The founder and CEO of on-chain analytics firm CryptoQuant has printed how Bitcoin on-chain capital inflows bear stalled over the final couple of months.

Bitcoin Realized Cap Has Witnessed A Slowdown Impartial recently

In a brand new post on X, CryptoQuant founder and CEO Ki Younger Ju has talked about how on-chain capital inflows had been weakening for Bitcoin only in the near past. “After about 2.5 years of enhance, realized cap has stalled over the final month,” illustrious Younger Ju. The “Realized Cap” here refers to an on-chain capitalization model for Bitcoin that calculates its complete price by assuming the price of every and each coin in circulation is the same as the label at which it used to be final transacted on the blockchain.

For the reason that final transaction of any coin is prone to signify the final occasion of it altering hands, the label on the moment would perhaps furthermore be regarded as as its fresh label basis. Therefore, the Realized Cap is correct a sum of the label basis of your complete BTC present. In other words, it tracks the capital that the investors veteran to dangle their tokens.

Realized Cap had been taking part in enhance for the final couple of years, but as the CryptoQuant founder has printed, capital inflows bear dropped off. This implies a decline in sentiment spherical Bitcoin.

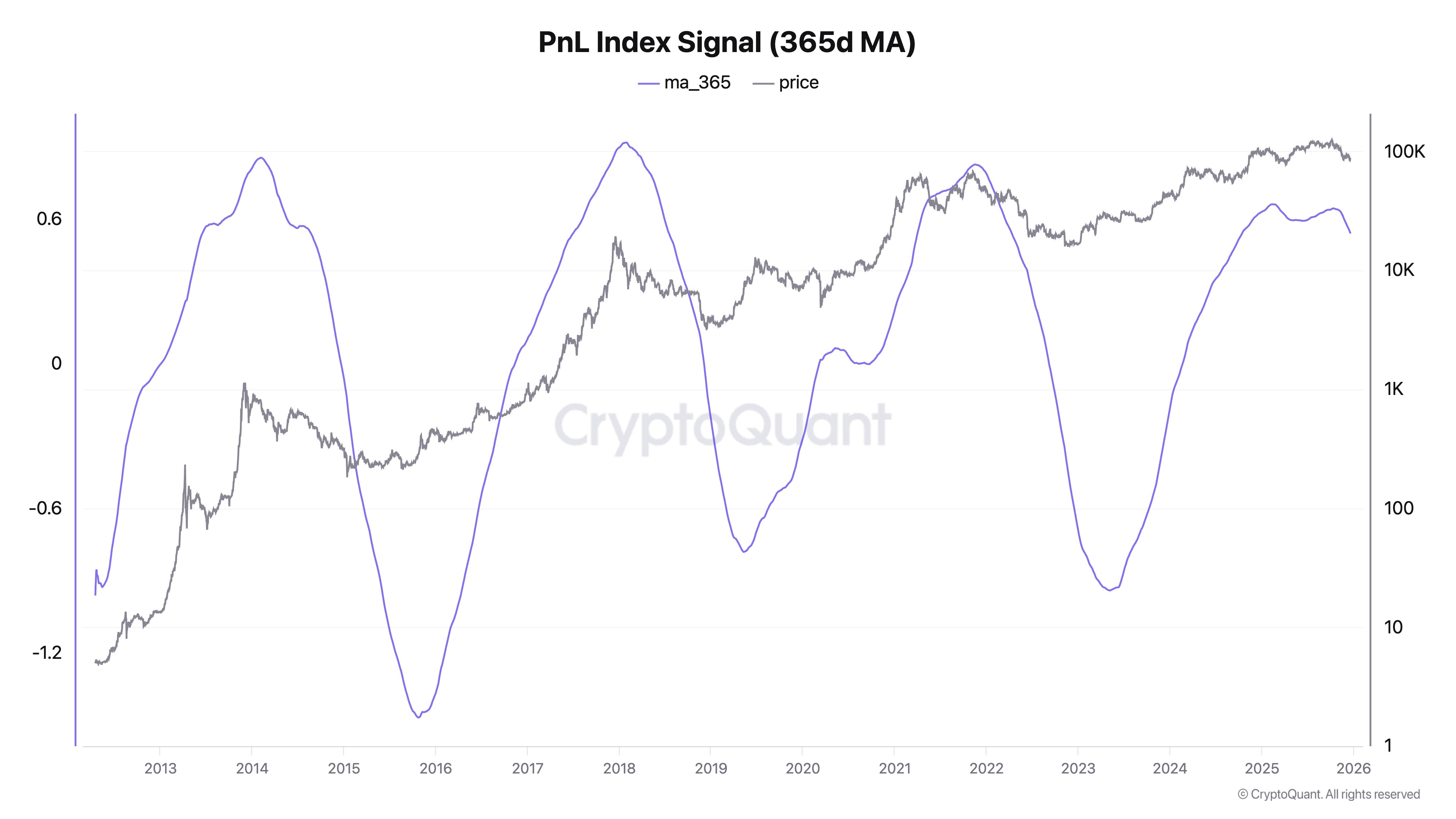

The turnaround in sentiment will seemingly be viewed thru the analytics firm’s PnL Index, which comprises key on-chain indicators to manufacture a single valuation metric for BTC.

The indicators in inquire are the MVRV Ratio, NUPL, and STH/LTH SOPR. The first two both address the volume of unrealized profit or loss held by the investors as a complete, whereas the latter offers a explore into investor profit-taking.

Below is the chart shared by Younger Ju that reveals the model in the 365-day involving sensible (MA) of the Bitcoin PnL Index over the ancient past of the asset.

From the graph, it’s viewed that the Bitcoin PnL Index saw its 365-day MA attain a high earlier in the year, implying that the coin had presumably change into overestimated.

Since then, the metric has viewed a reversal to the design back. For the time being, its price is mild notably definite, so the cryptocurrency would perhaps very effectively be regarded as to be in a bullish share, but historically, drawdowns bear tended to manual into undergo markets.

Despite the indisputable fact that there had been about a instances the put this pattern didn’t take care of. One being the aftermath of the COVID fracture and the different the decline that took place in the early months of 2025.

To this point, the indicator hasn’t confirmed signs of any turnaround lend a hand to the upside, even supposing it will mild be illustrious that it’s an sensible over the final year, so there would possibly be some extend connected.

In accordance to the on-chain model, Younger Ju has mentioned, “Sentiment recovery would perhaps steal about a months.”

BTC Designate

Bitcoin has made recovery from final week’s tumble as its label is now lend a hand at $89,800.

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com