Home » Markets » Bitcoin hits fresh all-time excessive above $121K as bulls tighten their grip

Jul. 14, 2025

Yarn ETF inflows and looming legislation give a enhance to Bitcoin’s climb, with consultants projecting persisted volatility and fresh all-time highs.

Represent: Nicolas Economou

Key Takeaways

- Bitcoin neared $120,000, with noteworthy ETF inflows driving trace momentum.

- Lawmakers are focused on main legislative adjustments impacting the crypto market.

Part this article

Bitcoin hit a fresh epic excessive of $121,000 on Sunday night after breaking thru $119,000 earlier within the day and clearing the $120,000 mark, in response to TradingView records. Bitcoin hovered around $120,835 at press time, up 30% for the explanation that delivery up of the one year and larger than double its trace from a one year ago.

Bitcoin’s most modern rally caps off per week of genuine beneficial properties, pushed by on-chain trends, increased institutional participation, and extending self perception in a extra supportive regulatory ambiance.

Per Glassnode, long-term holders are at display animated extra Bitcoin than miners are issuing. Wallets keeping lower than 100 BTC maintain been collecting around 19,300 BTC per month, while month-to-month miner issuance stands at stunning 13,400 BTC.

The chronic accumulate absorption, unfold all over a gargantuan deplorable of holders, is contributing to a structural present squeeze that would perchance well also present further give a enhance to for upward trace momentum.

Having a survey at accumulation by wallet dimension: Shrimps, Crabs, and Fish – wallets with <100 $BTC – are collecting ~19.3k BTC/month, while miner issuance stands at 13.4k BTC/month.

Persistent accumulate absorption all over a huge deplorable of holders is creating measurable present-aspect tightening. pic.twitter.com/ajut5hlpqv— glassnode (@glassnode) July 12, 2025

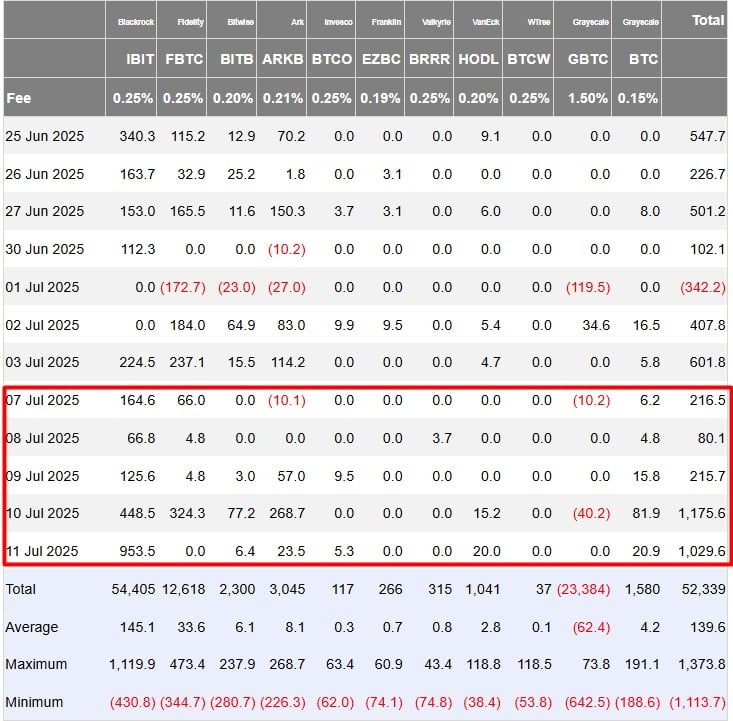

Per records from Farside Investors, US space Bitcoin ETFs accrued over $2.7 billion in accumulate inflows this week, with day after day inflows exceeding $1 billion on each Thursday and Friday. BlackRock’s iShares Bitcoin Belief (IBIT) dominated the flows, recording larger than $1.7 billion in inflows over seven days.

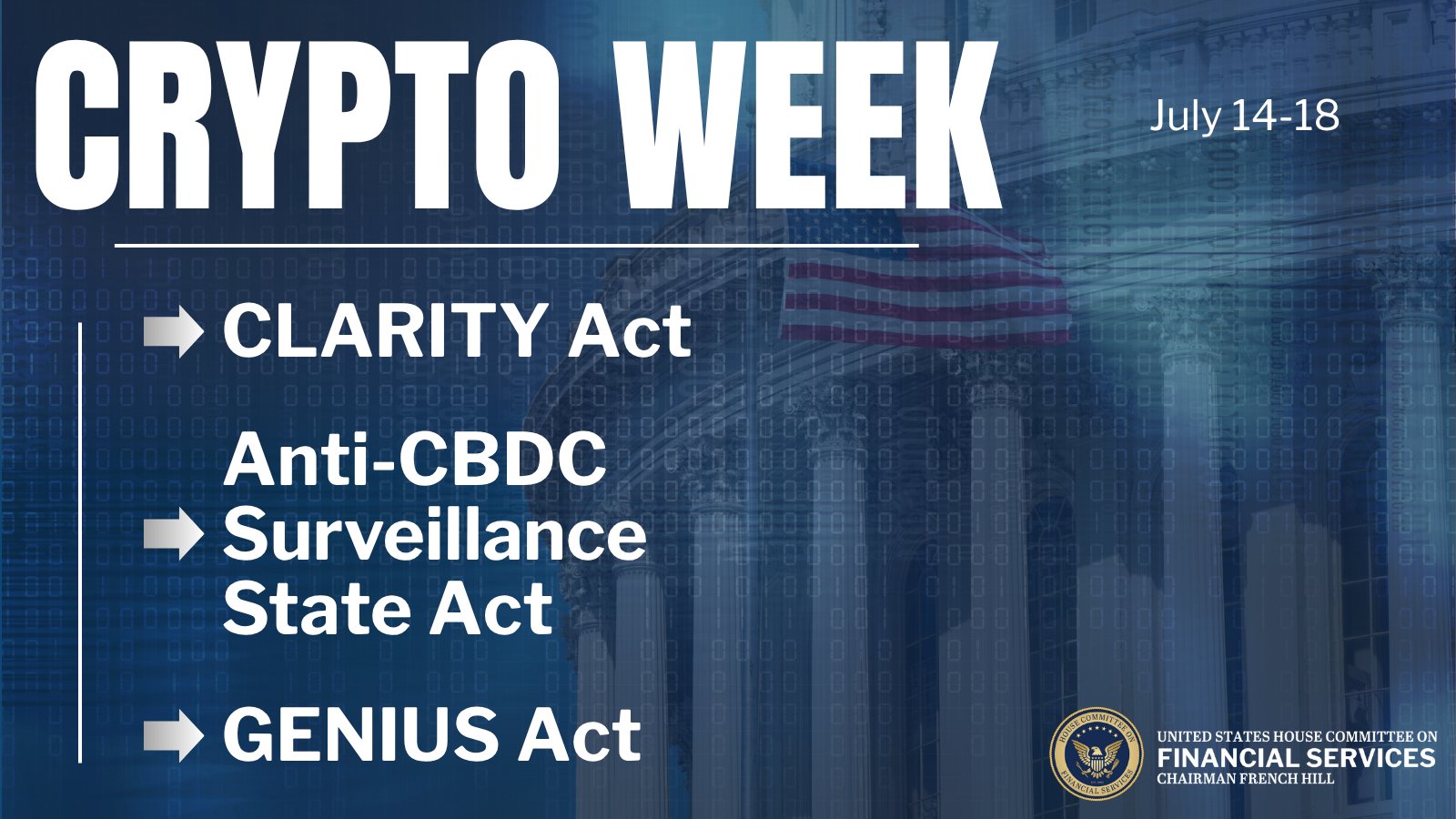

Optimism is additionally constructed around rules, with “Crypto Week” in focal level as a doable turning level for the crypto sector.

Lawmakers are situation to debate three key bills that would perchance well also eventually lift readability to digital asset oversight, at the side of measures addressing stablecoins (GENIUS Act), blockchain infrastructure, and the jurisdiction of regulatory agencies (CLARITY Act).

Ledn Chief Funding Officer John Glover suggests that Bitcoin’s most modern trace surge helps the commencement of the closing bull speed segment.

He projects Bitcoin will likely reach $130,000 by the give up of this one year, presumably followed by a short correction after which a closing rally to $136,000, marking the completion of a multi-one year bull cycle.

Part this article