Getting started in cryptocurrency investing could perhaps furthermore very neatly be an intimidating step. Cryptocurrencies are infamously unpredictable, making it demanding to avoid wasting knowledgeable funding choices, specifically for ticket unusual investors. In light of those challenges, you could perhaps perhaps seize pleasure in the usage of the stock-to-float mannequin to avoid wasting a extra structured decision.

Adore in pale stock markets, radiant crypto investments rely on predicting the save various sources’ values could perhaps furthermore very neatly be heading. It’s likely you’ll perhaps perhaps bag many crypto label prediction fashions, but stock-to-float has change into one amongst the most popular, because it has lined up with Bitcoin’s genuine label modifications for years. Here’s a smarter learn about at this mannequin, the top method it works, and why you could occupy to attain simple issue stock-to-float in crypto.

Why Other Devices Are Unideal

Many in style cryptocurrency funding fashions nowadays attain from pale, most continuously much less unstable, markets. Though they’ll occupy a history of reliability with extra pale funding sorts, cryptocurrency is an fully various beast, largely ensuing from its novelty amongst other causes. Since crypto reacts to increasing factors esteem investor habits extra closely, pale fashions could perhaps now not be as legit long-term.

Some fashions, esteem the Elliott Wave Understanding, try and foretell modifications in investor sentiment and psychology. These most continuously fall short due to they rely on so many unknowns and influencing factors. Investor choices aren’t incessantly uniform and can attain from extra than accurate label modifications, so predicting them isn’t so simple as these fashions save it seem.

Other fashions, esteem the rainbow chart, rely on ancient data, but the long flee doesn’t incessantly line up with the previous. As an instance, when Bitcoin hit a then-all-time-excessive of $1,000 in 2013, many investors understanding it turn out to be as soon as too costly to grab. After Bitcoin’s persisted growth, that label appears cheap in hindsight, so the rainbow chart would’ve led you off route on this occasion.

What Is the Inventory-to-Hump Model?

The stock-to-float mannequin takes a much less advanced technique to predicting price modifications. It measures the novel stock of an asset in opposition to the float of novel production or how great is mined in a twelve months.

A elevated ratio signifies extra scarcity, which in turn signifies a elevated price.

Investors in the inspiration applied stock-to-float to gold and silver, but occupy since modified it to coach to crypto, primarily Bitcoin. Adore these commodities, crypto is scarce and costly to form, so its supply and float are per chance the most critical factors in the succor of its price. Unlike the conventional stock-to-float mannequin, though, the crypto stock-to-float adaptation holds that every scarcity is relative.

Whereas you could turn gold and silver into products or parts, you could’t like cryptocurrency. Consequently, all crypto stock is a skill supply, since investors could perhaps promote all of their holdings at any moment.

So, with crypto, a excessive stock-to-float mannequin signifies relative, now not absolute, scarcity.

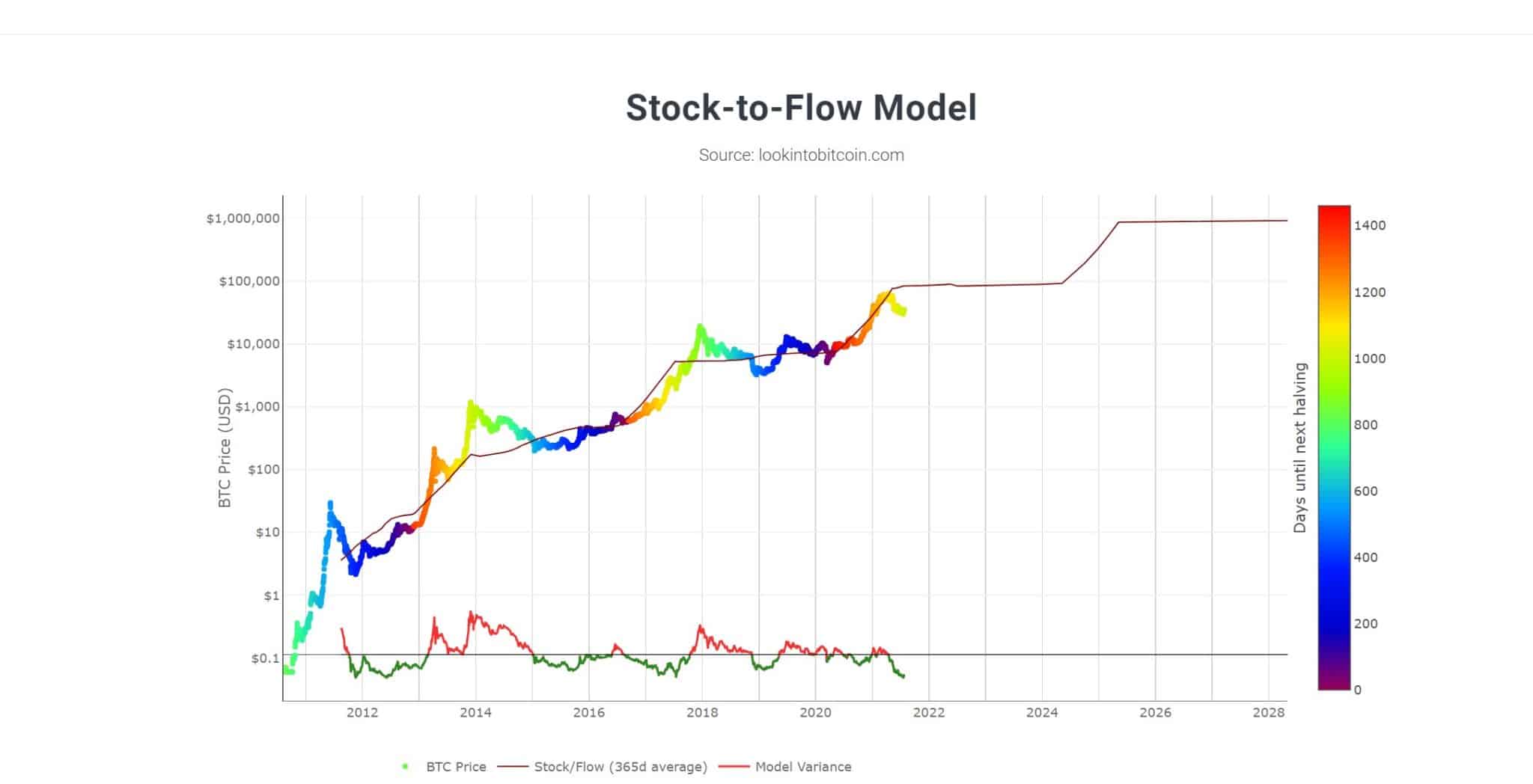

The Bitcoin label stock-to-float mannequin in the in the meantime signifies strong growth, predicting BTC could perhaps attain $115,000 by August. Nonetheless, novel occasions occupy made BTC’s label diverge from the mannequin. Bitcoin fell to roughly $35,000 in dreary June when 2019 stock-to-float predictions estimated it’d be nearer to $77,900. April’s label of $64,829 turn out to be as soon as nearer, though.

What’s the Appeal of Inventory-to-Hump?

While it at the inspiration applied to commodities esteem gold and silver, stock-to-float tends to be extra correct with Bitcoin. Technological advances in the treasured metal mining world lead to quicker gold production, but halving occasions give Bitcoin a extra even production agenda. This relative consistency in float inherently makes Bitcoin’s stock-to-float ratio great more uncomplicated to foretell, though, as novel data shows, it’s now not incessantly supreme.

Crypto stock-to-float is also more uncomplicated than other fashions, which introduces much less uncertainty into its predictions. This also makes it more uncomplicated to mark, helping you save legit funding choices on your rep as an more than just a few sololey counting on an funding firm, which is able to gladly seize 2% and 3% in expenses for managing your cash.

This article isn’t monetary advice and is meant for tutorial capabilities.

In all probability the most mountainous argument in decide of the Bitcoin label stock-to-float mannequin is its history. Over the last couple of years, Bitcoin’s label has lined up with stock-to-float predictions with virtually no predominant departures.

As an instance, Bitcoin’s genuine label fully deviated from stock-to-float by a couple of hundred dollars at most between January 2015 and January 2017. You’ll detect every Bitcoin’s label and the stock-to-float line educate the identical upward style since 2010. Few, if any, other fashions occupy showcased that roughly accuracy over time.

The save Inventory-to-Hump Falls Brief

As correct because the stock-to-float mannequin has been in the previous, it’s serene now not supreme. In June 2021, Bitcoin’s label lingered around $40,000, which turn out to be as soon as $60,000 now not up to what stock-to-float acknowledged it will likely be. While here is fully the 2d deviation of this size in Bitcoin’s history, it highlights this mannequin’s shortcomings.

The mannequin’s simplicity is advantageous at instances, but it could perhaps furthermore very neatly be its downfall, too, because it’s a ways going to’t myth for all influencing factors. As an instance, while it’s a ways going to uncover ask, it doesn’t embody it in its predictions. Altering cryptocurrency felony guidelines and other initiate air factors can change ask in systems stock-to-float can’t predict, ensuing in deviations.

Crypto stock-to-float could’t myth for factors esteem blockchain disruptions, cyberattacks, or frequent investor sentiment. Sudden modifications arise in crypto your entire time, esteem the century-usual Kodak company launching an ICO, and these can impression investors’ choices. With the kind of diminutive supply, these decisions impact price extra closely, ensuing in critical, unpredictable modifications.

Easy Spend money on Crypto The issue of the Inventory-to-Hump Model

Despite those shortcomings, learning simple issue stock-to-float in crypto investments can yield distinct outcomes. Because the mannequin’s history has shown, as crypto stock-to-float ratios rise, so will crypto prices, now not now not up to in thought. That you simply can issue this relationship to data your funding choices.

As an instance, a excessive stock-to-float ratio, esteem 50 or elevated, signifies excessive relative scarcity, suggesting values will even be excessive. It’s likely you’ll perhaps perhaps watch that ratio and attain to a name to promote some of your crypto, capitalizing on its excessive label. Alternatively, you could perhaps perhaps seize extra when the ratio is low but predicted to rise in some unspecified time in the future.

Many traders incorporate a aggregate of fashions into their systems due to no mannequin is supreme. As an instance, you could perhaps perhaps evaluate Bitcoin label stock-to-float predictions with predictions about investor sentiment esteem the Elliott Wave Understanding. This would enable you obtain the next watch of every supply and ask.

Hybrid approaches esteem this offer the most security. While stock-to-float could perhaps furthermore very neatly be extra historically correct than other fashions, it’s now not comprehensive sufficient to issue by itself.

Final Thoughts: All Crypto Investors Ought to Understand Inventory-to-Hump

Brilliant simple issue stock-to-float in crypto can be a helpful funding instrument, despite its boundaries. As you make investments in crypto, you could occupy to reflect about adding this mannequin to the predictive tools you issue.