House » Markets » ProShares leveraged XRP ETF will get NYSE Arca clearance, prepares for getting and selling debut

Jul. 15, 2025

ProShares’ Extremely XRP ETF is now effective and has a are living product web page, nevertheless shopping and selling is aloof pending.

Key Takeaways

- NYSE Arca permitted the itemizing of the ProShares Extremely XRP ETF, which targets to supply 2x leveraged publicity to XRP worth movements.

- ProShares is determined to initiate further XRP-centered ETFs, at the side of inverse and leveraged inverse merchandise for diversified publicity.

Allotment this article

Commerce NYSE Arca has “licensed the itemizing and registration” of the ProShares Extremely XRP ETF, in step with a Monday submitting with the SEC.

The certification got right here after the fund regarded on the DTCC’s listing, signaling it is operationally ready for getting and selling and settlement, even supposing its market debut must face delays.

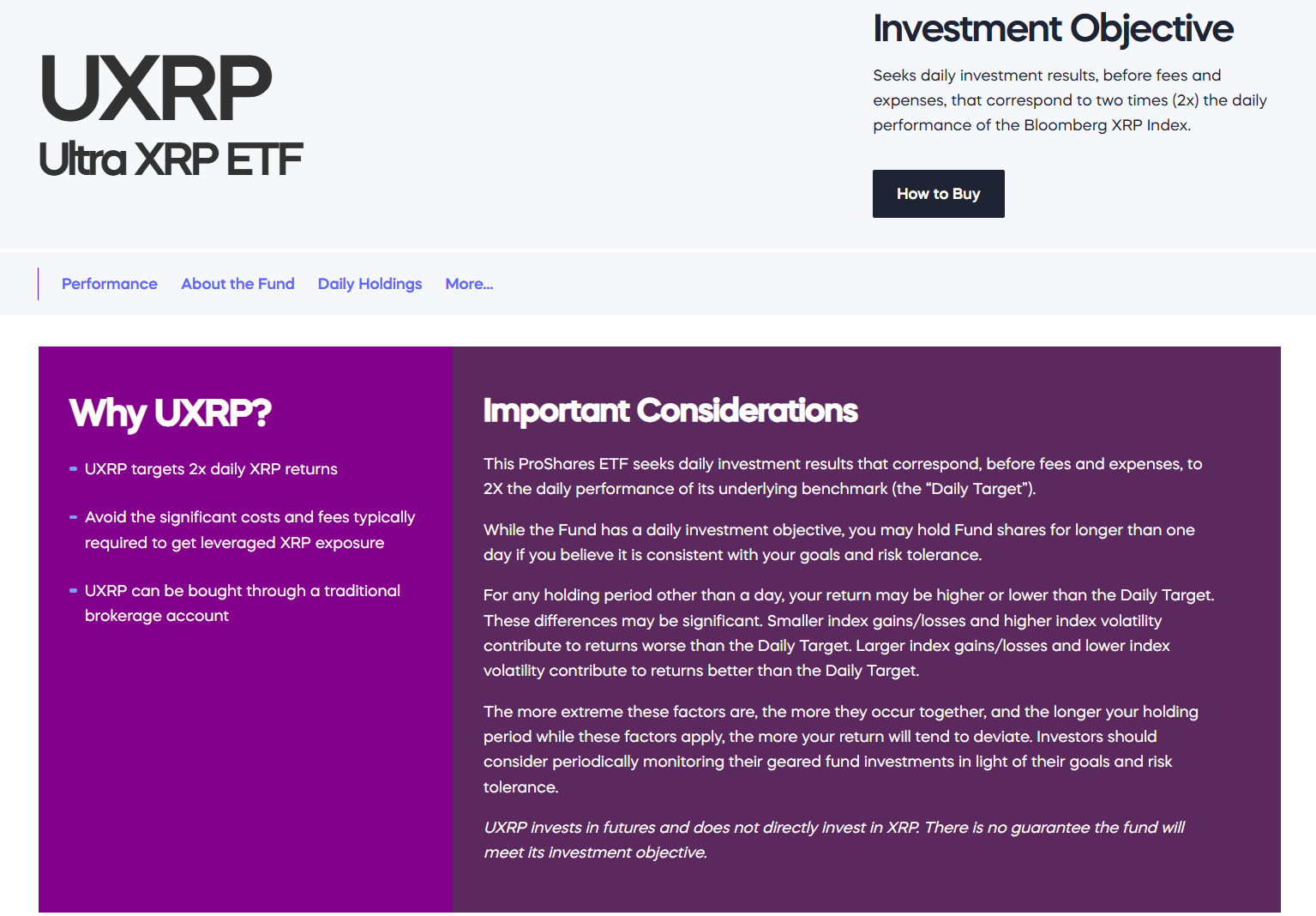

The leveraged futures-primarily based fully fully ETF, expected to change on NYSE Arca under the ticker UXRP, seeks to bring 2x the each day performance of an XRP index the usage of derivatives equivalent to swap agreements and futures contracts, as a change of preserving XRP straight.

As neatly as to the Extremely XRP ETF, ProShares plans to initiate two connected merchandise — the Short XRP ETF (XRPS) and the UltraShort XRP ETF (RIPS). Neither has yet been listed on the DTCC.

A product web page for the Extremely XRP ETF went are living Monday as the fund became effective. Then again, shopping and selling has now not yet commenced.

ProShares plans to initiate its trio of XRP futures ETFs on July 18, per a July 11 submitting, even supposing the timeline also can merely shift.

NYSE Arca has also permitted the itemizing and shopping and selling of ProShares’ Solana-linked product, the ProShares Extremely Solana ETF (SLON), a separate SEC submitting reveals.

Allotment this article