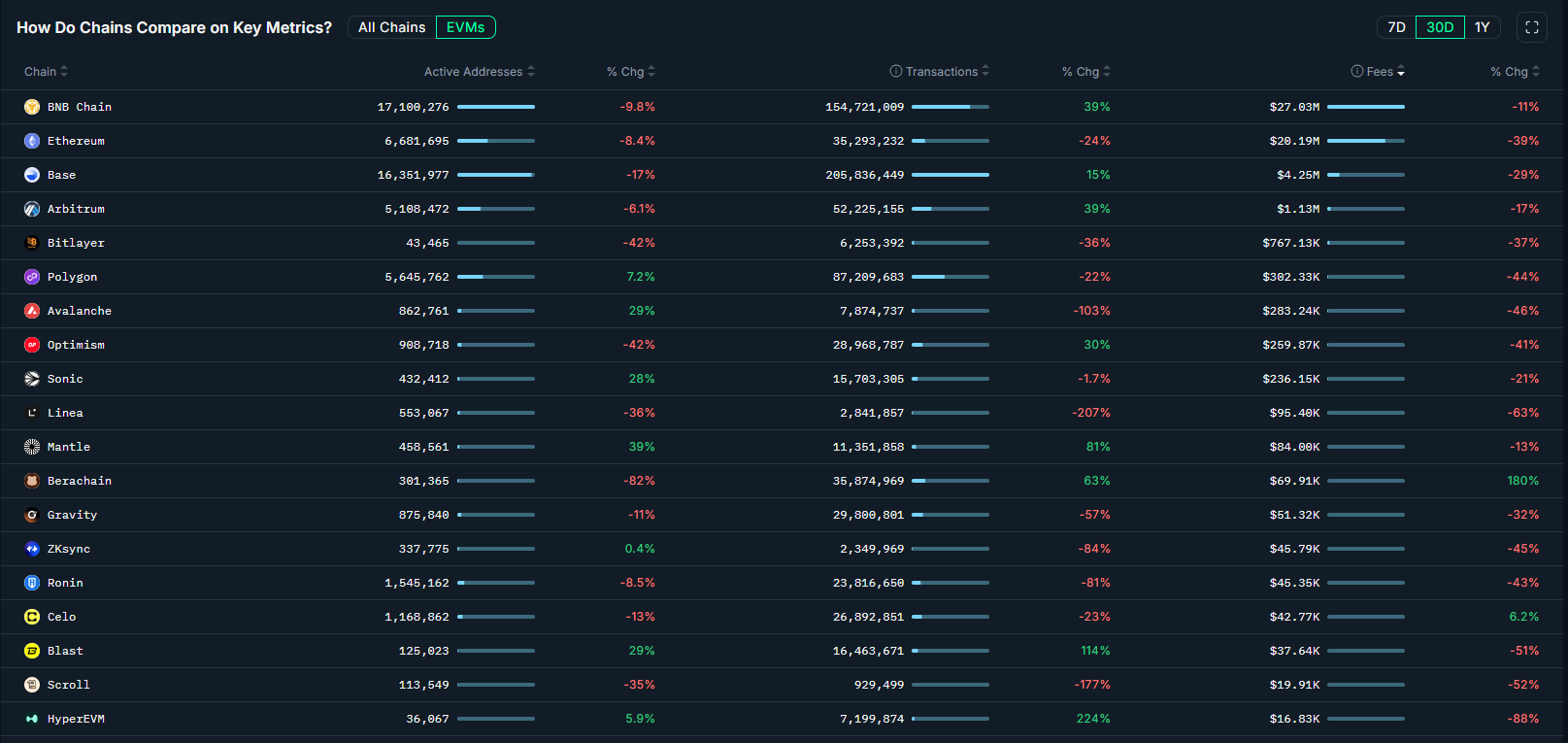

- Berachain Network income is up 180% over the past month despite the label dropping by 33% over the identical duration.

Berachain label jumped by over 12% earlier on the contemporary time, hitting an intraday high of $4.71, but it has since pulled again to around $3.85 at press time on April 10, 2025.

This brief rally provided a glimmer of hope for merchants after a brutal 52.9% decline over the past two weeks.

The token has now fallen again correct into a bearish channel on the 4-hour chart, unable to raise momentum despite a broader crypto market restoration spurred by Trump’s tariff quit.

Notably, bears remain firmly on prime of things, with technical indicators warning of extra plan back, overshadowing the community’s spectacular 450% income surge.

Technical indicators flash warning indicators

Berachain’s Relative Energy Index (RSI) on the 4-hour chart lately dropped to an alarming 16.97, signaling unsuitable oversold conditions.

Whereas it has bounced again above the oversold keep of residing, the bullish momentum has been minimize short, and it now sits at around 42, that device bears are tranquil on prime of things.

The Directional Lunge Index (DMI) shows an ADX of 46.7, reflecting an terribly solid bearish trend.

Sellers bear a chokehold with DMI readings of 50 (+DI) and 16.9 (-DI), leaving miniature room for bullish intervention.

The MACD, despite seeing a crossover, remains below 0, underscoring power detrimental momentum.

In addition, widening Bollinger Bands, now at 86% width, hint at escalating volatility that will trigger a technical leap or a sharper tumble.

Berachain Network growth clashes with label woes

In step with knowledge from Nansen, the Berachain ecosystem has skilled challenging growth in recent weeks.

Network fee income surged 180% month-on-month to $69,910, whereas transaction volume climbed 63% at some point soon of the identical duration.

Notably, this growth got right here despite an 82% decline in active addresses, indicating rising engagement or elevated practical job per user all thru the community.

Berachain’s ecosystem has considered explosive growth, with community fee income skyrocketing 180% to $69.91k in a month, with transactions rising by 63% despite active addresses dropping by 82% over the identical duration.

Notably, MEV-connected operations account for 34.97% of costs, whereas the core protocol and native DEX BEX contribute 18.64% and 17.38%, respectively.

Apparently, this surge in job contrasts starkly with the token’s 37.9% weekly loss and 62.44% tumble from its $14.ninety 9 all-time high in February.

Key BERA label ranges to see amid the bearish tension

Traders watch instant give a boost to at $3.06, with $2.71 as the leisure line of defense if promoting intensifies.

The pivot point at $3.74 remains a in point of fact significant threshold for any reversal confirmation.

Also, the resistance at $4.44 and $4.78 looms as a formidable barrier to restoration.

At this time, low liquidity at 58.43% amplifies the effort of challenging label swings, and merchants could well doubtlessly wait for an RSI divergence and volume spikes earlier than trying counter-trend trades.