MicroStrategy CEO Michael Saylor struck a defiant tone at some stage in a Q2 investor name, pledging to add extra Bitcoin to its balance sheet while persevering with to advocate for the cryptocurrency.

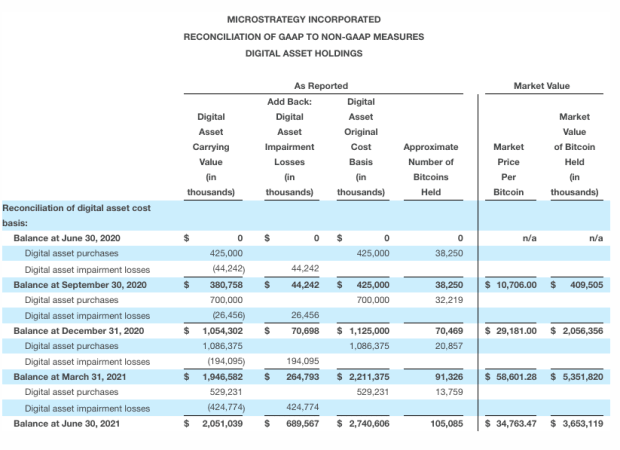

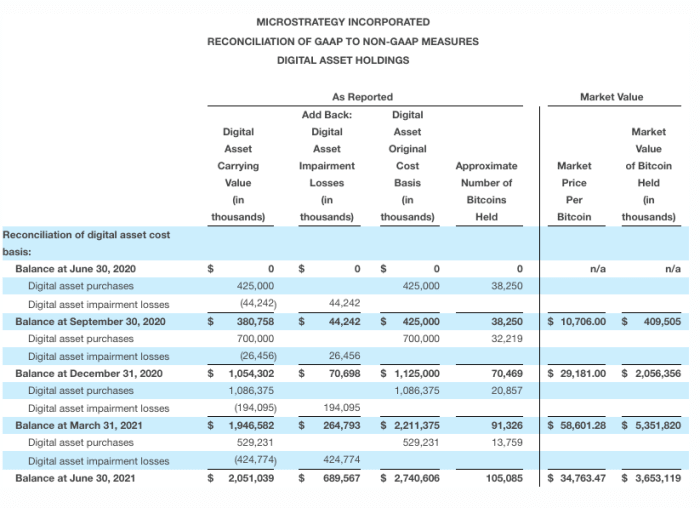

Publicly traded enterprise intelligence firm MicroStrategy is pledging to add extra Bitcoin to a company balance sheet that already comprises 105,000 BTC rate roughly $4 billion.

In an announcement issued sooner than the conference, MicroStrategy CEO Michael Saylor current: “We proceed to be fully gay by the results of the implementation of our digital asset approach. Our most modern capital elevate allowed us to enlarge our digital holdings, which now exceed 105,000 bitcoins. Going forward, we intend to proceed to deploy extra capital into our digital asset approach.”

Speaking at some stage in a are residing video name with investors Thursday, CEO Michael Saylor and CFO Phong Li struck a defiant tone at a time when the mainstream press has taken purpose on the firm for its focal level on collecting Bitcoin amid its recent market downturn.

Nonetheless, Saylor seemed unassuaged by criticism, stating: “Our macro approach is to catch and to withhold Bitcoin. We’ll relief interpret Bitcoin to the regulators, to the general public and to the media.”

“We deem procuring Bitcoin at the present goes to be a animated switch. We feel love there would possibly per chance be a land grab lawful now to catch as powerful as we are in a position to,” he acknowledged.

In assorted locations, Saylor acknowledged he used to be “fully gay” with the funding (to this level the firm has invested over $2 billion in Bitcoin), while describing an bettering economic environment for Bitcoin regardless of detrimental news catalysts that indulge in seemingly deterred retail investors of slow.

“The China exodus used to be a in point of fact right element for Bitcoin. The outcome used to be a decentralization of mining all over the field,” Saylor acknowledged. “Very long time period, the Westernization of Bitcoin is ideal for Bitcoin, the U.S. buck and Western expertise.”

Silent, in the query-and-resolution allotment of the match, Saylor faced no shortage of questions, including whether or no longer the corporate would take into memoir investing in assorted “crypto resources” including Ethereum.

Saylor spoke back, “Our approach is to focal level on Bitcoin. I’m in a position to trip Bitcoin into the total digital economy and it makes all the pieces greater. Bitcoin fixes all the pieces.”

“The least dangerous, most varied funding approach is to easily withhold Bitcoin.”

For his fragment, Phong Li backed Saylor’s statements arguing the funding has “generated tall tag for shareholders” and noting that the corporate is accrued in the early stages of deploying its Bitcoin approach.

“Bitcoin is per chance the most assuredly held monetary asset in the history of the field, growing on the quickest rate,” Saylor acknowledged.

“In case you roll motivate the clock twelve months it’s unheard of to search out any publicly traded corporations with Bitcoin on the balance sheet. Now you’ve got over a dozen corporations with billions of bucks in Bitcoin on the balance sheets.”

On the future of MicroStrategy, Saylor acknowledged, “Going forward you would possibly per chance well be in a position to ask we can bag extra bitcoin.”