The Wall Facet street Analyst’s Intro to Bitcoin:

- The Dimensions of Money

- What Bitcoin Does

- How Bitcoin Works

- The Monetary Properties of Bitcoin

The Historical past Of Bitcoin

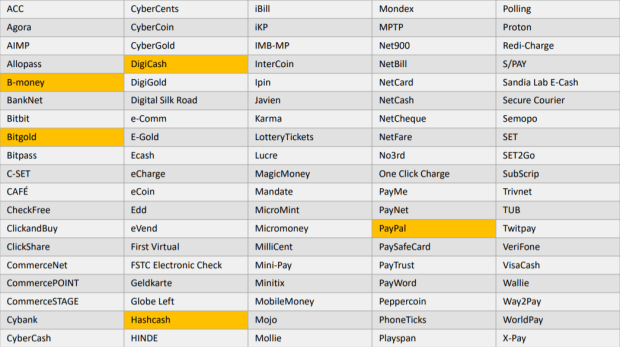

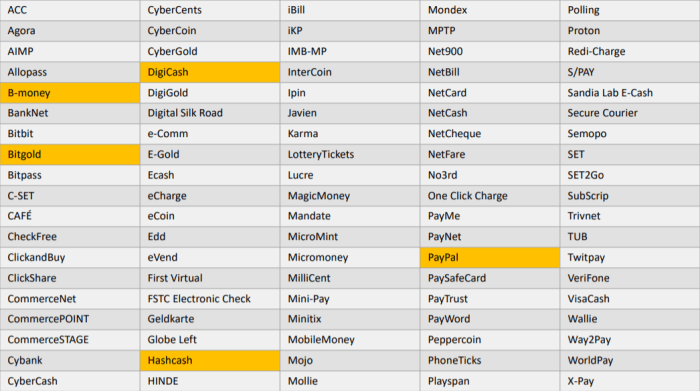

In October of 2008, amidst a world recession resulting in authorities bailouts of the banking map, a white paper became released beneath the pseudonym Satoshi Nakamoto titled Bitcoin: A Look-to-Look Electronic Money System. The paper summarized a confluence of applied sciences that, when combined, created the most major a success plot of digital money. These applied sciences had been the made of 4 a long time of makes an attempt and failures to catch digital money — below is a checklist of about 100 failed makes an attempt:

PayPal is on that checklist — their favorite realizing became cryptographic funds accessible-held devices. They had been no longer in a situation to manufacture on this realizing, and survived by pivoting remote from it. Many of the initiatives in the above table have a the same chronicle of attempting to assemble one thing esteem bitcoin however coming up brief. In hindsight we ticket that their traditional advise became that they tried to be a firm in the most major location. On the other hand, with every failure records became won, and the world came one step nearer to digital money.

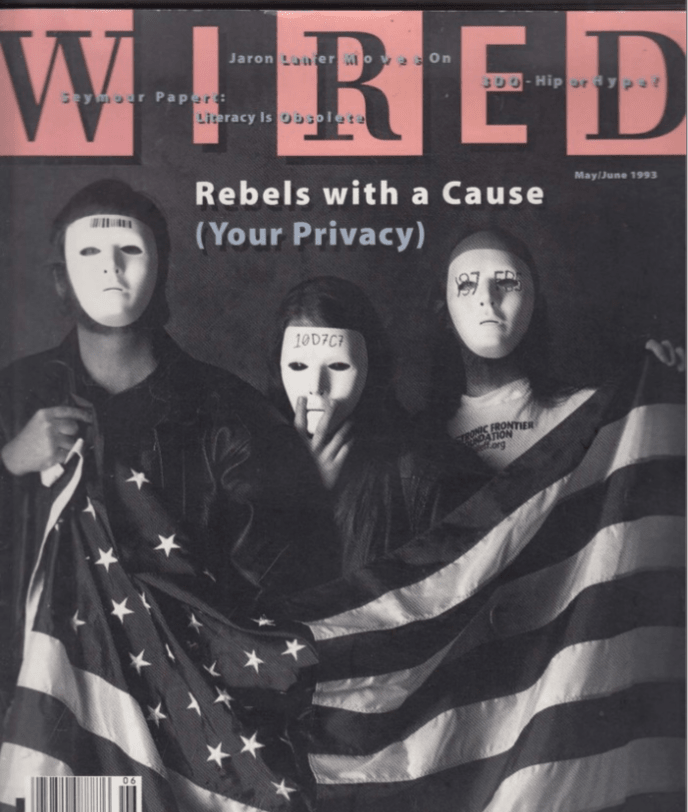

Many makes an attempt to catch digital money had been spawned by the cypherpunk poke which originated in the 1990s along with the improve of the internet. Cypherpunks believed the internet would change into a authorities surveillance apparatus unless defensive applied sciences had been created.

Earlier than governments utilized national firewalls, forward of social media internet sites had been promoting our private records, forward of the NSA’s PRISM program,l and forward of tall tech became systematically censoring political actions, the cypherpunks had been at work expecting this recent world. They had been in a situation to count on it for this reason of their abnormal intersection of assorted forms of information — along side cryptography, computer science, Austrian economics and libertarianism.

Cryptography enables digital encryption, which removes the energy of sovereign impact over the internet. On the other hand, an self reliant plot of digital money is additionally required to have an economy free from authorities regulate. Digital money enables an encrypted on-line economy to freely transfer fee and thus to freely situation up in the digital world.

Here’s a summary of the principle events that in a roundabout contrivance end result in the introduction of Bitcoin:

- Public-key cryptography: Began in the 1970s and allowed for public keys to be old over worried verbal change channels. Governments tried to manage this recent technology by invoking the fable that criminals will narrate it. They in a roundabout contrivance misplaced this battle and this technology is now portion of the underlying safety for internet communications. It is old in a wealth of recent applied sciences for encryption.

- Digital signatures: Developed by David Chaum in 1989, who old it to stumbled on the firm Digicash. This allowed a person to assemble a signature (esteem one on a take a look at) that will per chance well point to they had a inner most key connected to a public key, without revealing the inner most key. This allowed of us to anonymously take a look at that they are who they are saying they’re. Chaum’s firm, nonetheless, didn’t determine a approach to envision signatures without trusting a third party.

- Digital shortage: Since digital money is honest bits on a computer, what became to cease any individual from copying it? Money wishes to be scarce to have traditional fee. Within the loyal world, scarce issues are few in quantity or are incredibly no longer easy to search out. Adam Abet recreated this loyal-world advise the usage of computational puzzles in his proposal for HashCash in 1997. Computers are correct at math however there are some math issues that they’ll only solve by guessing. Within the event you narrate tall sufficient numbers, these issues can change into extremely no longer easy for computer techniques to resolve by guessing. By tying the introduction of money with alternate suggestions to those no longer easy math issues, digital money became made scarce. In Bitcoin this realizing referred to because the proof-of-work consensus algorithm which requires computer techniques, acknowledged as miners, to resolve a computationally tense puzzle to catch recent bitcoin. This makes bitcoin costly to catch and thus scarce.

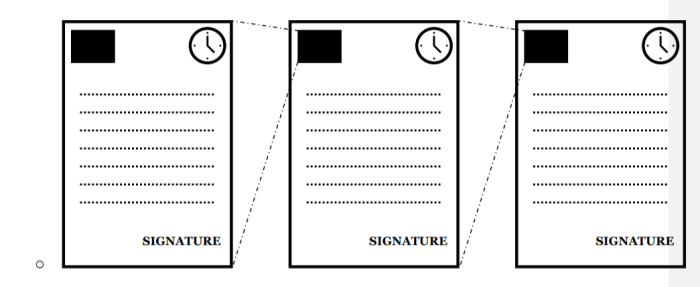

- Blockchain: The realizing that of a blockchain can even be traced help to a paper by Haber and Stornetta in 1991. The foundation became for folk to ship varied variations of a doc to a server over time. The server would add a hash pointer to the prior doc, a time tag and a digital signature of the server to envision that it became indubitably the server that signed off on this (i.e., verified it). This intended that the most modern version in the checklist had a link to its prior version, thus rising a series between all of them.

- A hash pointer is a hash characteristic that hashes the prior doc in a temporal checklist of paperwork. These capabilities compress immense databases into strings of textual explain material for storage, and a single commerce in any portion of the database would be mirrored in the string of textual explain material. If every doc created has a hash pointer to its prior version integrated, then any adjustments to its lineage would be obvious through a commerce in the hash pointer of the recent doc. Together with a time tag to every doc creates a temporal checklist, after which the usage of a digital signature permits you to point to which server signed off on the doc update. All of these measures combined produced a verified chain of information where any tampering with its historical past would be correct now obvious.

To recap, digital signatures catch a verifiable contrivance of confirming an identification digitally without disclosing it. This digital signature, when incorporated in a blockchain records construction, creates a temporally linked, immutable file of information. These applied sciences might be old to counteract issues native to digital money. On the other hand, the provision of that digital money wished to be scarce, and this advise became solved the usage of computationally intensive puzzles (by capacity of hash capabilities) to organize provide.

On the other hand, none of these trends had stumbled on a approach to catch to the bottom of disagreement between nodes on the recorded ledger. Bitcoin resolved these final challenges. This is succesful of per chance additionally goal no longer assemble full sense yet, however this can, so whenever you are at a loss for phrases please maintain reading.

Bitcoin utilized digital signatures, the blockchain records construction and computational puzzles to efficiently catch, for the most major time in historical past, decentralized digital money.

Bitcoin

Satoshi says he or she started coding Bitcoin round Would possibly per chance 2007 and registered www.bitcoin.org in Would possibly per chance 2008. In October 2008 he released the Bitcoin white paper and code. The Bitcoin network became up and running by the originate of 2009. The first transaction became sent to Hal Finney and a neighborhood of cypherpunks started encouraging the usage of bitcoin for look-to-look transactions.

The foresight of the cypherpunks is fabulous, and what they did took courage. Powerful of their quest to fabricate internet money became impressed by economists rooted in the Austrian school.

In 1984, Nobel laureate economist Friedrich Hayek said:

“I compose no longer hiss we shall ever have a correct money again forward of we desire the item out of the hands of authorities, that is, we are succesful of’t desire it violently out of the hands of authorities, all we are succesful of cease is by some sly roundabout manner introduce one thing that they’ll not cease.”

In 1999 Nobel laureate economist Milton Friedman said:

“I mediate that the Net is going to be one among the principle forces for reducing the characteristic of authorities. The one thing that’s missing, however that will quickly be developed, is a legitimate e-cash, a formulation whereby on the Net you would possibly per chance well presumably additionally transfer funds from A to B, without A incandescent B or B incandescent A.”

In 2008 this vision started its whisk toward fact. Satoshi created decentralized digital money whereas standing on the shoulders of giants.

What Bitcoin Does

What bitcoin does is a separate quiz from why it is miles precious. What makes bitcoin precious is the network of of us that have determined to make narrate of it. To like why these of us have determined to make narrate of it you would possibly like how it indubitably works. This would be no longer easy, as Bitcoin’s technology is a confluence of technical concepts unfamiliar to most of us.

The Bitcoin protocol permits you to ship scarce money to anyone in the world. This skill sounds straightforward, however it is miles grand. Name your financial institution correct kind now and request them to wire a broad quantity of money to anyone in a single other nation for you. Indulge in spending the next week attempting to assemble that happen and subsequently getting tracked by the authorities. The skill to pass immense amounts of fee within minutes over a digital network does no longer exist wherever else.

You might per chance well presumably request, what about Paypal or Venmo or Money App?

These are all relied on third parties, and trusting third parties has consequences.

- It is essential to play by their guidelines

- It is essential to describe them who you are

- It is essential to belief they’re going to maintain your records gain

- It is essential to give them regulate over your money

Let’s append “trustless” to my final assertion: the flexibility to pass immense amounts of fee within minutes over a trustless digital network is incredibly grand. It is trustless since you don’t need to belief a third party. Here’s that you would possibly per chance well presumably additionally hiss because it is miles a decentralized network which has no third party intermediaries and thus no person can regulate it; more on this later.

In April 2020, $1.1 billion in bitcoin became moved in a transaction for a fee of 68 cents, and it became performed in a topic of minutes. This became performed cheaply and efficiently without the transactors having to play by any one’s guidelines, describe a third party who they’re, belief anyone with their records or give anyone regulate over it. No other fee map in the world can pass that quantity of fee, for that impress, in that period of time, without oversight from a third party.

To like how this is doable we now need to catch technical. I will maintain this excessive level — you would possibly per chance well presumably additionally attempt my e book for a more in-depth clarification .

One-manner Calculations

Bitcoin makes narrate of hash capabilities (additionally acknowledged as hashes) in a unfold of ways correct throughout the protocol. Within the most straightforward sense it enables us to assemble one-manner calculations — a calculation where if A*B=C you would possibly per chance well presumably additionally only gain A or B whenever you realize them (e.g., whenever you would possibly per chance well presumably additionally goal have A and C that you would be succesful to no longer divide them to search out B).

In Bitcoin, your public key’s C, A is your inner most key, and B is acknowledged by all people.

- A = inner most key: a random quantity you use out.

- B = this variable is public and acknowledged by all people and by no contrivance adjustments (in bitcoin it known as secp256k1 which you would possibly per chance well presumably additionally study more on on the link).

- C = public key: additionally acknowledged as your bitcoin take care of (however there is a small incompatibility between the 2).

One-manner calculations work because they’re dependent upon an unsolvable mathematical advise known as the discrete log advise. Briefly, whenever you narrate finite field math over a field of an unfathomably immense high quantity then dividing for the answer is practically unimaginable. Powerful of recent cryptography rests on this unsolvable advise. Whether it is miles solved, most of our cryptographic techniques will crumble. Computers might per chance well theoretically change into quick sufficient to bet alternate suggestions through iteration (e.g., through quantum computing). On the other hand, this is incredibly no longer possible. To provide you some perspective on this, the high quantity old by bitcoin is 2256~ or 1077 digits long. The estimated sequence of atoms in the universe is 1080. One thousand billion computer techniques doing a thousand billion computations every trillionth of a second for a thousand billion years is easy lower than 1056 computations.1

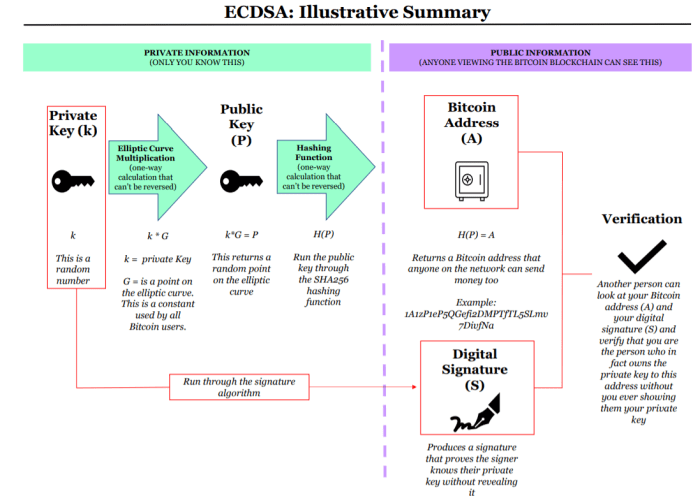

Bitcoin Addresses And Digital Signatures

Hash capabilities and digital signatures are old to catch the foundation of Bitcoin. They enable the introduction of Bitcoin addresses. An take care of is where of us can ship and receive bitcoin to and a digital signature permits you to publicly point to you realize the inner most key that unlocks your take care of without revealing it. To cease this, Bitcoin makes narrate of the Elliptic Curve Digital Signature Algorithm (ECDSA) and below is a description of how this all ties collectively.

At a excessive level here is how the ECDSA works:

- A non-public key’s generated as a random quantity. A correct provide of randomness is crucial for safety purposes.

- The inner most key’s multiplied by an odd point on the Bitcoin elliptic curve to catch a public key that can even be shared without revealing the inner most key.

- The public key’s then hashed to catch a bitcoin take care of. In case your inner most key old a glum provide of randomness, your take care of can have a safety advise.

- The ECDSA algorithm creates a digital signature from your inner most key. Using this signature and your bitcoin take care of you would possibly per chance well presumably additionally now ship bitcoin to other of us on the network.

- Within the event you ship bitcoin, every node on the network that hears about your transaction verifies your signature along with your take care of and tests that you would possibly per chance well presumably additionally goal have in any case as grand bitcoin as you strive to ship. If verification of your signature fails, or if the amount of bitcoin you have is insufficient, your transaction is dropped from the network.

Transaction Mechanics

In Bitcoin every transaction has an enter and output. Within the event you ship bitcoin the enter is how grand is at your take care of, and the output is the amount you are sending to one other take care of.

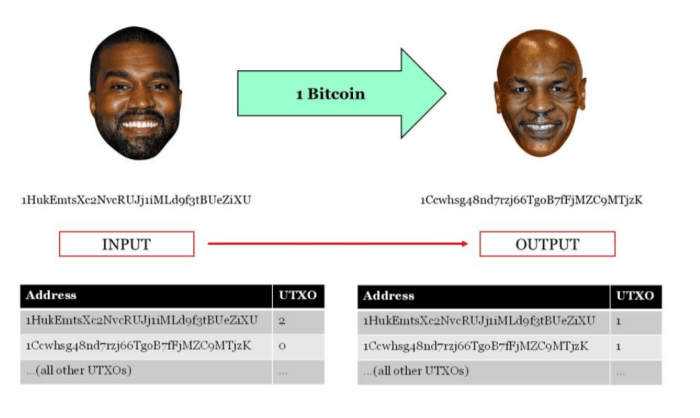

Remove Kanye West sends one bitcoin to Mike Tyson:

Bitcoin exists at addresses, which would be doable inputs and outputs for any transaction to realize. Bitcoin contributors maintain a checklist of all bitcoin in existence at every take care of known as unspent transaction outputs (UTXOs). This checklist is what network contributors reference to ascertain that Kanye had the one bitcoin he sent to Mike. After the transaction, Kanye’s take care of lowered by one bitcoin and Mike’s take care of increased by one bitcoin. Mike now has one bitcoin to exhaust which might be verified from the up to this point checklist of UTXOs.

The Blockchain Data Structure

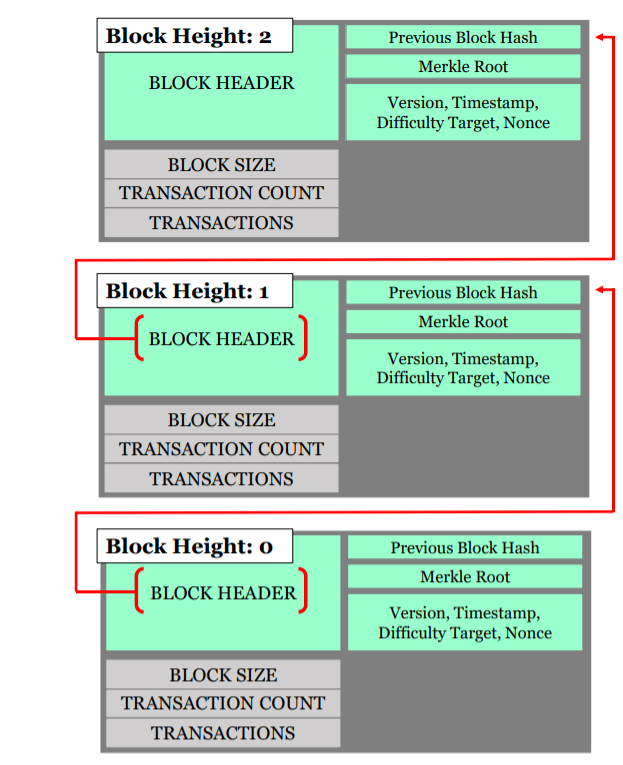

Bitcoin enables of us to catch transactions and if the transactions shuffle verification from other nodes they’re aggregated into blocks. These blocks are linked collectively to plot a blockchain. The blockchain is old as a ledger that will per chance no longer be changed.

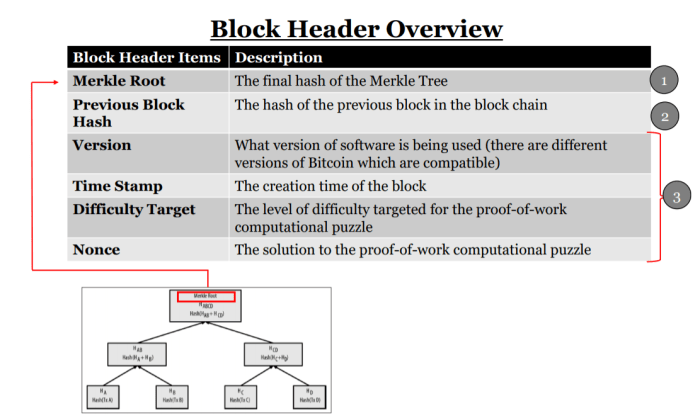

Every block has a block header that contains records for easy verification of blocks between nodes.

- All transactions are formed into a tree (merkle tree) after which combined and hashed until there is one hash left known as a merkle root.

- The previous block hash is a hash of the block header in the previous block.

- The final classes are old in mining, to be discussed later.

This records construction links the entirety collectively which enables computer techniques to quick take a look at that the historical past of the Bitcoin ledger is constant between one one other.

So, all transactions are linked within blocks through a tree construction and the previous block hash links all blocks collectively forming a blockchain. Under you would possibly per chance well presumably additionally sight a block header that contains the full fields shown above besides to the scale of the block and the full transactions in it.

Any commerce in a previous block might be instantaneously mirrored in the recent block for the reason that previous block hash would commerce. This construction became utilized to quick allow contributors to like that they are each working off the identical historical past of bitcoin transactions. Here’s as soon as in a whereas a formulation of version regulate that protects against unfriendly actors. A pudgy clarification of this requires an working out of the Bitcoin network, lined in the next essay.

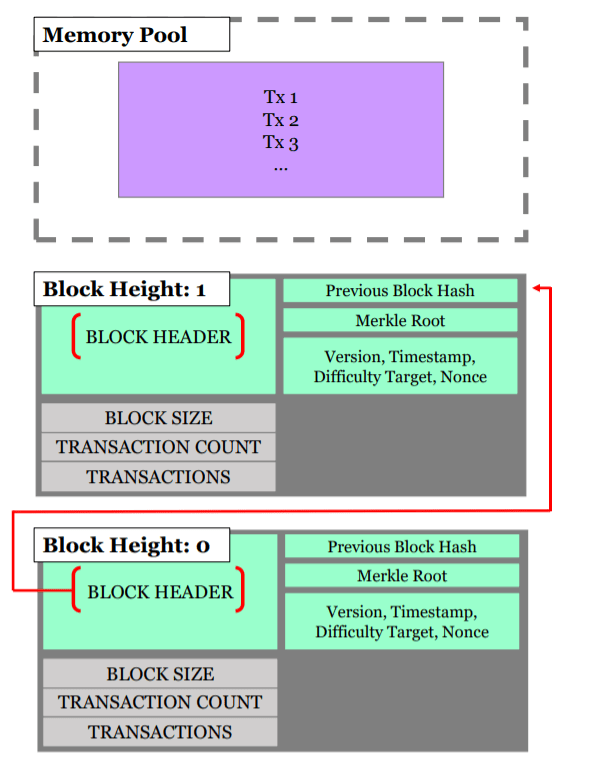

Lastly, you can need to like the reminiscence pool. There is a period between the introduction of a transaction and its final recording in the blockchain. For the period of this period, a transaction is held by every participant who has heard of it of their respective reminiscence pool. Here’s esteem a waiting room where it sits until a miner has solved the computational puzzle that publishes the transactions to the blockchain. The reminiscence pool can vary for every network participant. The reminiscence pool of the miner who in a roundabout contrivance stumbled on the next block is the one which might be inserted in the block chain; any transactions that had been sent however no longer integrated by this miner will merely need to wait to be integrated in the next block.

We now realize the attain of the blockchain. This summary of the blockchain is incomplete without working out the Bitcoin network. How does all people hear about transactions? Does all people agree on the identical transactions? If no longer, how is consensus done among hundreds of assorted contributors when more than one variations of the blockchain are being referenced? The following essay will describe.

References

- Mastering Bitcoin, Andreas Antonopolous, https://github.com/bitcoinbook/bitcoinbook