For the rationale that market-huge atomize in early October, the Bitcoin ticket has struggled to renew any significant movement to the upside. The flagship cryptocurrency has persisted to tumble even deeper into bearish territory, breaching a lot of strengthen zones within the approach.

With the crypto market’s danger checklist a bleak image, the prevailing sentiment around its chief can now not ceaselessly be acknowledged to be bullish. Interestingly, a up to the moment on-chain review puts into standpoint the predominant gamers within the support of Bitcoin’s weakness.

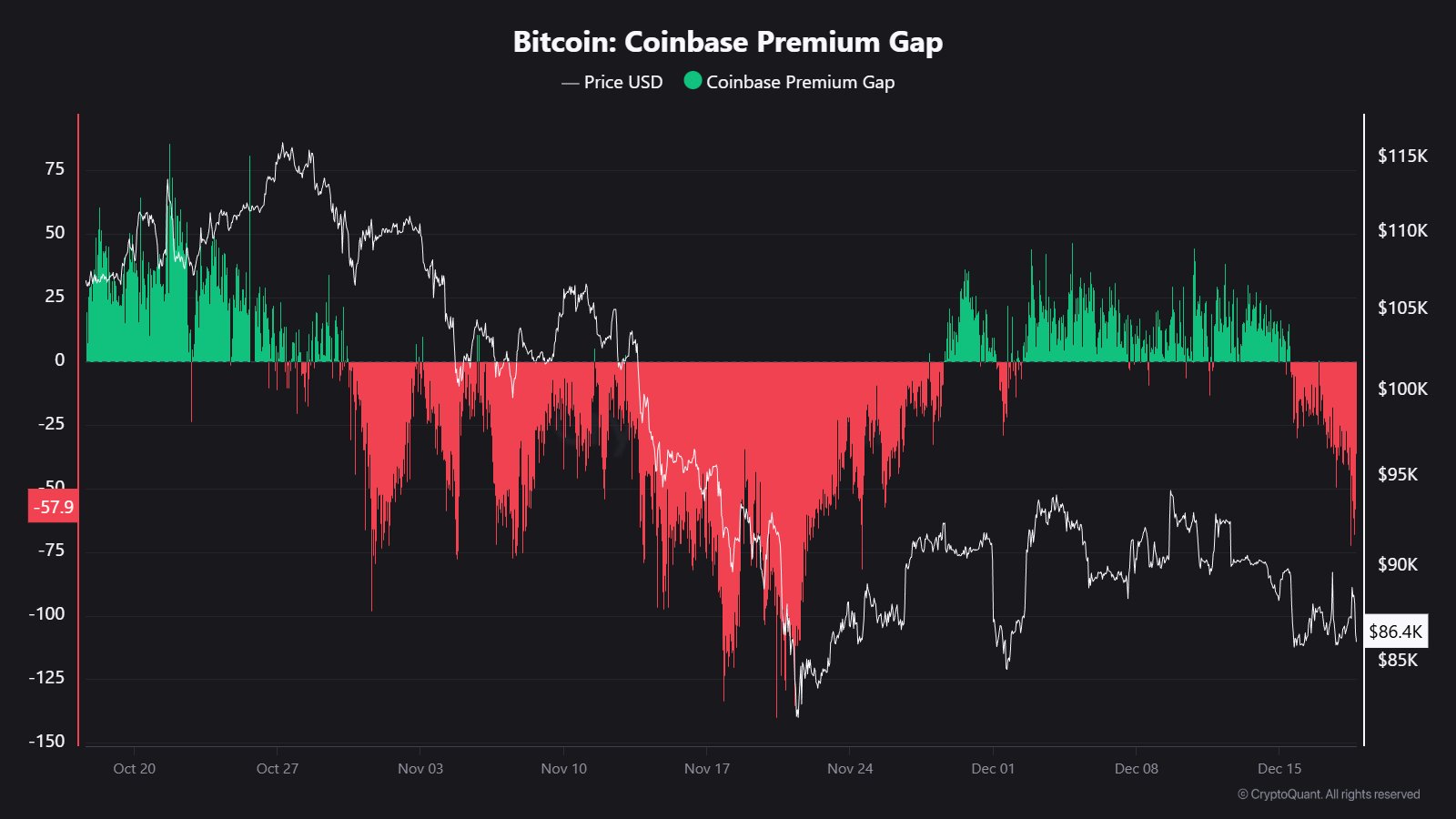

BTC Coinbase Top rate Gap Reads –$57

In a up to the moment submit on the social media platform X, on-chain analyst Maartunn shared that a big portion of promote stress considered within the Bitcoin market can also be from the activities of US investors. This on-chain commentary is according to the Coinbase Top rate Gap metric, which measures whether US basically based investors are shopping or promoting Bitcoin more aggressively than the the relaxation of the international market.

For context, the metric tracks the ticket gap between Bitcoin on Coinbase and Bitcoin on predominant offshore exchanges (for instance, Binance). A undeniable reading assuredly indicates that Bitcoin is dearer on Coinbase, that manner that US merchants are shopping aggressively. On the assorted hand, detrimental readings are interpreted as elevated sales or diminished ardour among investors within the US.

According to the analyst, the Coinbase Top rate Gap recently dropped to a -$57 reading. As has been earlier implied, this deep detrimental ticket finds that merchants from the US are actively offloading, moderately than accumulating Bitcoin.

Interestingly, this heightened promoting exercise accompanies Bitcoin’s ticket momentum in direction of decrease stages. Thus, it turns into certain that the promote-stress reflected on Bitcoin’s ticket is due mainly to the absence of US demand.

BTC Market Outlook

According to historic knowledge, Bitcoin’s direction within the lengthy-time length can also poke either manner. While a detrimental Coinbase Top rate Gap reading is customarily indicative of a bearish portion within the short time length, the lengthy-time length standpoint is terribly much less easy.

In past cycles, extended classes of detrimental readings have preceded the formations of market bottoms, after which prices noticed recoveries to the upside. This assuredly occurs when promote-aspect stress dwindles, and original demand enters the Bitcoin market.

Hence, if this detrimental reading deepens and there shouldn’t be any original demand within the market, the Bitcoin ticket can also discover suit and proceed south. Nonetheless, a reversal of the Coinbase Top rate Gap to the upside — pushing it in direction of neutral or certain stages — can also point to pivotal for the realm’s main cryptocurrency.

As of this writing, Bitcoin holds a valuation of $88,260, reflecting no significant ticket movement within the past day.

Featured image from Dall-E, chart from TradingView