Bitcoiners yearn for the appropriate light days of mountainous debates with instructed critics who fill been up for the intellectual venture. It allowed the group to hone its belief processes, invent recordsdata and skills to widen the debate and dialogue, and incessantly toughen our salvage to the bottom of and dedication to our funding thesis.

Sadly, we fill been entirely out of practising for about seven years, without a longer one single fresh criticism of Bitcoin surfacing that hasn’t already been factually refuted to demise. The light critics fill been a frosty glass bottle of Classic Coke, now all we salvage is lukewarm, off-price, generic cola.

Et tu, Elon? In any case we’ve been thru collectively?

In enlighten to maintain this text readable within an cheap quantity of time, I will rely upon the reader to dig into the refutations of these arguments, ready by commerce experts in line with laborious recordsdata and computer science, and I will seemingly be broadly linking to their work at some stage in this share.

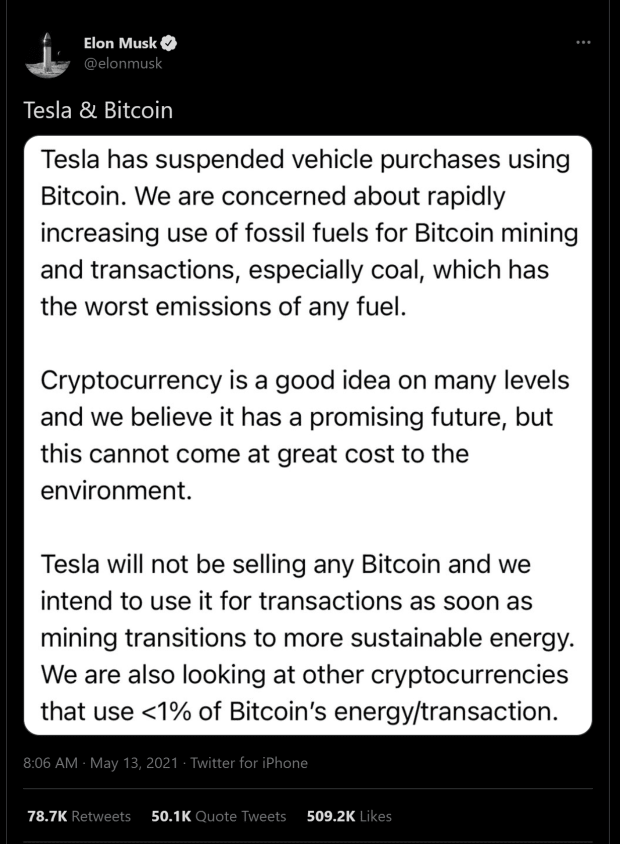

1. “Tesla has suspended automobile purchases using Bitcoin. We’re serious about by shock rising expend of fossil fuels for Bitcoin mining and transactions, particularly coal, which has the worst emissions of any gas.”

I primarily fill two phrases for you Mr. Musk: “Level to it.” Level to that the expend of fossil fuels for Bitcoin mining is rising. Sadly for everybody, right here’s:

- Very unlikely to attain with 100% accuracy attributable to the decentralized nature of the commerce and the impossibility of surveying every single mining operation on this planet.

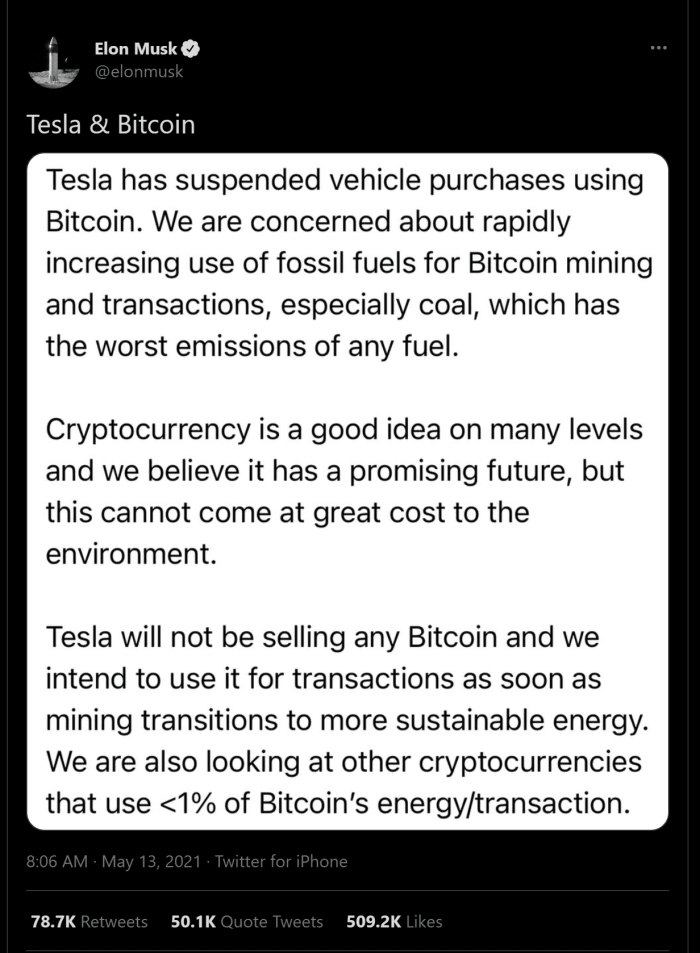

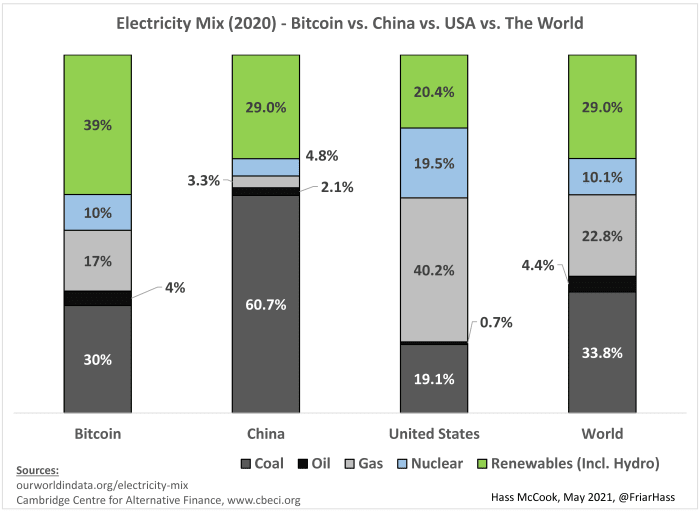

- No longer what the literature has been pronouncing: A) The Cambridge Centre For More than a few Finance estimates that 76% of all miners expend renewable energies as share of their mix, with between 29% and 39% of all vitality aged coming from renewables, in line with commerce recordsdata from the sphere’s greatest miners and mining pools B) CoinShares estimates that total portion of renewables could perchance well perchance even be as excessive as 73%.

2. “Cryptocurrency is a appropriate recommendation on many ranges, and we give it some belief has a promising future, nonetheless this can not near at a mountainous charge to the atmosphere.”

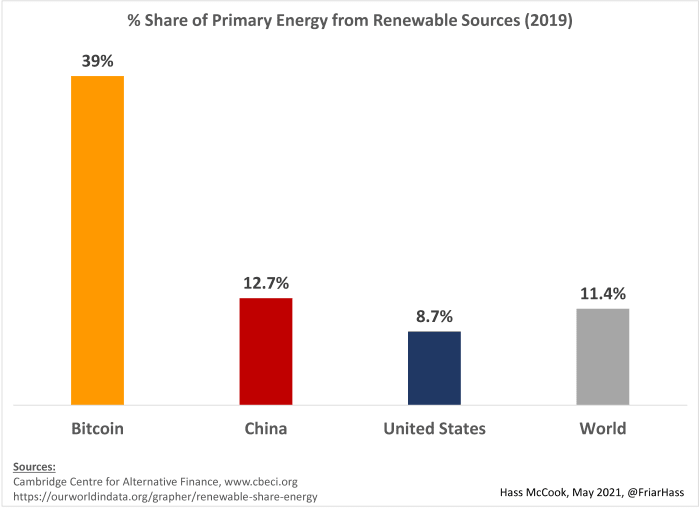

Here’s the achieve it appears to be Musk could perchance well perchance be making this assertion under duress. Clearly, Musk clearly knows that methane has over 50 times the greenhouse gas raise out as carbon dioxide and completely he knows that there are primarily miners who expend discontinuance methane to mine bitcoin, equivalent to Upstream Data, Expansive American Mining, Giga Vitality, Crusoe Vitality and Wesco Working, Inc, to call perfect a few.

Maybe he perfect doesn’t know that within the U.S. alone, 538 billion cubic feet (cf) of methane modified into as soon as vented and flared in 2019. Everyone knows that 1 cf of methane equates to 0.29 kilowatt hours (kWh) of vitality (and 1 cubic meter equates to 10.28 kWh), attributable to this truth we calculate that 156 terawatt hours (TWh) is wasted to flaring, extra than adequate to vitality Bitcoin for a year. Globally, the final resolve for flaring is 150 billion cubic meters, or, 5.3 trillion cubic feet, resulting in 1536 TWh wasted, adequate to vitality Bitcoin extra than 10 times over.

Is Bitcoin primarily saving the planet? The Aker Community appears to deem so in its most trendy letter to shareholders and thru the establishment of Seetee.io, a venture dedicated to reaching these environmental ends. Here’s even being seen in different a bunch of industries, with heat from Bitcoin miners being aged to lengthen greenhouse farming yields in arctic environments, invent residential water boilers, brew whiskey and even originate gourmand flake salt. The International Vitality Agency (IEA) tracks flaring reduction steadily, with its “Sustainable Pattern Scenario” (SDS) no longer-surprisingly having a fresh station of “No longer Heading within the correct course.”

“There could be an rising sequence of voluntary govt and commerce commitments to attain away with flaring by 2030,” in step with the IEA. “The SDS relies on a speedy reduction in flaring, with govt insurance policies and commerce dedication all nonetheless removing it by 2025.”

I abominate to interrupt it to you guys, nonetheless perchance the most sharp technique to even near shut to the form of lofty aim as removing all international flaring by 2025 is with a lot extra Bitcoin mining!

3. “Tesla is perchance no longer promoting any Bitcoin and we intend to expend it for transactions as quickly as mining transitions to extra sustainable vitality. We’re also a bunch of cryptocurrencies that expend <1% of Bitcoin’s vitality/transaction.”

There are primarily three statements that must be addressed right here, no subject this paragraph simplest having two sentences! Clearly, Tesla isn’t promoting any bitcoin; nonetheless perchance shopping extra within the wake of Musk’s tweet, which triggered $3.45 billion of liquidations (https://archive.is/wjcb7), including $1.8 billion of bitcoin, $120 million of dogecoin, and unsurprisingly, $60 million of shiba inu coin, the achieve 2.85 trillion (certain, trillion with a “t”) cash fill been liquidated. Wow.

On 2d belief, Tesla pronouncing extra purchases would perchance space off a bid over with from the authorities, as Musk’s recklessness has triggered a wipe-out of over $1 trillion of wealth within the weeks since his tweet, so Tesla doubling down wouldn’t fill perchance the most sharp optics from a market manipulation level of look. He’s also completed valuable anxiety to Tesla shareholders with his antics, so per chance he could perchance well perchance moreover must acknowledge to questions from them as to why he would capture to nuke Bitcoin from orbit when his company holds over $1.5 billion of it. But I digress…

Musk then goes on to articulate that they intend to expend bitcoin when mining transitions to extra sustainable vitality. The U.S. vitality grid is 20% renewable and 19% coal, and Tesla’s 2d greatest market, China, has a grid that is 28% renewable, and 64% coal. As mentioned earlier on, within the worst case, Bitcoin is 29% renewable, and in perchance the most sharp case, around 73%, nonetheless perchance closest to about 39%.

Here’s an even bigger resolve than either the U.S. or Chinese language grid. So, if Musk is worked up about sustainable grids, we invite him to discontinuance promoting his vehicles within the U.S. or China, as the electrical energy going into his vehicles is dirtier than that going into Bitcoin. Maybe he can resume gross sales as soon as the grid is 100% sustainable? He hasn’t but bestowed us with his recordsdata on what the best grid mix would must be sooner than he starts to primarily feel appropriate about using Bitcoin.

Lastly, he says that he’s cryptocurrencies which fill much less than 1% of Bitcoin’s vitality per “transaction.” Smartly, he’s in luck! There is a cryptocurrency that has been are residing for nearly three years now, which makes expend of as minute as one-octillionth of Bitcoin’s vitality “per transaction” — it’s known as Bitcoin! Sure, you heard that appropriately — an octillionth, or 0.0000000000000000000000001%, of the vitality per transaction!

Now, Musk could perchance well perchance now not fill learned about how Bitcoin settlements and transactions work sooner than he splurged $1.5 billion on it, nonetheless, effectively, how Bitcoin works is that every 10 minutes or so, the total world’s money supply, alongside every settlement in history, is meticulously vetted and audited, and as a lot as a couple thousand extra settlements are stamped into Bitcoin’s putrid layer blockchain. That’s about as colossal and straightforward a description of the classic mechanics of Bitcoin as it’s good to perchance well perchance perchance salvage. Furthermore, all of Bitcoin’s vitality expend is extra so geared in direction of auditing and securing the money supply, with settlements effectively having a marginal vitality expend of zero.

Gift the repeated deliberate and mettlesome expend of the observe “settlement” main as a lot as this level, as I’m hoping to galvanize upon you the criticality of distinguishing settlements and transactions from every a bunch of (this text by the legendary Nic Carter is a mountainous plan to begin!). Every settlement is a transaction, nonetheless no longer every transaction is a settlement. What’s meant by right here’s that even supposing it’s appropriate that Bitcoin can simplest attain around 3.5 settlements per 2d, the sequence of transactions within any particular person settlement can range from “one transaction” to several hundred thru tactics equivalent to transaction batching.

On Bitcoin’s 2d layers, equivalent to the Lightning Community or the Liquid sidechain, the sequence of transactions per 2d are theoretically a lot of. New trends equivalent to Taproot, that could perchance well perchance seemingly be activated later this year, will create the putrid layer indispensable extra efficient, though no longer exponentially so as Musk would fill hoped.

Musk is mountainous at arithmetic and calculus, and he optimistically understands the conception of limits, so he must level that as the denominator in a fraction tends toward infinity, the resulting acknowledge will plan zero. As an instance, Bitcoin currently makes expend of around 116 TWh per year. Let’s deem that there are about 3.5 settlements per 2d, or around 110 million settlements per year. If it’s assumed that every settlement simplest contains one transaction, then certain, Bitcoin would expend 116,000,000 kWh / 110 million = ~1 MWh per transaction.

Brooding about the everyday U.S. dwelling aged 77 million British thermal units (BTU) of vitality per year (equivalent to 22.5 MWh) in 2015, one “transaction” could perchance well perchance vitality a U.S. dwelling for perfect over two weeks. On the opposite hand, within the occasion you deem that 10 transactions happen in a settlement, then your “per-transaction vitality expend,” no subject primarily being zero as explained above, will seemingly be stated to be simplest 100 kWh as a alternative of 1 MWh. Must you mosey further and uncover about the 2d layers esteem the Lightning Community, you will be taught that the restrict for transactions per settlement is theoretically a lot of. As a consequence of this truth, realistic vitality per transaction is 116 TWh per year divided by infinity, which is as shut to zero as one can salvage.

We can not ever primarily know for definite why Musk stated and did what he did. What we are in a position to all steal from this episode, then again, is that recordsdata and proliferation of the facts are of extreme significance to the growth of Bitcoin, as even a “genius billionaire” can without effort salvage sucked into mistaken narratives and accomplish one trillion bucks’ price of tension.