Bitcoin’s shortage, every perceived and realized, sells.

The underneath is a most up-to-date model of the Deep Dive, Bitcoin Journal‘s top class markets publication. To be among the many first to fetch these insights and various on-chain bitcoin market prognosis straight to your inbox, subscribe now.

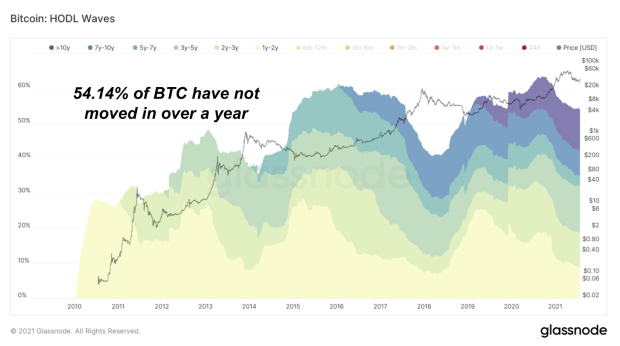

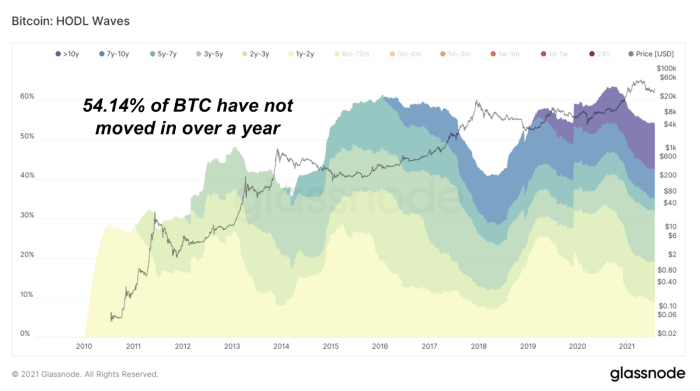

HODL Waves

“Attain you know that when bitcoin went from $17,000 to $3,000 that 86% of the of us that owned it at $17,000, by no arrangement sold it?

“Effectively, this became tall in my mind. So here’s something with a finite provide and 86% of the owners are spiritual zealots. I imply, who the hell holds something through $17,000 to $3,000? And it turns out none of them — the 86% — sold it. Add that to this new central monetary institution craziness phenomenon.” – Stan Druckenmiller on his dialogue with Paul Tudor Jones

54% of the circulating provide of bitcoin has no longer moved in over a one year. Over time, an ever rising proportion of the bitcoin provide is purchased and hoarded, decreasing the readily accessible free float, and as exemplified by the quote above, here is an more and more stunning characteristic of the asset.

Shortage, every perceived and realized, sells.

This dynamic on a micro and macro level is what brings about events linked to what occurred this weekend with the bitcoin rapid squeeze.

Whilst you would possibly be rapid bitcoin, the longer you wait, the higher the chance that that you can presumably like to pay a bigger imprint than you at the origin sold for. Right here is the dynamic of a sound monetary asset present process global adoption.

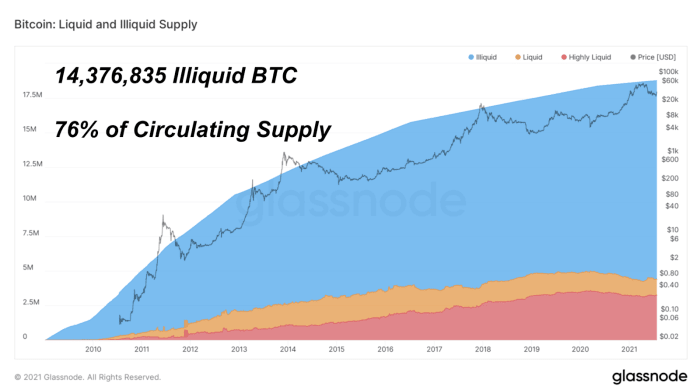

Currently, 76% of the bitcoin provide is assessed as illiquid and, over time, this amount has finest grown.

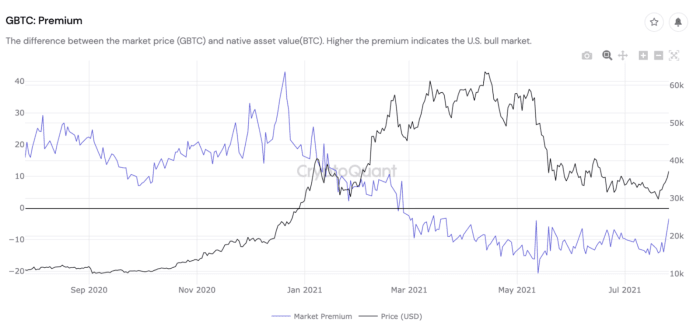

Grayscale Top charge/Gash imprint

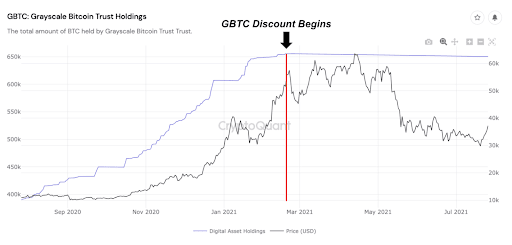

The Grayscale Bitcoin Have faith (GBTC) bargain improved to its very top ranges in over two months earlier this week as a rebound in the price of bitcoin has reputedly reinvigorated institutional and retail passion in the protection.

With the GBTC bargain forthcoming 0% again following the expansive unlockings of shares onto secondary markets, the assert bitcoin markets can like to soundless reclaim a couple of of the beforehand siphoned off inquire of that the severely discounted GBTC would possibly well also like mercurial stolen.

It’s miles additionally price watching if ample inquire of in secondary markets is able to push shares of GBTC succor into clear territory in opposition to its gather asset charge (NAV), as this would probably designate the return of new portion introduction of GBTC, which would possibly well presumably obviously be a welcome register the bitcoin markets.

Following the product’s tumble underneath NAV on February 18, new portion introduction halted at Grayscale, which became one of many finest drivers of inquire of all around the second half of of 2020 and early months of 2021.