In step with Charles Hoskinson, the flee between Solana and Ethereum seems assorted reckoning on the time body. Solana also can receive flooring like a flash since it moves mercurial. Ethereum seems receive 22 situation to diagram for a broader, slower invent that also can matter extra later.

Short-Term Beneficial properties For Solana

Solana’s charm is horrible. Its community pushes a amount of transactions on each day basis and it is far going to adopt upgrades extra like a flash, Hoskinson said. That bustle has helped tasks ship tokenized stocks and diverse finance tools onto the chain.

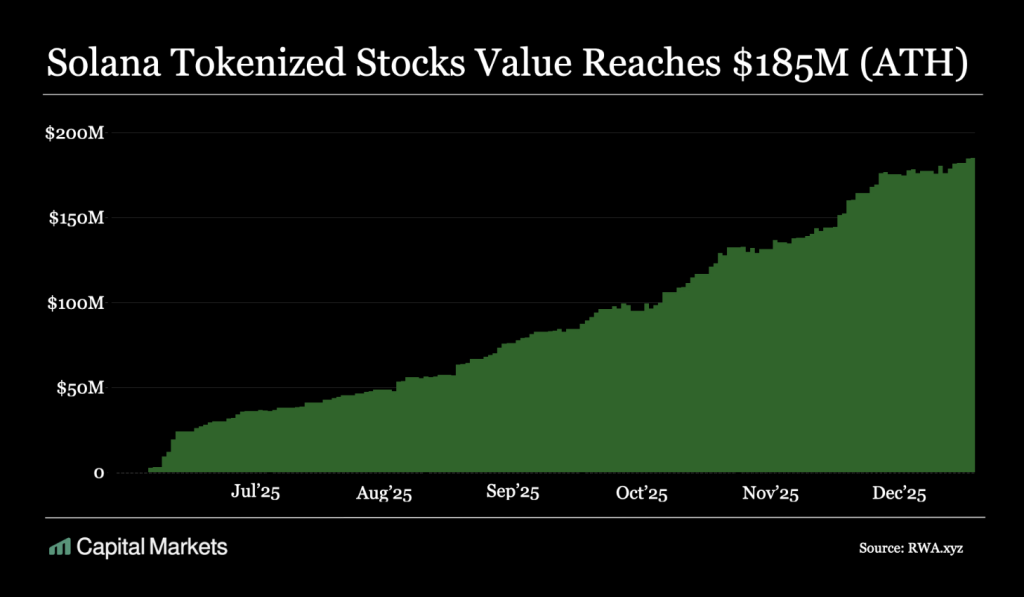

Reports be pleased disclosed that the total heed of tokenized equities on Solana no longer too long within the past hit about $185 million. Platforms such as xStocksFi, Superstate, and Remora Markets are amongst those constructing there. For traders and a few institutions, low prices and high throughput are animated to ignore.

A Sizable Monetary Hole Remains

Tranquil, there are sizable differences below the flooring. Solana’s complete heed locked and stablecoin hiss take a seat at about 10% of Ethereum’s ranges. That gap diagram the forms of financial activity viewed on Ethereum are no longer yet matched on Solana.

The size of a series’s monetary ecosystem impacts what forms of companies and markets can develop on it. So whereas adoption on Solana is growing, the size of on-chain lending, staking and stablecoin volumes is unexcited principal smaller compared with Ethereum.

Ethereum’s Compare-First Methodology

Ethereum’s work is taking into account be taught and longer-term upgrades, especially in areas treasure zero-files proofs and developed scaling programs. Reports be pleased suggested that Ethereum is aiming to switch extra of its validation to cryptographic proof methods so it is far going to behave as a verification layer for many networks.

Amble Now, Approach Later

Hoskinson framed the inequity as considered one of timing. Solana’s leadership and make allow quicker selections and sooner rollout of novel aspects. Ethereum’s path is marked by heavy be taught and behind coordination.

This diagram Solana also can clutch hiss and consideration within the shut to term, whereas Ethereum’s technical path also can form broader infrastructure over a longer span. Every approaches arrive with alternate-offs. One specializes in immediate adoption, the assorted on constructing methods that count on stronger mathematical proofs.

Tokenized stocks on Solana attain a novel All-Time High with ~$185M in complete heed.

Solana stands because the institutional infrastructure of preference for main tokenized stock platforms treasure

– @xStocksFi– @SuperstateInc’s Opening Bell

– @RemoraMarkets pic.twitter.com/xr7q54sucs— Capital Markets (@capitalmarkets) December 24, 2025

What This Means For Markets

For traders and builders, the split is evident: architects chasing mercurial growth also can make a choice Solana as of late, whereas those making a wager on deep monetary stacks and ample verification also can keep on with Ethereum.

The $185 million milestone for tokenized stocks on Solana indicators rising belief in blockchain-primarily based equity merchandise, but it is little compared with fashionable markets. Reports and feedback from industry figures treasure Hoskinson inspire expose why assorted groups make a choice one chain over one other.

In the tip, both chains are being examined by genuine hiss, and their paths will most seemingly be measured by what users and institutions make a choice to speed on them.

Featured image from Equiti, chart from TradingView