Hear To This Episode:

On this episode of Bitcoin Journal’s “Fed Note” podcast, hosts Christian Keroles and myself, Ansel Lindner, had a conversation about contemporary Federal Reserve policy, headlines within the monetary press and rumors. Then, we touched on PBOC and Evergrande Crew concerns in China. Lastly, the fun started when we talked in regards to the proposed U.S. infrastructure invoice and equipped some scorching takes about what to make your mind up a ways from it. It’s one amongst our longest episodes and a must hear for contrarian Bitcoiner opinions.

Calls For The Federal Reserve To Taper, Reverse Repo And Jerome Powell’s Future

Starting with the Fed, calls for taper are getting louder. In the YouTube version of the podcast, we worth the articles and browse thru some quotes.

From Reuters, “Atlanta Federal Reserve Monetary institution President Raphael Bostic acknowledged he is eyeing the fourth quarter for the delivery of a bond-interact taper.”

It’s interesting that calls for tapering are converging on Q4, due to that can be when the Fed’s standing repo facility is starting. Inventive tapering plans may presumably be within the works to reduce any taper tantrum this time spherical. We went real into just a few of the mechanics on the relieve of this theory, nevertheless there is room for more work within the long speed. Final analysis for tapering: it’s a ways making an strive likely it may perchance presumably delivery in Q4 this 365 days.

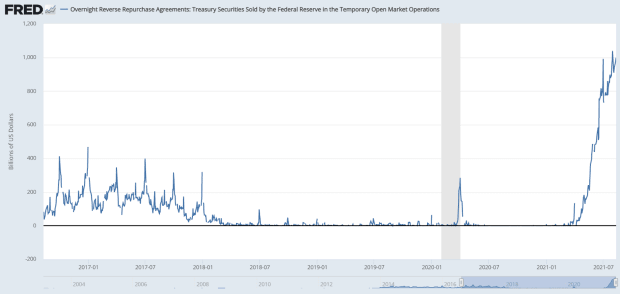

Next, we spent some time discussing the dispute of the reverse repo facility and the coming standing repo facility. Two interesting choices of the standing repo facility: It’s starting at 25 foundation choices and it may perchance presumably be launch to worldwide international monetary authorities. These two factors can give us clues into what the Fed is planning.

The final fragment of Fed news we covered used to be the chance that Jerome Powell can also honest no longer accumulate a second term as Fed chairman. He’s shedding some recognition among progressives fancy Senetor Elizabeth Warren, regardless that he does peaceable have the toughen of the administration for the time being. His major competition is Lael Brainard. She differs from Powell in being for a small bit of more law and, important for us here, she appears to be like to be backing central bank digital currencies (CBDCs).

In a contemporary speech reported by PYMNTS.com, she acknowledged, “The buck is terribly dominant in worldwide funds, and at the same time as you have the opposite major jurisdictions on this planet with a digital forex, a CBDC offering, and the U.S. doesn’t have one, I excellent, I will’t wrap my head spherical that. That excellent doesn’t sound fancy a sustainable future to me.”

There are two sides forming within the Fed about CBDCs. Those that unknowingly judge there is just a few relieve to a CBDC, and these which have performed their homework and are skeptical. In the latter category, we’re going to have the capacity to place apart Powell and Waller. Waller lately gave feedback to the American Project Institute, announcing, “After cautious consideration, I’m no longer convinced, as of but, that a CBDC would solve any original anxiety that isn’t any longer being addressed more promptly and efficiently by other initiatives.”

The Most neatly-liked Macro Factors Coming From China

On to China. The Chinese Communist Event is initiating to face some major financial points. In the podcast we outlined loads of, fancy the worst floods in a long time, raging delta infections, slowing financial recount and the accelerating default of the country’s biggest true estate developer, Evergrande. That is a gigantic Twitter thread on the Evergrande effort by @TheLastBearSta1. As long-time listeners will know, we’re bearish on the CCP within the approaching years, and factual now it’s a ways making an strive significantly tense for them.

Bitcoin And The Proposed U.S. Infrastructure Bill

Sooner or later, we got to the U.S. Senate’s proposed infrastructure invoice and the drama all around the Bitcoin provision argued about over the final week. Now we have got some very scorching takes on the route of from a Bitcoiner level of view. We suspect many Bitcoiners are fancy us.

In a puzzling turn of events, the White House and U.S. Treasury had been these combating the Bitcoin level of view, while the supposed Bitcoin advocates had been desperately seeking to set altcoins.

We don’t believe the authorities picking winners and losers, or interfering on the market, nevertheless that is why Bitcoin is decentralized. Govt interference can no longer be mitigated by hiss anxiety. Bitcoiners must no longer really feel obligated to come relieve to the rescue of altcoins, wrong scams, within the establish of “innovation.” This innovation used to be decentralized for the very reason of being censorship resistant within the first dispute. If the altcoins must depend on advocacy in dispute of decentralization, their innovation is worthless.

We also instant mentioned the hypothesis that the U.S. authorities is closer to recognizing bitcoin than previously belief. This thread on Twitter by @_log_scale_ choices to many connections with MIT, the Fed and the White House. It also fits with my observation that the true central bank free to act within the large recreation of monetary assets is the Fed due to the buck’s world reserve forex jam. It’s a theory on the least worth sharp.

All of that and scheme more is stumbled on in this jam-packed episode. It’s a must-hear Bitcoin podcast.