Opt notify of this a signpost. This assertion by Yellen, while assumed by most merchants, is factual one other “stamp of the times.”

For these that are no longer yet mindful, we reside by the main bursting global sovereign debt bubble in 100 years and the main forex system shift in 50 years.

Sovereign debt bubble? Currency system shift? Journey, you heard that factual. When Janet Yellen, broken-down chair of the Federal Reserve and incumbent U.S. Treasury Secretary states that the U.S. is presumably no longer allowed to default on its debt tasks, she is factual.

The federal authorities is no longer going to explicitly default on its debt, as a replacement it’s going to implicitly default, which is in actuality precisely what’s happening this day.

What precisely is the variation between an implicit and explicit default, you query? While the history of authorities defaults is extraordinarily nuanced, we shall be in a position to quickly survey two examples of sovereign default, each of which happened in america over the closing century, to produce context.

The Roaring ’20s

The 1920s possess been identified as “the “roaring twenties,” and for proper aim. Following the conclusion of World Battle I, U.S. productiveness soared as inventions and technological advances corresponding to the mass manufacturing of the radio and car brought about basically the most prosperous times in all of recorded history.

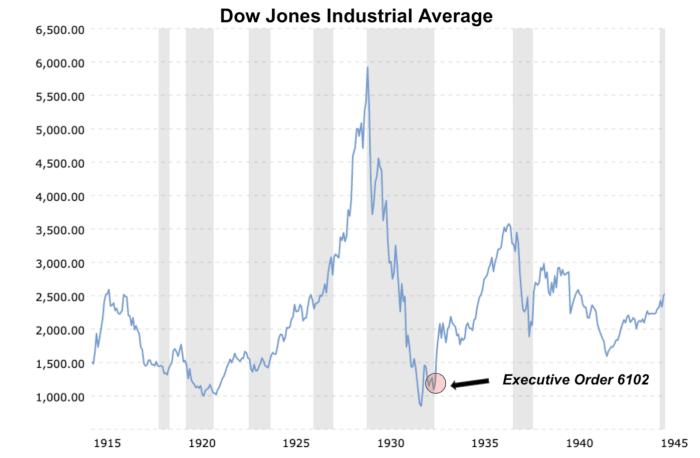

Now no longer simplest turn into technological advancement occurring, nevertheless the stock market completely soared, bringing about wild enthusiasm as day after day of us grew rich as the Dow Jones Industrial Practical (DJIA) almost grew by almost a ingredient of 5, from 1920 to 1929.

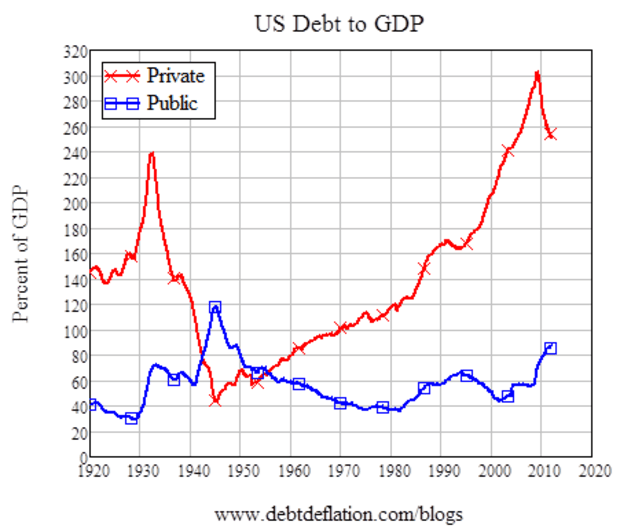

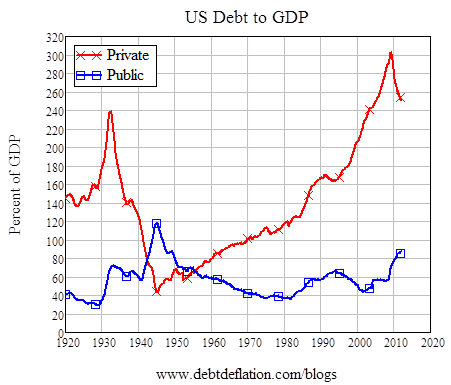

Nonetheless, the booming stock market turn into no longer a consequence of a “new paradigm” of productiveness or financial markets like many believed at the time, nevertheless pretty turn into mostly because of unchecked credit score expansion which created a large asset bubble.

All over the later years of the 1920s, many folk and entities would borrow utterly to make investments in the stock market that perceived to simplest prance up.

Collateral values elevated -> extra creditworthy borrowers -> less complicated credit score -> additional credit score expansion -> better asset costs. A virtuous cycle.

Nonetheless, like all credit score-fueled asset bubbles, there turn into at closing a bust, and what followed turn into amongst basically the most notorious financial market collapses ever. The DJIA collapsed by 85% in pretty much less than three years, as the virtuous cycle of a credit score enhance worked in reverse.

Collapsing asset costs -> Forced margin calls because of falling collateral rate -> Lower creditworthiness – > tighter lending stipulations.

Nonetheless, at this era in time, the greenback turn into pegged in rate to gold, which restricted the Fed’s capability to ease, as any easing of the cash provide would possess needed to be backed by additional gold reserves. Thus, the entire credit score extension and fractionally reserved “cash” in circulation collapsed lend a hand onto the gold peg as the malinvestment tried to liquidate itself from the system.

Here is a quote from Ray Dalio’s ebook, “Rules For Navigating Wide Debt Crises”:

“In most cases, governments with gold-, commodity-, or foreign-forex-pegged cash programs are compelled to possess tighter monetary policies to provide protection to the value of their forex than governments with fiat monetary programs.

But at closing the debt contractions turn into so painful that they relent, fracture the link, and print (i.e., both they abandon these programs or switch the quantity/pricing of the commodity that they will interchange for a unit of money).

As an illustration, when the value of the greenback (and therefore the quantity of money) turn into tied to gold at some level of the Mountainous Depression, suspending the promise to rework greenbacks into gold in mutter that the forex would possibly possibly be devalued and more cash created turn into key to growing the bottoms in the stock and commodity markets and the economic system.

Printing cash, making asset purchases, and providing ensures possess been unheard of less complicated to attain in the 2008 financial disaster, as they didn’t require a legalized and reputable switch in the forex regime.”

Gold has traditionally no longer simplest serves as a hedge against monetary inflation at some level of a credit score enhance, nevertheless also at some level of the deflationary bust that follows and the accompanying counterparty threat that incorporates it.

In 1933, President Roosevelt issued executive mutter 6102, which mandated that every privately-owned gold be handed over to the authorities. At this time after, in 1934, Roosevelt revalued the gold peg from $20.67 per troy ounce to $35 per troy ounce. The stated explanation for the mutter turn into that “laborious times had precipitated hoarding of gold, stalling economic development and worsened the sorrowful.”

The real fact turn into that this turn into no fault of “grasping gold hoarders.” This turn into an explicit default. The U.S. greenback, which turn into pegged to a identified quantity of gold, turn into now no longer redeemable at the conversion rate, and U.S. voters possess been the ones careworn with the devaluation. There turn into no longer ample gold in reserves to redeem the entire claims in circulation. This turn into a straight away consequence of fractional reserve banking.