Must you’re weighing your cryptocurrency hobby sage alternate strategies, Blockfi vs. Crypto.com is a stable first comparison.

BlockFi is essentially based totally in the U.S. and is viewed as a CeFi staple. It’s straight forward to begin, extremely-trusted within the cryptocurrency team, and provides above-average yields all the arrangement by strategy of money address BTC, ETH, and USDC.

BlockFi has yet any other, hobby sage, and bank card that one and all seamlessly pair together.

Crypto.com is essentially based totally in Hong Kong and has established itself as a pioneer in what it does, which is interestingly every thing. Its products encompass yet any other, hobby sage, staking platform, NFT storage platform, bank card, and more.

Whereas Crypto.com provides some of the highest APY for its hobby sage, it requires its customers to leap by strategy of many hoops and lend a hand principal amounts of its native token, CRO, to bag them.

Our plump BlockFi vs. Crypto.com comparison entails every thing or no longer it’s critical to perceive about rates, security, public belief, and more.

Let’s begin.

BlockFi vs. Crypto.com: Key Data

| BlockFi | Crypto.com | |

| Opinions | BlockFi Review | Crypto.com Review |

| Trouble Kind | Cryptocurrency hobby sage + traditional alternate | Crypto alternate + crypto hobby sage + NFT alternate |

| Beginner Friendly | Sure | Sure |

| Cell App | Sure | Sure |

| Shield/Deposit Strategies | ACH, wire transfers,crypto deposits | ACH, wire transfers, PayPal, credit or debit card |

| Sell/Withdrawal Strategies | External crypto pockets, checking sage | External crypto pockets switch, ACH |

| On hand Cryptocurrencies | Bitcoin, Ethereum, Litecoin, Hyperlink + stablecoins | Bitcoin, Ethereum, Dogecoin, stablecoins, totally different altcoins |

| Company Originate | 2017 | 2016 |

| Space | Jersey City, NJ, USA | Hong Kong |

| Community Belief | Mountainous | Mountainous |

| Security | Mountainous | Mountainous |

| Customer Increase | Goal appropriate | Mountainous |

| Verification Required (KYC) | Sure | Sure |

| Fees | Medium | Average |

| Trouble + Promo | Be pleased up to $250 on BlockFi | Be pleased up to $25 on Crypto.com |

Company Bios: BlockFi vs. Crypto.com

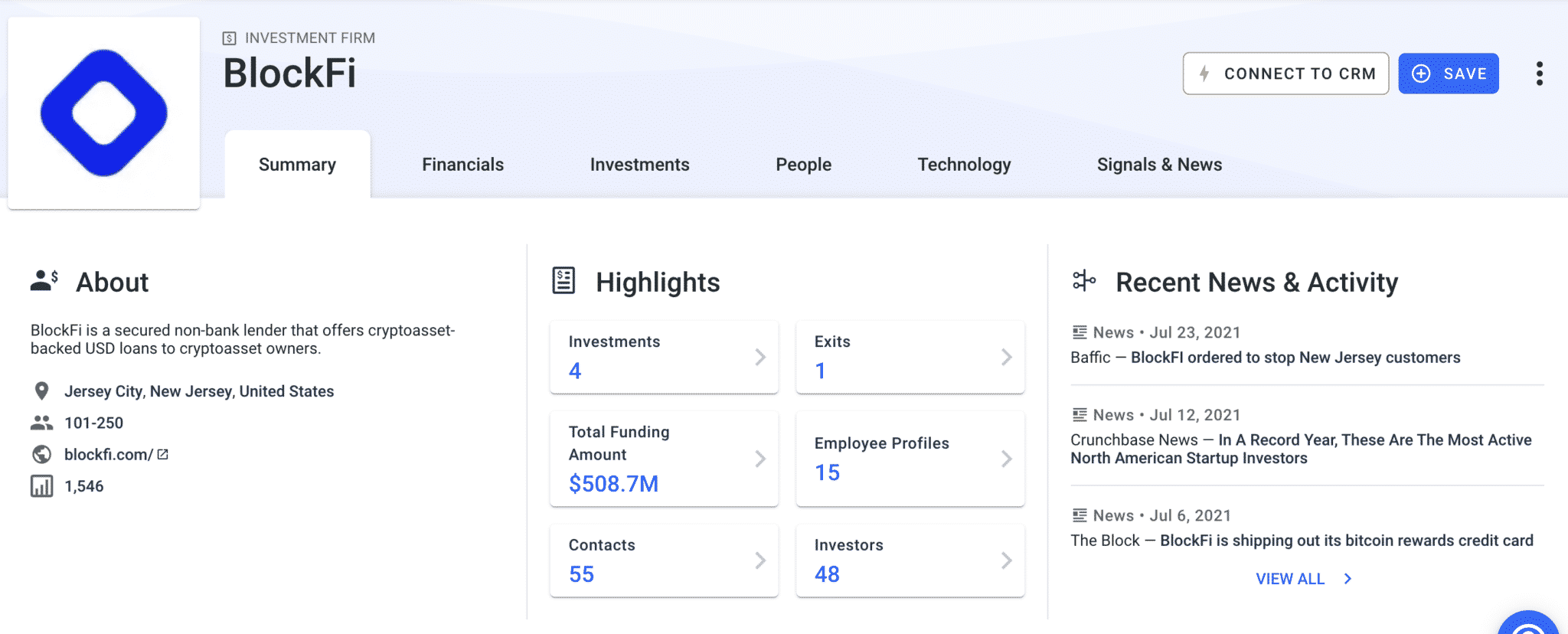

BlockFi became once founded in 2017 by Zac Prince and Flori Marquez. It’s headquartered in Recent Jersey and has got investments from several tremendous names in the Fintech and cryptocurrency industries, alongside with SoFi, Winklevoss Capital, and Pomp Investments.

BlockFi on Crunchbase (courtesy of Crunchbase)

BlockFi’s most up-to-date round of funding took set in March 2021, by which it raised $350 million at a $3 billion valuation. The firm has around $15 billion in assets below administration (AUM).

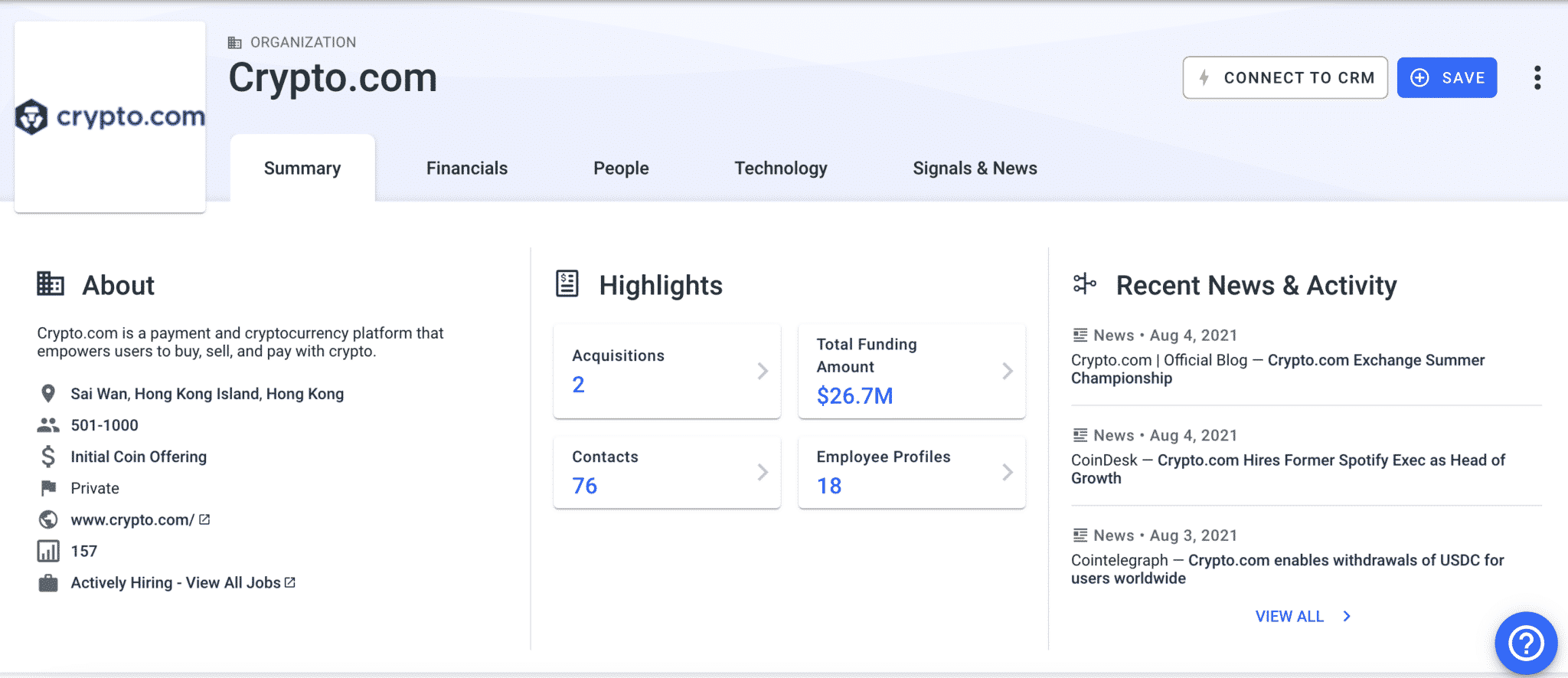

Crypto.com on Crunchbase (courtesy of crunchbase)

Crypto.com became once launched in Hong Kong below the title Monaco Technologies in June 2016 however rebranded in July 2018 to its present title. The firm grew rapid, as it became once current dependable into a Hong Kong-executive-backed cryptocurrency incubation program known as SuperCharger in 2017.

Crypto.com is led by CEO Kris Marszalek and CFO Rafael Melo. Its team is plump of alumni from some of the superb names in both ragged finance and cryptocurrency, alongside with:

- Deutsche Bank

- JP Morgan

- PayPal

- Binance

Feature #1: Passion Charges: Who Pays Extra, BlockFi or Crypto.com?

Both Crypto.com and BlockFi pay customers hobby on the cryptocurrency assets they retailer on the platform.

BlockFi’s machine is mighty less complicated, which makes an tremendous distinction in the user abilities.

On BlockFi, customers merely applicable maintain to perceive the amount of an asset they’re depositing to calculate their yields.

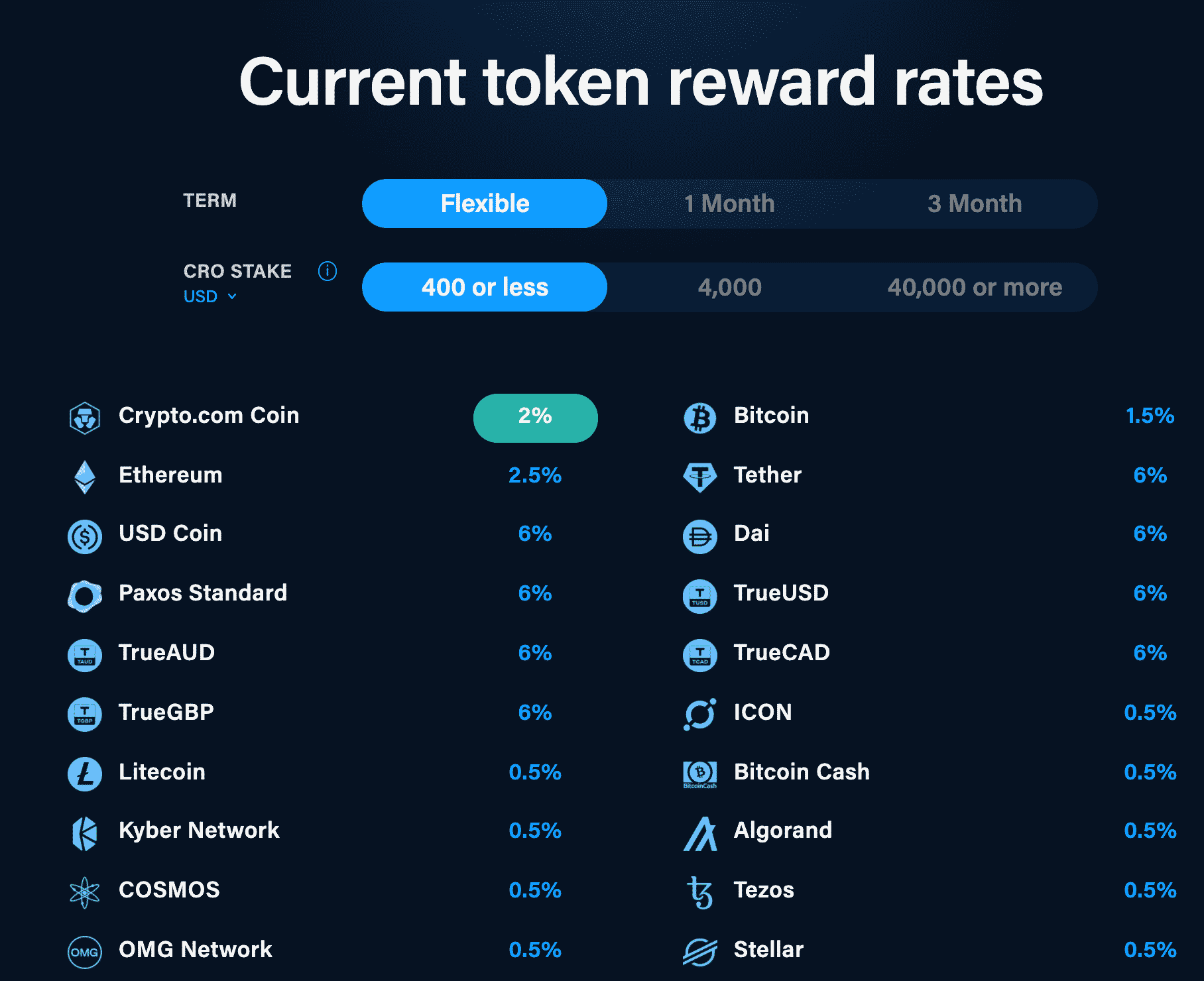

Crypto.com’s machine is arrangement more sophisticated, with hundreds of alternatives to bag perplexed. Crypto.com Charges fluctuate in response to whether a user chooses a flexible, 1-month, or 3-month timeframe. Extra, customers maintain to own Crypto.com’s token (CRO) to form the utmost hobby. Charges scale up in response to the tiers of CRO holdings:

- $400 or less in CRO

- $401 to $4,000 in CRO

- $4,001 to $40,000 or more in CRO

- $40,001 to $400,000 in CRO

The principle and lowest tier of Crypto.com

Grab into sage that these CRO amounts are in greenback amounts– as in you can maintain to maintain interaction $400,000 worth of CRO to liberate the highest tier.

Let’s look for how this performs out with some examples.

Bitcoin

- BlockFi makes use of a tiered hobby-price machine for Bitcoin; APY scales in response to how mighty BTC you retailer on the platform. Charges are around 4% for 0 – 0.25 BTC, 1.5% for 0.25 – 5 BTC, and nil.25% for > 5 BTC, however are discipline to alternate.

- Crypto.com’s BTC rates vary from as low as 1.5% for a flexible sage without a longer up to $400 in CRO to as excessive as 8.5% for a user with $40,000 or more in CRO with a 3-month sage.

Ethereum

- BlockFi also makes use of a tiered hobby-price machine for Ethereum. Most up-to-date rates are 4% for 0 to 5 ETH, 1.5% for five to 50 ETH, and nil.25% for > 50 ETH.

- Crypto.com’s Ethereum rates begin at 3.5% for a flexible user with $400 or less in CRO and scuttle up to 8.5% for a 3-month user with more than $40,000 in CRO.

Alts

| Coin Title | BlockFi | Crypto.com |

| Chainlink | 3% (0 – 750 LINK), 0.5% (>750 LINK) | 0.5% – 5% |

| Bitcoin Cash | N/A | 0.5% – 5% |

| Compound | N/A | 0.5% – 5% |

| Cosmos | N/A | 0.5% – 5% |

| UNI | 3.75% (0 – 750 UNI), 1.5% (> 750 UNI) | 0.5% – 5% |

| Dogecoin | N/A | 0.5% – 5% |

| Litecoin | 4.5% (0 – 100 LTC), 2% ( >100 LTC) | 0.5% – 5% |

| Polkadot | N/A | 6% – 14.5% |

Stablecoins

| Coin | BlockFi | Crypto.com |

| Tether | 7.5% (0 – 50,000), 5% (> 50,000) | 6% – 8.5% |

| GUSD | 7.5% (0 – 50,000), 5% (> 50,000) | N/A |

| USDC | 7.5% (0 – 50,000), 5% (> 50,000) | 6% – 14% |

Winner: BlockFi. BlockFi’s simplicity and aggressive rates raise the day.

Though Crypto.com provides increased prime-discontinue rates than BlockFi on most money, it’s asking loads from its customers. Maintaining $40,000 to $400,000 worth of an arguably uncertain token address CRO might perchance perchance appear unrealistic and pointless for many customers. In totally different phrases, Crypto.com’s juice isn’t worth the squeeze, particularly when a platform address BlockFi (or Celsius) provides comparably excessive rates with out the complexity.

How Kind BlockFi and Crypto.com Get Money?

BlockFi makes its money by lending out the assets it holds for no longer up to it pays its customers for them. As an illustration, it might per chance well perchance perchance offer 7.5% on Tether (USDT) however lend it out for 12%. These loans are over-collateralized so the menace of default is comparatively low.

Crypto.com makes its money by strategy of both loans and alternate charges. The firm’s loaning machine works in an analogous vogue to BlockFi’s. It makes use of a advanced maker/taker rate structure for crypto shopping and selling, with maker rates starting from 0.036% to 0.1% and taker rates starting from 0.090% to 0.16%.

Feature #2: Payouts and Withdrawals

BlockFi hobby accrues every single day and is paid out on a monthly foundation. A form of its rivals pay out hobby every single day. BlockFi customers are entitled to 1 free crypto withdrawal and one free stablecoin withdrawal every month. Extra withdrawals incur a rate.

Crypto.com costs charges for all withdrawals that are completed on-chain. Users can steer clear of these charges by utilizing the firm’s withdraw to app characteristic. That being said, there’s no such thing as a rate to send cryptocurrency to fully different Crypto.com customers.

Crypto.com pays its hobby out every single day, nonetheless, this hobby does no longer compound.

Winner: BlockFi. BlockFi wins this one attributable to its free withdrawal alternate strategies and compounding hobby. Crypto.com is the next resolution for fogeys that prefer their hobby paid out straight in want to monthly– nonetheless, beware the costs.

Feature #3: BlockFi vs. Crypto.com Security

Crypto.com and BlockFi seem to take customers’ security severely and neither has suffered a principal breach that impacted clients’ funds.

BlockFi holds 95% of the funds it shops in chilly storage. That is managed by Gemini, which holds a SOC certification from Deloitte.

Crypto.com is many times audited by Bureau Veritas and has partnered with Ledger to chilly retailer the overwhelming majority of its customers’ funds. It also makes use of hardware security modules and multi-signature applied sciences to defend assets stable.

Both corporations maintain numerous user-facing security functions a lot like 2-reveal authentication.

Each provides FDIC insurance coverage for up to $250,000 of its customers’ money funds– this is applicable for fiat, no longer stablecoins or cryptocurrency.

Winner: Crypto.com It’s no longer easy to distinguish a winner right here, however Crypto.com gets the nod since it claims to retailer 100% of its customers’ funds in chilly storage, beating out BlockFi’s 95%.

Feature #4: Ease of Spend

BlockFi is by far the less complicated of the two platforms to make use of; customers merely maintain to scamper funds to BlockFi and sit serve while the hobby starts accruing.

Granted, Crypto.com customers can form that too, however they received’t bag essentially the most productive rates except moreover they prefer a non-insignificant sum of CRO tokens. This introduces a brand novel ingredient of menace into the equation that BlockFi doesn’t power upon its customers. Extra, Crypto.com customers maintain to lock up their funds to bag essentially the most productive rates.

Celsius is exclusively like Crypto.com in that it also has its own cryptocurrency (CEL). Nonetheless, it doesn’t require customers to lock their funds or lend a hand a particular amount of CEL to form essentially the most productive rates.

BlockFi vs. Crypto.com Standout Facets

Crypto.com and BlockFi maintain a identical standout feature: a cryptocurrency bank card.

Both the BlockFi bank card and Crypto.com bank card enable customers to form hobby in crypto on everyday purchases.

Nonetheless, as one might perchance perchance retract in response to fully different facets at some level of this BlockFi. vs. Crypto.com review, BlockFi’s bank card is mighty less complicated to make use of.

BlockFi’s card is free to maintain a study for, it has no annual rate, and it doesn’t require leaping by strategy of hoops to bag its maximum advantage.

Crypto.com provides several variations of its credit cards at totally different tiers, with rewards that adjust from 1% to eight% in response to the amount of CRO a user holds. An particular particular person needs to lend a hand as a minimum $400,000 in CRO to qualify for the highest hobby rates.

The Court of Public Idea: BlockFi vs. Crypto.com Reddit

Other folks on Reddit are in total complimentary of both BlockFi and Crypto.com. The frequent consensus is that every platform is protected to make use of and provides incredible yield-incomes alternatives.

A conversation about BlockFi and Crypto.com on Reddit

Some individuals on Reddit maintain instructed spreading your funds all the arrangement by strategy of both of these platforms and Celsius. That manner, if something had been to happen to 1 in every of the platforms, you wouldn’t be impacted as negatively.

A conversation about BlockFi and Crypto.com on Reddit

BlockFi vs. Crypto.com Customer Increase

BlockFi has stay phone make stronger available from 9: 30 AM – 5 PM EST. The firm also has a internet FAQ page customers can visit to bag answers to commonly-asked questions.

Crypto.com has a abet heart with answers to frequent questions. The firm also has e-mail make stronger available at [email protected]

Can You Belief BlockFi and Crypto.com?

The frequent consensus is that both BlockFi and Crypto.com are both real. Each firm claims to make use of chilly storage for user funds, which retains them far from internet-essentially based totally security dangers.

That being said, crypto hobby accounts aren’t menace-free and couldn’t be viewed as in the event that they had been financial savings accounts. Digital assets address BTC and USDC aren’t FDIC insured.

Extra, these corporations lend your cryptocurrency to third events. Though they take precautions to over-collateralize their loans, there is collected a menace fervent whenever you don’t maintain custody of your digital asset.s

BlockFi has got recognition for its security practices from trusted names address Deloitte and the Recent York Department of Monetary Services.

Crypto.com has earned an ISO/IEC 27001: 3013 certification and is many times audited by Bureau Veritas.

BlockFi vs. Crypto.com: Which is the Better Crypto Passion Fable?

There’s hundreds to address roughly BlockFi and Crypto.com.

BlockFi comes out earlier than Crypto.com since it’s mighty less complicated to make use of, and it doesn’t require customers to lend a hand its own native token to form essentially the most productive yields.

That being said, whenever you happen to’re inclined to was a Crypto.com power user and accept the dangers that reach with conserving tremendous amounts of CRO tokens, Crypto.com is at menace of be for you. When the token amounts and lock-up classes are maxed out, Crypto.com’s yields are some of the highest in the CeFi crypto hobby sage industry.