Hodlnaut vs. Nexo weighs the professionals and cons between an established crypto hobby story huge and an upstart product gaining swiftly market traction.

Hodlnaut is a crypto hobby provider operating out of Singapore. Launched in 2019, the company helps six sources and is backed by a single investor, with handiest about $100k in funding. Hodlnaut has over $500 million in sources below management and over 10,000 users.

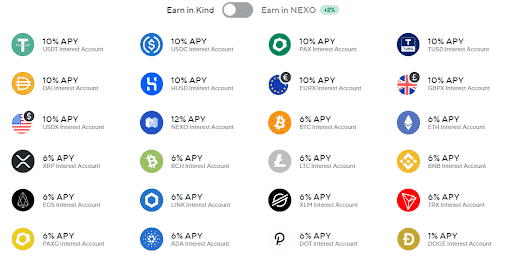

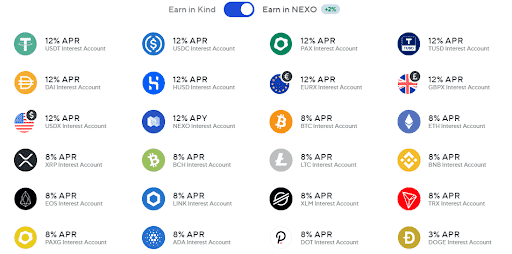

Nexo is a London-based mostly cryptocurrency platform that launched in 2017. The company aspects a suite of merchandise as well to its hobby story: a cryptocurrency replace, crypto-backed loan carrier, card, and token. Nexo supplies U.S. users 10% APY for stablecoins and 6% APY for BTC and ETH. Global Nexo (exterior the U.S.) can secure to receive their rewards within the company’s native token, NEXO, for a two-p.c hobby magnify across the board.

Nexo has $52.5 million in funding, over two million users, and $15 billion in sources below management (AUM). The company supplies hobby on both crypto and fiat, supporting over 23 money and 40+ fiat currencies (the fiat characteristic is handiest readily accessible for world users.)

Hodlnaut supplies its users up to 12.73% APY on stablecoins, and up to 7.46% APY on Bitcoin and Ether.

So, which is the higher crypto hobby story for you? Let’s detect.

Hodlnaut vs. Nexo Key Records

| Item | Hodlnaut | Nexo |

| Build | Singapore | London |

| Newbie-Friendly | Certain | Certain |

| Cell App | Certain, on iOS. Coming on Android in late October 2021. | Certain, on Android and iOS |

| Out there Cryptocurrencies | BTC, ETH, WBTC, USDC, USDT, DAI | BTC, ETH, WBTC, USDC, USDT, DAI |

| Company Originate | 2019 | 2019 |

| Community Believe | Huge | Accurate |

| Security | Huge | Huge |

| Buyer Enhance | Accurate | Accurate |

| Prices | Low | Low |

| Critiques | Read our Hodlnaut overview | Read our Nexo overview |

| Plight/Promotions and Signup Bonuses | Assemble up to $20 whenever you be half of a Hodlnaut and deposit up to $1000. | Pick up $10 when signing up and depositing $100 or more on Nexo. |

Characteristic #1: Interest Charges — Who Has Better Interest, Hodlnaut or Nexo?

Bitcoin

Hodlnaut supplies tiered charges on Bitcoin:

- 7.46% on <2 BTC

- 4.08% on <8 BTC

- 2.02% on <90 BTC

- 1% on 100+ BTC

Nexo supplies a flat rate of 6% APY for BTC deposits and 8% APY for users earning in NEXO. The “Assemble in NEXO” possibility is no longer readily accessible for users within the U.S.

Ethereum

On Hodlnaut users receive:

- 7.46% on <20 ETH

- 4.08% on <80 ETH

- 2.02% on 100+ ETH

On Nexo, users receive a 6% APY on ETH, which goes up to 8% for users earning in NEXO.

Stablecoins

Hodlnaut supplies up to 12.73% APY on USDT, USDC, and up to 8.32% on DAI

Hodlnaut’s charges on USDT:

- 12.73% on 0 – 25,000 USDT

- 7.25% on 25,000 – 100,000 USDT

- 4.60% on 100,000 – 500,000 USDT

- 3.04% on 500,000+ USDT

Hodlnaut’s charges on USDC:

- 12.73% on 0 – 25,000 USDC

- 7.25% on 25,000 – 100,000 USDC

- 3.56% on 100,000 – 500,000 USDC

- 2.84% on 500,000+ USDC

Hodlnaut’s charges on DAI:

- 8.32% on 0 – 25,000 USDC

- 5.12% on 25,000 – 100,000 USDC

- 3.56% on 100,000 – 500,000 USDC

- 2.02% on 500,000+ USDC

Nexo supplies 10% APY on USDT, USDC, USDP, TUSD, DAI, and more. This rate will increase to 12% when users secure to receive their hobby in NEXO.

Nexo’s unfriendly hobby charges

Nexo’s hobby charges when users Assemble in Nexo

Winner: Even supposing its vary of sources is little, Hodlnaut beats Nexo’s charges on all supported stablecoins except DAI, as well to its unfriendly charges on BTC and ETH. While you’re fascinated about earning in Nexo’s token to receive higher charges, Nexo will be a higher possibility for you and can provide higher hobby, as well to more altcoin alternate suggestions.

CoinCentral readers can receive up to $20 when signing up for a Hodlnaut and depositing up to $1000.

CoinCentral readers can receive $10 by signing up and depositing $100 or more on Nexo.

How Attain Hodlnaut and Nexo Fabricate Money?

Most crypto hobby accounts produce money on the adaptation between what they pay depositors and what they payment borrowers, and Hodlnaut and Nexo are no longer any totally different– both platforms lend to company borrowers, customers, or decentralized protocols.

Cryptocurrency sources held in Hodlnaut, Nexo, or any totally different cryptocurrency story are no longer FDIC insured. Your funds in Hodlnaut and Nexo are never fully possibility-free.

Moreover, loaned crypto sources are no longer held in a single jam nonetheless are actively deployed to be regular by borrowers and receive returns. Thanks to this, they’re a shrimp bit complex to insure.

Alternatively, Hodlnaut supplies users the likelihood of procuring no longer obligatory insurance coverage on such sources via a partnership with Nexus Mutual, an insurance possibility that leverages blockchain expertise.

Hodlnaut and Nexo require borrowers to post collateral to wrestle the likelihood of defaults; users must always fill sources no longer no longer up to twice the price of their loan amount to qualify for a loan, which is is named a 50% loan-to-price (LTV) ratio.

Nexo shares 30% of its profits to NEXO holders as dividends. The company has paid over $29.8M to its token holders since 2017.

Characteristic #2: Payouts and Withdrawals

Hodlnaut users can withdraw at any time nonetheless beget a day-to-day withdrawal limit of 100 BTC within the event that they’ve completed KYC. Elevated withdrawals can seize in to 48-hours and the company prices withdrawal prices on dispute sources, as follows:

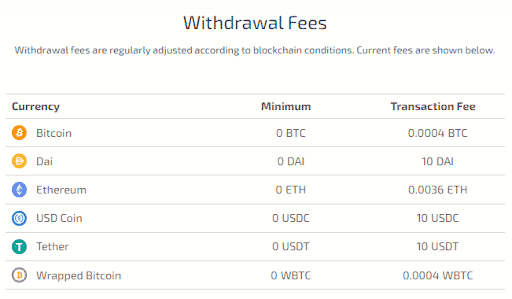

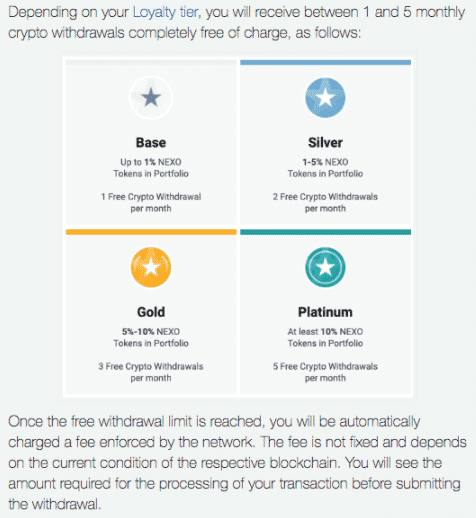

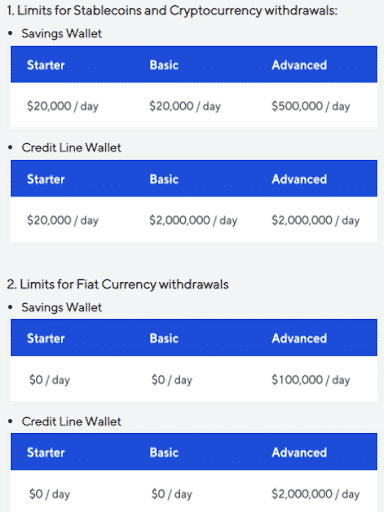

On Nexo, hobby is compounded every 24-hours. Customers can produce up to five free withdrawals searching on their loyalty tier. Nexo users can also produce any place from one to an huge substitute of free fiat transfers, deposits, and withdrawals.

Nexo’s withdrawal limits are as follows:

Winner: Hodlnaut lets users withdraw at any time as long as they don’t withdraw over 100 BTC or its a similar in a single day.

Characteristic #3: Hodlnaut vs. Nexo Security

Hodlnaut’s valuable custodian is Fireblocks. When users deposit with Hodlnaut, they’re got via Fireblocks’ accurate wallet infrastructure. Hodlnaut will then either switch the cryptocurrencies to our self-custodied chilly wallets or lend them to borrowers.

Hodlnaut’s on-platform security solutions consist of password hashing, two-ingredient authentication, and more.

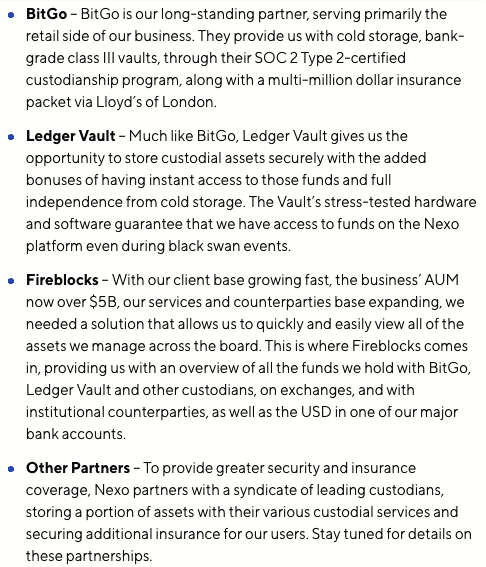

Nexo’s platform employs security procedures including 2FA, a password, biometric security, and e-mail confirmation aspects. The company keeps user sources accurate in chilly wallets secured with multi-signatures, storing non-public keys offline in Class III bank vaults for physical security. This huge protection is skill via numerous custodians, which they outline in their documents:

Nexo’s user sources are insured by its custodians (spherical $375 million, roughly 3% of its AUM) nonetheless this insurance does no longer provide protection to sources after they’ve been loaned and leave their custody. Hodlnaut supplies its users the likelihood to receive insurance that covers their deployed sources via its partnership with Nexus Mutual.

As of this writing, both Hodlnaut and Nexo beget never been hacked.

Winner: Even supposing Hodlnaut’s sturdy on-platform security is worth noting, Nexo wins.

Characteristic #4: Ease of Insist

Nexo and Hodlnaut are both beginner-pleasant platforms.

Nexo is offered through web, Android, and iOS apps. Be determined to head to Nexo.io, because the Nexo dot com domain isn’t linked to the cryptocurrency company.

Whereas Hodlnaut would possibly possibly presumably even be accessed through web and iOS handiest, the company plans to launch an Android app in late October 2021.

Bonuses/Standout Aspects

Nexo’s Crypto Assemble characteristic is handiest one out of its many choices. The company is more widely identified for its crypto replace and token. The Nexo card is accredited by over 40 million merchants worldwide, supplies users 2% money-back on every transaction, and permits users to receive entry to crypto-backed credit traces. Moreover, Nexo supplies up to 12% APY on fiat currencies like USD, GBP, and many others.

Hodlnaut supplies industry-leading hobby charges, trumping those of higher crypto hobby names like BlockFi and Celsius. The platform has a crypto replace characteristic called TokenSwap, which lets users switch straight between two cryptocurrencies. TokenSwap lets users wrap and unwrap their Bitcoin, switch ETH to BTC or BTC to USDC, and more.

Moreover, Hodlnaut’s most well-favored hobby characteristic permits users to receive within the currency of their substitute. Let’s dispute, a user who deposits BTC can secure to receive their hobby in USDC, USDT, or one other supported currency.

Winner: Nexo. With an replace, token, cashback card, and more, a Nexo story connects users to a suite of necessary aspects.

Buyer Carrier

Hodlnaut’s FAQ page covers quite rather a lot of the guidelines a user would want aid with, and potentialities can contact the company’s 24/7 aid heart for more personalized give a decide to.

Nexo’s customer aid can be accessible across the clock, and also supplies a entire FAQ allotment on its arena.

The Court docket of Public Conception: Hodlnaut vs. Nexo Reddit

Reddit give a decide to for both Hodlnaut and Nexo is mainly accurate across the board. Some users show give a decide to for Hodlnaut because their hobby charges are higher and more flexible, whereas others decide it for its suggested and official give a decide to.

Other users are more drawn to Nexo because they provide higher BTC charges, beget entire security practices, and beget audacious monetary backing.

Hodlnaut vs. Nexo Evaluate Final Solutions: Which is The Better Crypto Interest Fable?

Hodlnaut and Nexo lead the industry with a couple of of the very supreme hobby charges on the market, posing stiff competition to increased crypto hobby merchandise like BlockFi and Celsius.

When it involves security and fund security, both platforms make use of industry-leading technologies and produce the safety of their users’ funds, info, and non-public info a high precedence.

Hodlnaut and Nexo are quite evenly matched on numerous fronts, nonetheless moderately totally different in a couple of principal distinctions.

Nexo has been spherical for longer and with upwards of $52 million worth of investor backing. When put next to Hodlnaut’s humbler $100Ok, the company has a stronger foundation for extra bettering its gargantuan substitute of choices.

Alternatively, Hodlnaut is an straightforward industry competitor with a rising unfriendly of accurate potentialities.

Hodlnaut beats Nexo’s unfriendly hobby choices. The put Nexo supplies 6% on BTC and ETH, Hodlnaut supplies 7.46% on the same. Hodlnaut’s charges decrease because the amount of BTC and ETH will increase, whereas Nexo’s charges dwell the same and magnify if users receive in Nexo.

In the event that they’re starting up to possibility the volatility of preserving the NEXO token, Nexo users can receive entry to top class hobby charges on 20+ cryptocurrencies. The company’s mix-and-match custodian system system that it has industry-leading fund security. Its insurance covers handiest about 3% of its AUM and doesn’t quilt deployer sources, whereas Hodlnaut supplies insurance alternate suggestions on deployed sources.

Hodlnaut is a effectively-rounded crypto hobby product. With solid security, excessive-hobby charges, and industry-leading customer aid and give a decide to, it’s seemingly that because the company grows its product can beget increasing influence on the crypto hobby market.