Charles Edwards, founder and CEO of Capriole Investments, has issued his starkest warning yet on quantum computing, arguing that Bitcoin must migrate to post-quantum signatures on an accelerated timeline or face existential likelihood later this decade. “We’ve to reinforce Bitcoin to be Quantum proof next One year. 2026. Otherwise we are fucked,” Edwards wrote on X early Monday, escalating a sequence of posts whereby he contends “Q-Day is that this decade.”

Would possibly well maybe Bitcoin Crash To $0?

Edwards’ thesis hinges on the rapid compression of resource estimates required to lag Shor’s algorithm against Bitcoin’s elliptic-curve digital signatures (ECDSA/Schnorr on secp256k1). Pushing lend a hand at skeptics who “handwave Quantum as being 20+ years away,” he argued that handiest “~2,000 logical qubits” is at likelihood of be ample to interrupt ECC-256 within a vivid time window, inserting a credible assault in “2–6 years.” In a separate alternate he framed the stakes bluntly: “Derive you contend with to bear $1M Bitcoin in 5 years, or $0?”

Edwards’ timeline closely tracks a recent line of study and alternate messaging from Pierre-Luc Dallaire-Démers, founder of Pauli Community, a startup targeted on quantum-resistant money. In an August study preprint and public thread, Dallaire-Démers and co-authors launched graded ECDLP challenges on Bitcoin’s curve and, after translating logical circuits to bodily charges right thru several error-corrected architectures, placed “cryptanalytically linked” ECC-256 attacks in a “roughly 2027–2033” window—emphasizing extensive error bars and sensitivity to hardware assumptions.

Pauli Community summarized the upshot plainly: “The foremost assault on 256-bit ECC will plausibly happen between 2027–2033.” The company also provocatively talked about by technique of X: “PQC BTC will stir to $1M+ by 2030. ECC BTC obtained’t.”

The core likelihood vector is wisely-established: once a Bitcoin contend with reveals its public key on-chain—by spending from it or by the utilization of legacy codecs that repeat the important thing outright—a sufficiently great quantum computer running Shor’s algorithm also can, in thought, procure the non-public key rapid ample to attract close funds.

Safety researchers and alternate teams indicate that coins in already-uncovered keys are the first in line, while coins peaceful sitting at the lend a hand of hashed (unrevealed) public keys are safer till they stir. Loads of analyses estimate that a non-trivial piece of excellent BTC resides in uncovered-key outputs, including early “pay-to-pubkey” expertise coins usually associated with Satoshi. Edwards leaned into that tail likelihood, claiming “Satoshi’s coins will be market dumped” absent a migration.

No longer every person is of the same opinion on the clock bustle. Some conservative estimates peaceful recent thousands and thousands of error-corrected qubits for vivid, rapid ECDSA breaks, and requirements our bodies bear published transition guidance that implicitly assumes an extended runway.

In unhurried 2024, field topic circulated in the NIST/PQ ecosystem sketched migrations faraway from weak algorithms by roughly 2035—a horizon many safety engineers expect as life like for extensive IT programs, even supposing niche breakthroughs advance sooner. The spread between the “thousands” versus “thousands and thousands” of logical qubits camps shows rapid-evolving algorithmic optimizations, differing error-correction units, and various assumptions about gate speeds and code distances.

Significantly, Edwards is taking the message to TOKEN2049 this week, where he’s slated to indicate “DOUBLE THREAT: Quantum & the Treasury Bubble” on Wednesday, October 1 at 10:Forty five a.m. native time—positioning quantum compromise and a rising “Bitcoin Treasury Bubble” because the 2 dominant shrink back dangers for BTC over the following cycle.

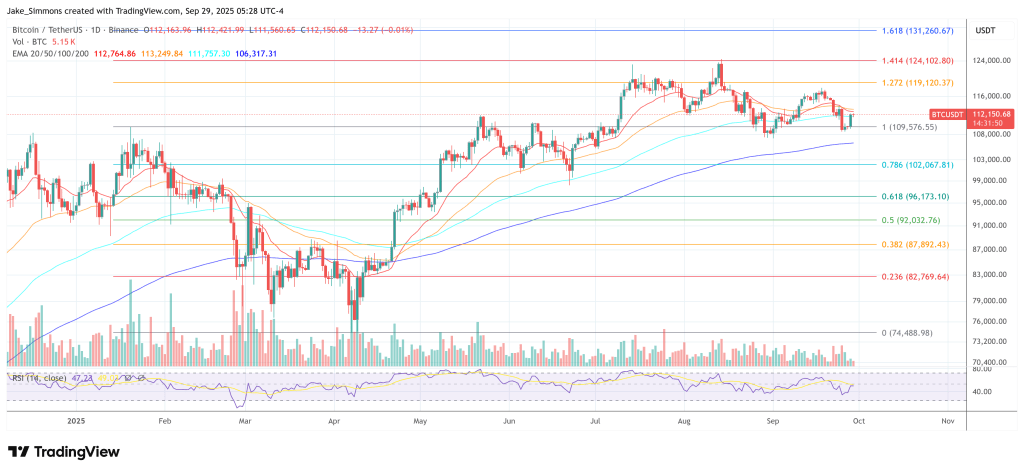

At press time, BTC traded at $112,150.

Featured image created with DALL.E, chart from TradingView.com