Dogecoin’s on daily basis chart is coiling into a technically luminous inflection, fixed with trader IncomeSharks, who posted a rising channel and an on-balance quantity (OBV) wedge that together device a easy path to increased ranges. “DOGE – No longer a defective setup. Obvious channel and decided OBV wedge. Ideally OBV will trail sooner than ticket,” the analyst wrote, sharing the chart that frames the present approach.

Dogecoin Breakout Watch: $0.33 Trigger On Deck

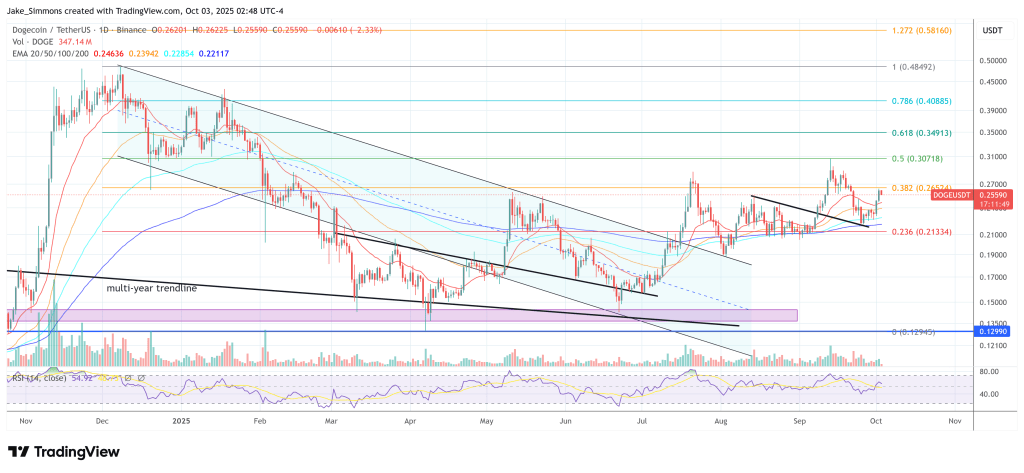

Tag has been respecting a smartly-defined ascending channel that has dominated change since early summer time. Loads of touches on every boundaries validate the structure: increased lows along the decrease trendline from July thru early October, and decrease-excessive rejections in opposition to the better rail thru mid-July, slack August, and slack September.

After a singular rebound off the rising toughen device before the full lot of October, DOGE has pushed support into the channel’s mid-vary, the assign it assuredly pauses sooner than the subsequent impulse. IncomeSharks’ course sketch envisions a transient consolidation or shallow pullback all around the channel, adopted by a power in direction of the ceiling.

The vacation inform is relate on the chart. The upper boundary for the time being intersects in the low-to-mid $0.30s, and the drawing marks a breakout strive between roughly $0.32 and $0.33. That zone represents confluence: it’s the assign the rising channel’s resistance comes into play and the assign slack-September present capped the prior thrust. A decisive on daily basis finish thru that band would verify a bullish channel breakout and dash away the door birth for a creep in direction of the early December 2024 excessive at $0.4843.

Quantity dynamics are the expose to examine. The decrease panel plots OBV, a cumulative measure of aquire/sell rigidity, compressed into a symmetrical wedge: a gently rising crude since mid-July and a descending lid drawn off the July and September OBV peaks. This roughly narrowing vary in OBV usually precedes a directional expansion.

IncomeSharks’ comment underscores that sequencing: an OBV breakout earlier than ticket would signal unique accumulation and enhance the percentages that ticket follows with a push to the channel’s top. Conversely, failure of OBV at its wedge toughen would warn that the rebound lacks sponsorship, increasing the possibility of one more take a look at of the decrease channel line.

Structurally, the setup is easy. As long as DOGE continues to preserve the rising toughen that has defined the pattern since July, the path of least resistance stays up all around the channel. A luminous OBV damage of its wedge would give a boost to that look.

If bulls can then decided overhead present and convert the $0.32–$0.33 band into toughen, the chart would verify the breakout roadmap IncomeSharks outlined. If instead ticket loses the ascending crude, the channel thesis could be invalidated and the market would likely revisit prior increased-low areas along the decrease rail sooner than making an strive one more pattern leg.

At press time, DOGE traded at $0.2559.

Featured image created with DALL.E, chartfrom TradingView.com