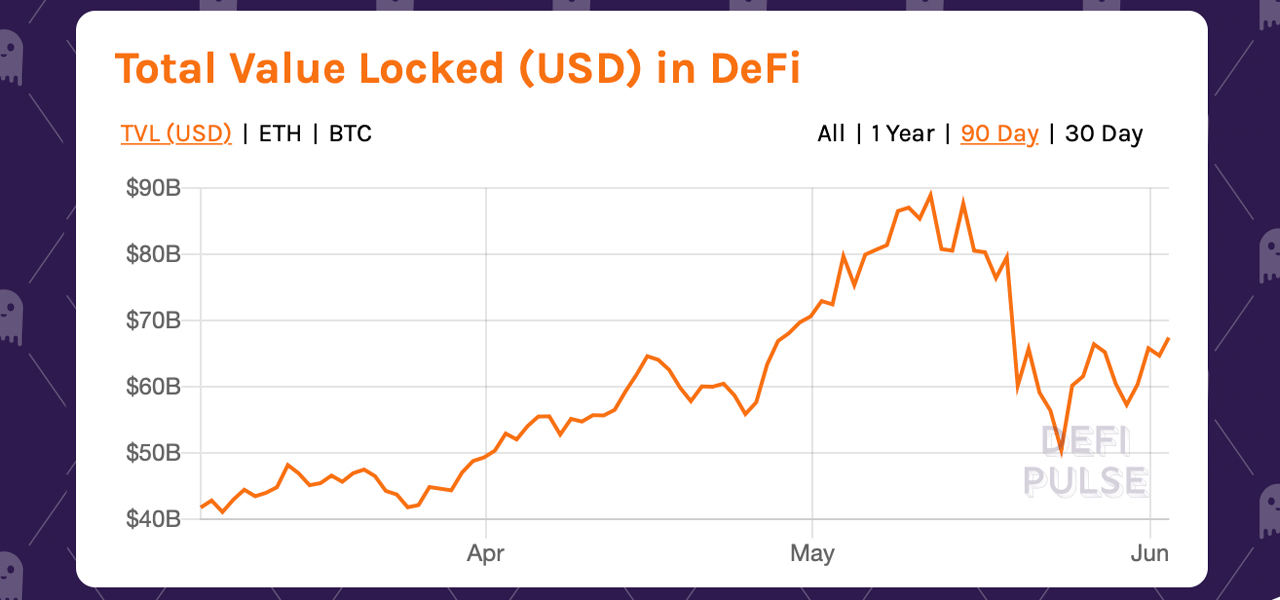

Decentralized finance (defi) exchanges and tokens are getting greater quite a bit faster than a critical sequence of digital sources that lost extra than 40% in price final week. Defi tokens like curve, kyber community, terra, hxro, and additional had been seeing double-digit gains. On May perhaps perhaps perhaps furthermore simply 23, the defi economic system’s mixture total-price locked (TVL) dropped to a low of around $50 billion and has since gained $17.4 billion.

Defi Economy Lifts Bigger Than the Leisure

Defi fans are seeing the economic system improve a shrimp bit after many decentralized finance tokens lost a critical quantity of price right by essentially the most novel market rout. Nevertheless, the defi economic system is deciding on up steam as soon as extra as a myriad of metrics existing the ecosystem is therapeutic faster than assorted crypto sources.

Seven-day statistics for decentralized exchanges (dex) existing $19 billion swapped on dex applications like Uniswap, Sushiswap, Curve, 0x Native, and Tokenlon.

Dune Analytics stats existing Uniswap saw $11.4 billion in trades while Sushiswap saw $2.4 billion in swaps right by the final week. On the Binance Super Chain (BSC), the novel dex platform Pancakeswap tallied $20.4 million in volume within the final 24 hours.

Binance dex has considered $5.4 million in 24-hour volume while BSC dex apps like Autofarm and Nerve Finance delight in furthermore considered increased shopping and selling circulation. Coinranking.com’s commerce ratings existing Uniswap is ranked 18 out of the tip 20 exchanges this day.

The defi economic system’s TVL has increased by 34.8% since May perhaps perhaps perhaps furthermore simply 23, after the defi TVL slid to $50 billion and jumped support to $67.4 billion, in step with files composed on June 2. Defipulse.com files existing that Aave has a dominance ranking of 15.18% because the lending protocol has $10.2 billion TVL.

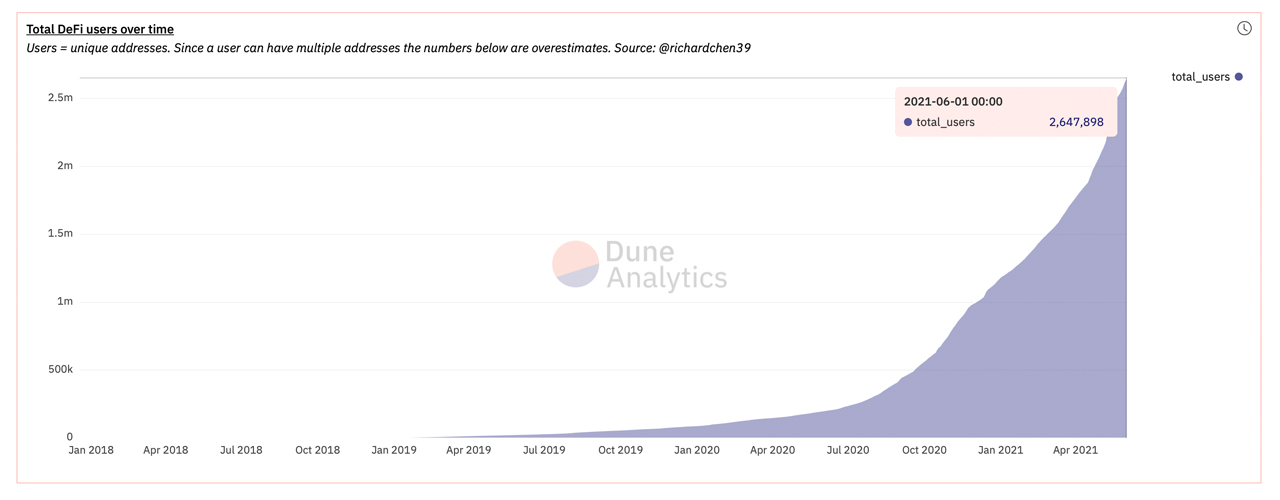

Defi customers (abnormal addresses) delight in increased significantly right by the course of 2021.

Defi customers (abnormal addresses) delight in increased significantly right by the course of 2021.Defi customers over time continue to rise exponentially as Dune Analytics signifies there are 2.64 million abnormal addresses this day. Abnormal defi addresses delight in grown 124% since December 31, 2020.

At this time, Uniswap is pulling in essentially the most revenue followed by Sushiswap and Aave. Up to now as TVL files is concerned, following Aave, defi platforms like Maker, Compound, Polygon, and Curve delight in jumped 7-12%.

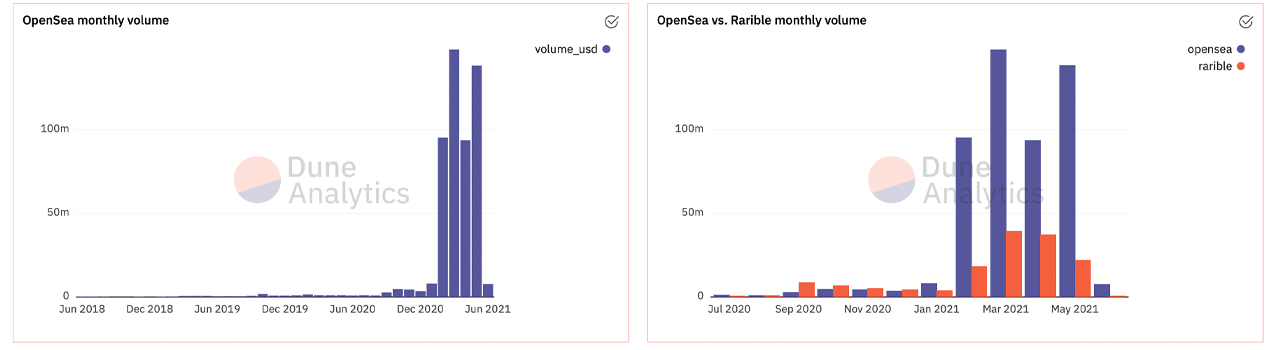

30-day month-to-month volumes for Opensea and Rarible NFT markets.

30-day month-to-month volumes for Opensea and Rarible NFT markets.The terminate non-fungible token (NFT) markets Opensea and Rarible delight in considered a critical rise in USD volume in May perhaps perhaps perhaps furthermore simply as compared to April. Opensea for occasion saw $93 million in April and in May perhaps perhaps perhaps furthermore simply volume jumped to $138 million.

Rarible’s volume used to be rather increased in April as compared to May perhaps perhaps perhaps furthermore simply and Opensea quiet towers over Rarible through USD volume. Rarible saw $37 million in April and May perhaps perhaps perhaps furthermore simply stats veil the NFT market saw easiest $22 million.