No doubt one of many very most practical design close indicators in bitcoin flashed this week, suggesting the tag is primed to explode.

On August 9, one of many very most practical design close indicators in bitcoin flashed a design close price:

Hash Ribbons.

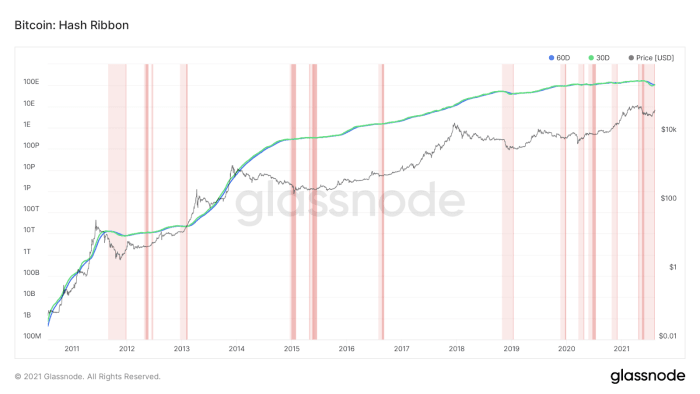

The Hash Ribbons Indicator created by Charles Edwards uses the thirty- and sixty-day transferring averages of bitcoin hash price to discover when miner capitulation has befell, and uses this to estimate native bitcoin bottoms.

Under is the historical past of the bitcoin tag and at any time when that the hash ribbons indicator has flashed:

Miner Capitulation

Hash ribbons abet as such an efficient and historically upright design close indicator for bitcoin due to it uses the adjustments in bitcoin hash price to measure miner capitulation in the bitcoin market.

All over intervals where mining operations are turning off their rigs, it exhibits that it is uneconomical to mine. Hash price declines, blocks are mined slower than the 10-minute block target, and finally challenge will adjust downwards to abet these miners to roam abet in.

Here’s typically the technique at some level of which miners flip off their machines in spacious numbers, which is therefore adopted by the hash ribbon indicator signaling capitulation, adopted by an eventual design close price.

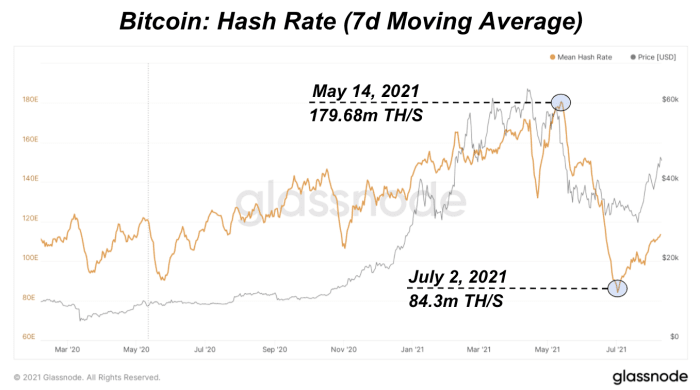

On the choice hand, the motive for the huge decrease in hash price wasn’t fully precipitated by elevated competitiveness in the mining replace using earnings down, but rather attributable to political decree in what ended up being the ideal nation-verbalize assault on bitcoin ever, from the arms of the Chinese Communist Party.

Over the route of six weeks the bitcoin mean hash price declined by 53%, and though the capitalution tournament became more synthetic, the decline in hash price aloof had a extraordinarily meaningful impact on miner revenues for these that aloof remained plugged in.

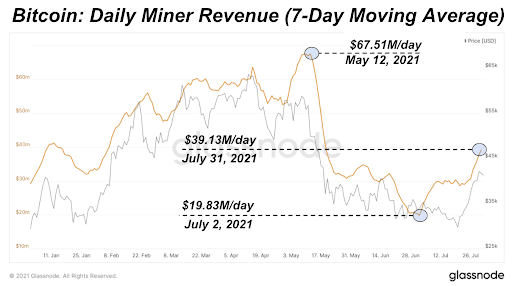

As considered in the July monthly anecdote, daily revenue for bitcoin miners declined from a excessive of $67.5 million per day in Can also simply to a low of $19.8 million per day in early July.

No longer handiest had been the closing miners squeezed whereas challenge became lagging in the center of four straight downwards adjustments, but mining operations in China who had been faced with transferring their entire operations abroad most indubitably had to liquidate reserves, of which a majority could well even be assumed to had been stored in bitcoin (as is the case with all miners, who purpose to hodl as famous bitcoin as that you just should to well be think).