Ethereum has managed to procure a extremely essential stage of toughen, which would perchance perchance delivery the doorways for an upswing in direction of $5,000.

Key Takeaways

- Around $28.8 billion price of Ethereum has been set out of circulation by way of the ETH2.0 deposit contract and EIP-1559.

- Meanwhile, the ETH on hand on trading platforms has plummeted to a three-year low.

- The essential provide scarcity parts to an impending mark breakout.

Ethereum would perchance perchance be gearing up for an explosive mark scurry because it lacks any resistance phases forward, while the number of tokens on hand on acknowledged cryptocurrency alternate wallets plunges.

Ethereum Faces Offer Shock

Ethereum’s circulating provide is declining at an exponential rate.

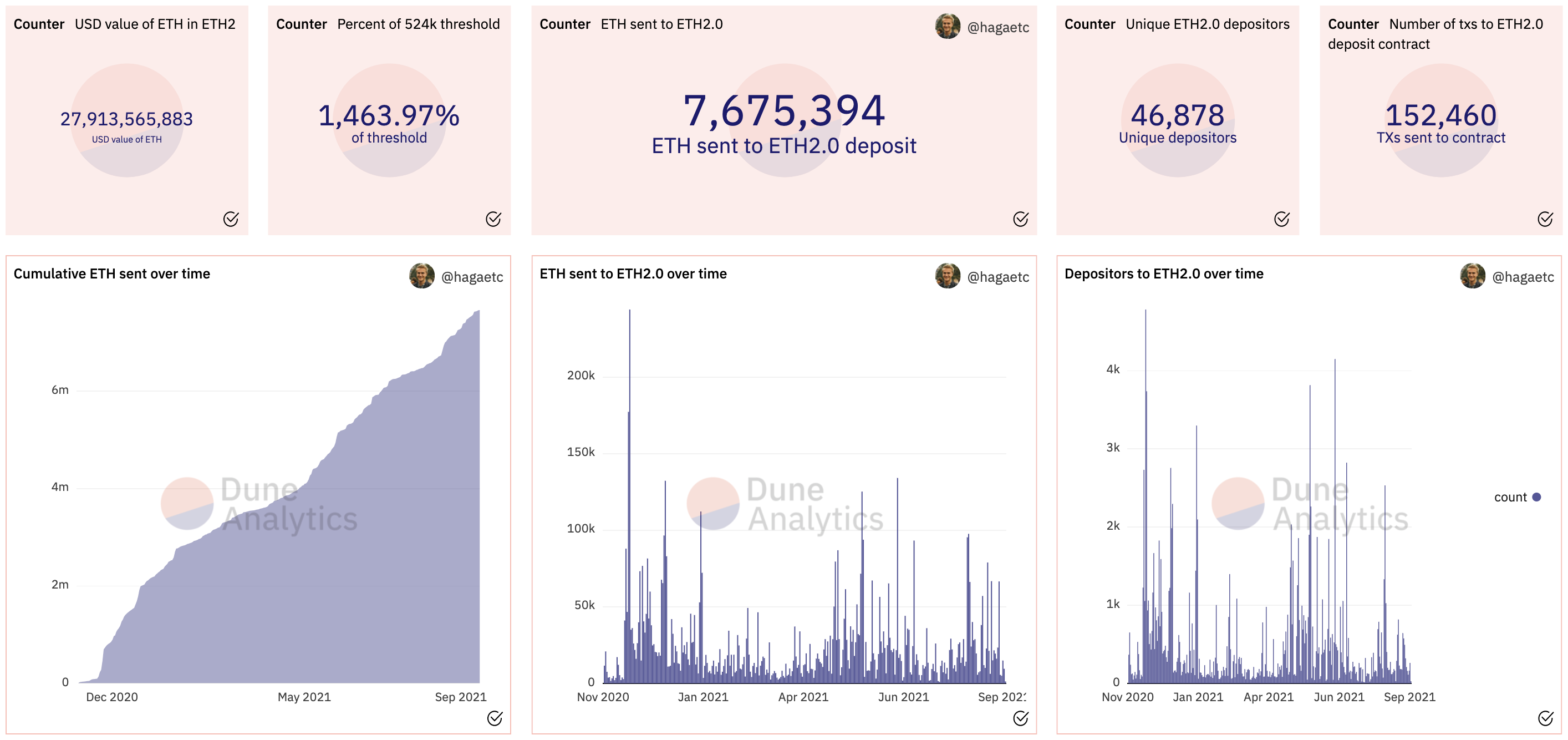

Since the ETH 2.0 deposit contract went dwell leisurely final year, nearly 7.7 million ETH had been locked by extra than 46,800 extra special depositors. 7.7 million ETH equates to roughly $28 billion on the time of writing.

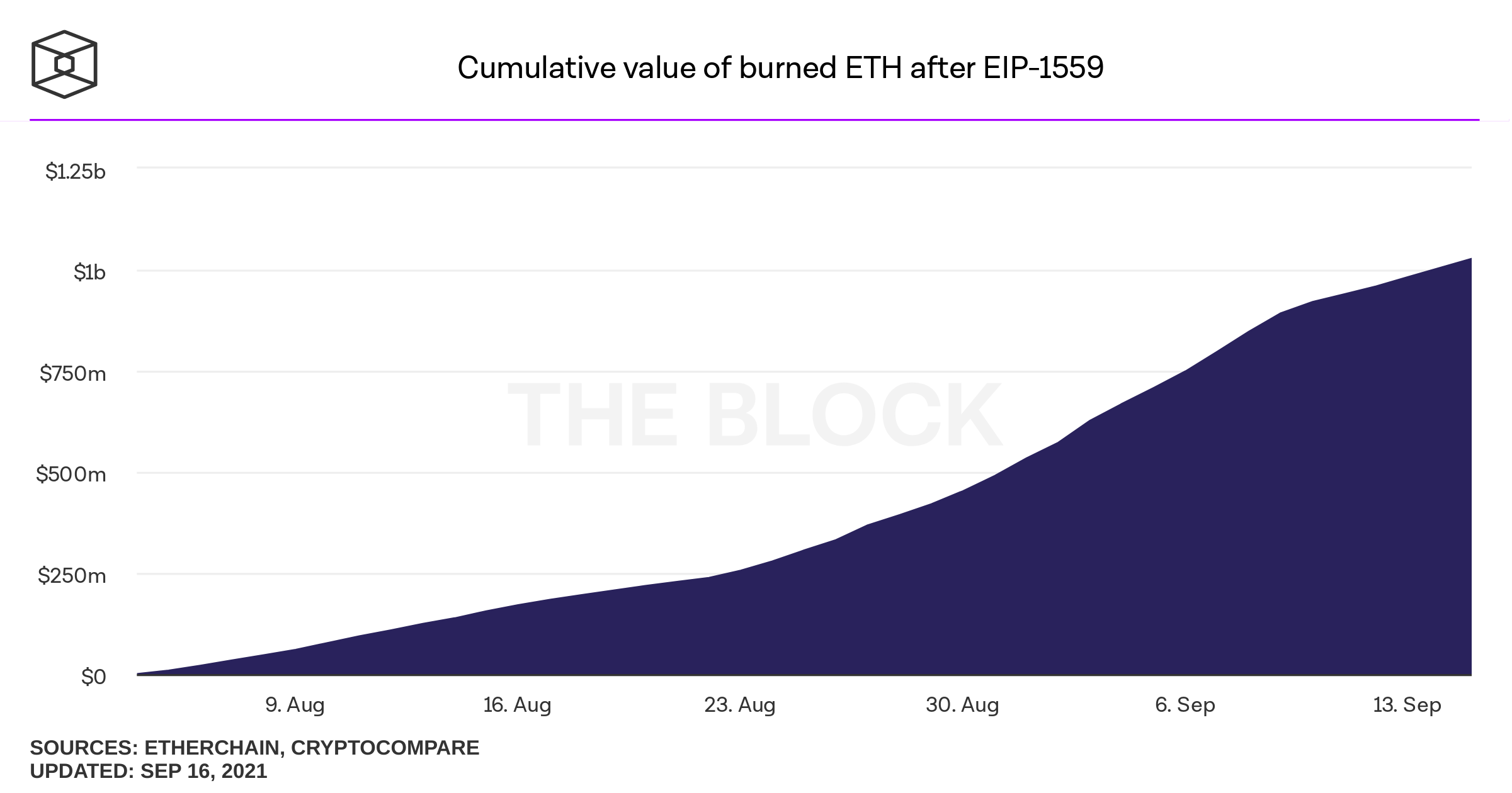

The implementation of EIP-1559 within the London hardfork on Aug. 5 has also diminished the number of tokens in circulation. Over 303,000 ETH had been burned to date, price roughly $1.1 billion.

The combo of ETH deposited within the staking contract and provide burned by way of EIP-1559 equates to about 8 million ETH price $28.8 billion being taken out of circulation.

The huge provide good deal considered over the previous couple of months has also impacted cryptocurrency exchanges.

The number of tokens on hand on trading platforms has plummeted to a three-year low of 19.45 million ETH. Meanwhile, the provision outside of those monetary entities has reached a brand fresh all-time excessive of 98.31 million ETH.

The rising number of tokens being set out of circulation combined with the provision scarcity on acknowledged cryptocurrency alternate wallets paints a undeniable image for Ethereum’s future mark articulate. Technically, the good deal of ETH on hand to sell locations a cap on Ethereum’s mark downside ability.

No Offer Barrier Earlier than Ethereum

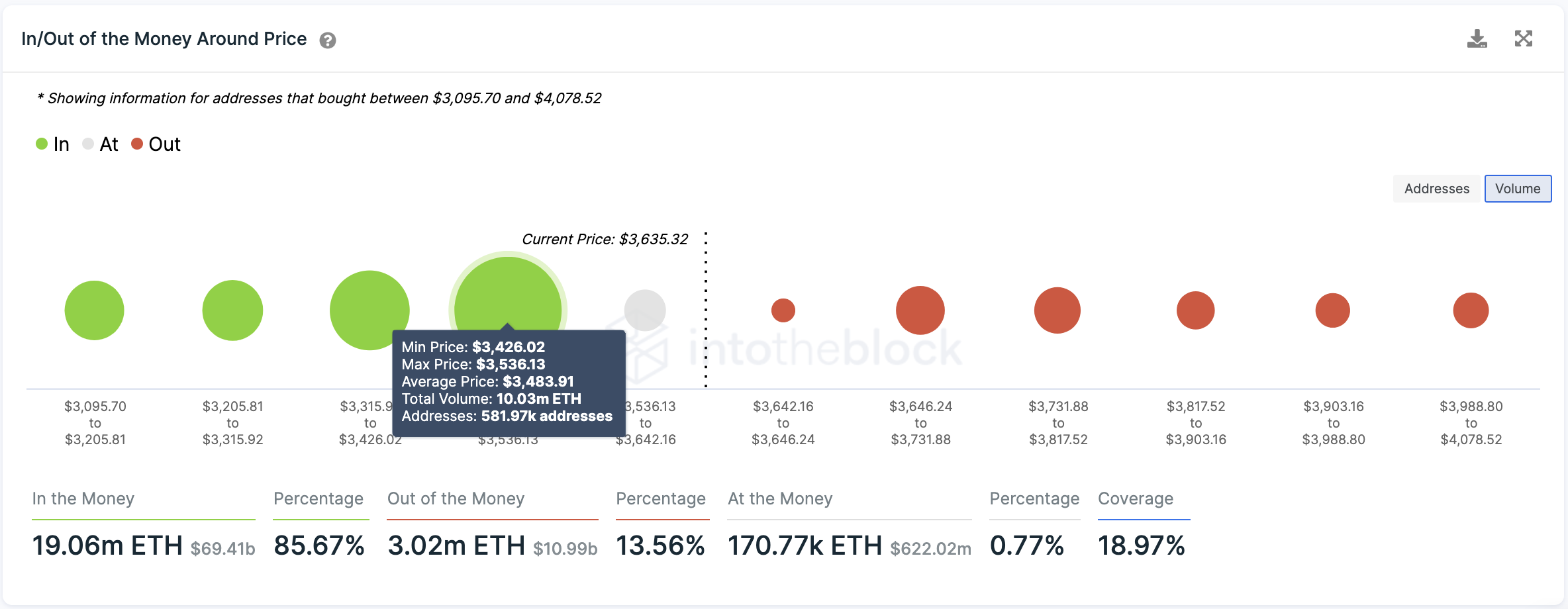

Transaction historical past presentations that Ethereum is sitting on true toughen. Essentially based completely completely on IntoTheBlock’s In/Out of the Cash Around Tag (IOMAP) mannequin, extra than 580,000 addresses enjoy previously bought over 10 million ETH at a mark of $3,430 to $3,540.

ETH would doubtless continue to pattern upward in direction of $5,000 as prolonged as this quiz barrier holds since there are no essential provide walls forward.

The essential good deal of downward stress within the aid of Ethereum has nearly nullified a ability pessimistic outlook. Restful, the cryptocurrency market is characterised by its excessive volatility.

Only a sustained day-to-day candlestick shut below the $3,430 to $3,540 fluctuate might perchance furthermore lead to a sell-off in direction of $3,000 as non everlasting merchants would doubtless try and forestall their investments from going “Out of the Cash.”

2 comments

Very interesting details you have observed, thankyou for posting.

magnificent points altogether, you simply gained a logo new reader. What could you recommend in regards to your publish that you just made some days in the past? Any certain?