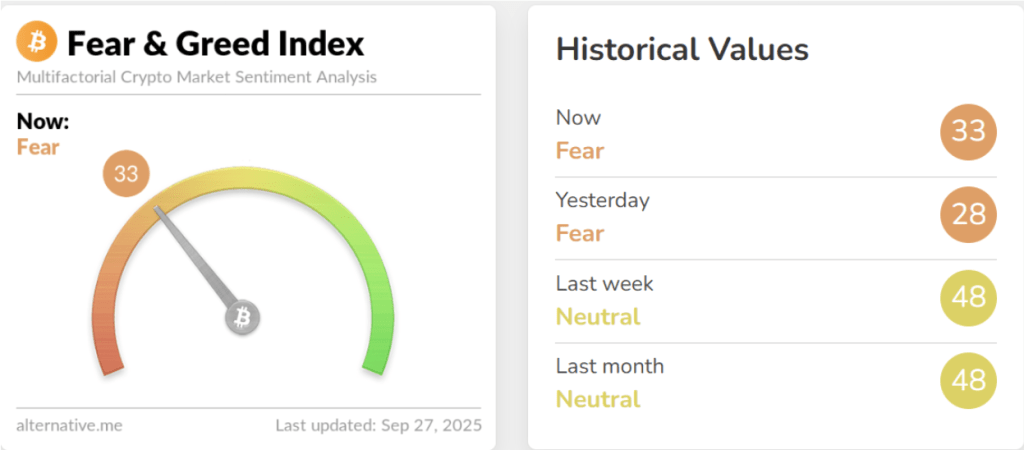

The cryptocurrency market is in a worrying mood after Bitcoin misplaced distinguished tag phases this week, and investor sentiment has taken a beating. This precipitated the Bitcoin Distress & Greed Index to descend by 16 aspects in a single day, sinking to twenty-eight the day gone by, its lowest level since March. At the time of writing, the index has recovered moderately to 33, but it no doubt composed in the Distress zone. This may per chance well presumably furthermore just unsettle many buyers, but history reveals that fearful prerequisites is probably to be blessings in conceal for Bitcoin buyers.

Bitcoin Distress & Greed Index Drops To 28

This week has been tricky for many cryptocurrencies, especially Bitcoin. Bitcoin, which started the week above $115,000, entered into an extended decline that seen it damage below $110,000, which in flip ended in liquidations of over $1 billion worth of positions all around the industry. This slither also seen Ethereum damage below $4,000, alongside altcoins likes XRP, Solana extending to the plot back.

Taken collectively, these strikes erased the cautious optimism of closing week, when the index sat at a impartial level of forty eight. As a replace, Bitcoin’s Distress and Greed Index fell to as shrimp as 28, which is a dramatic 16 level descend in a single day.

This atomize in the Bitcoin Distress and Greed Index reveals correct how snappily sentiment can reverse when distinguished tag thresholds fail to again. However, while the fearful mood may per chance well presumably well appear to be a bearish designate, these prerequisites will most probably be a possibility for long-term traders. The Distress and Greed Index has traditionally been a contrarian indicator, with extreme apprehension phases customarily performing earlier than fundamental rebounds.

Earlier in March, when the index closing reached equivalent depths, Bitcoin became buying and selling at a relative low around $83,000. These days, even after breaking below 30 on the index every other time, Bitcoin is ready $27,000 bigger than it became in March.

Bitcoin Distress And Greed Index. Provide: Different.me

Positive Outlook For The Coming Weeks

The broader takeaway from this sentiment shift is that the crypto market is probably to be nearer to its next restoration segment than many search knowledge from. The index’s miniature rebound to 33 as of late from the day gone by’s low of 28 reveals that some traders are already positioning for a turnaround. For one, Bitcoin’s recent costs may per chance well presumably well give savvy buyers the probability to rep Bitcoin at good deal costs.

Bitcoin customarily ever sustains rallies in prerequisites of overwhelming greed. As a replace, consolidations and corrections reset sentiment and bear room for more fit boost. For instance, crypto analyst Michael Pizzino stated in a submit on X, that the newest apprehension will probably be the turning level Bitcoin and crypto has been expecting.

In this sense, the fearful atmosphere is probably to be setting the stage for Bitcoin, Ethereum, and different altcoins to form bullish momentum once promoting drive eases.

Now, the distinguished part is for the Bitcoin tag to reestablish itself above $110,000. At the time of writing, Bitcoin is buying and selling at $109,220.

Featured image from Unsplash, chart from TradingView