Final Week In Bitcoin is a series discussing the events of the outdated week that took place in the Bitcoin industry, masking the total foremost news and evaluation.

Summary Of The Week

A mere month ago, bitcoin turned into as soon as hovering beneath $30,000 with many anticipating an additional dump. But must you equipped the dip, you’d already be up over 60% with bitcoin breaking $50,000 on Sunday, trading on stages final considered in mid Would possibly per chance. With bitcoin’s surge of over 60% over the final month, make we request it to hit its most latest all-time high of upright over $64,000?

Likely unsurprisingly, the final week has been fleshy of bullish news as more institutional merchants attain onboard, banks pave the potential for bitcoin adoption, and legendary merchants soar on the bitcoin bandwagon (or ascertain they’ve been alongside for the hurry this total time). Let’s take a survey at the final week in bitcoin.

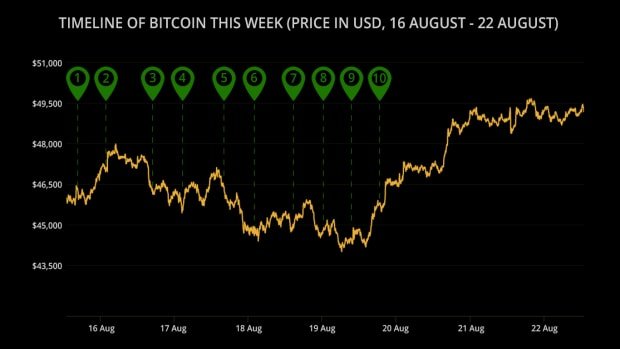

Timeline Of Bitcoin This Week

Bullish Financial Services News

❶ No longer to be left at the help of, world retail massive, Walmart, posted a job listing for a ‘digital currency and cryptocurrency product lead’ on Monday. Following in the footsteps of different retail giants, equivalent to Amazon, Walmart appears to be like to be to be preparing to stumble on the acceptance of bitcoin and other cryptocurrencies. For some context on the firm’s dimension, in its final fiscal yr, Walmart reported practically $560 billion in income, throughout a world pandemic. The scale at which they characteristic would possibly per chance well whine a drastic elevate to the bitcoin network would possibly per chance well aloof they accumulate to permit bitcoin payments.

❷ Also on Monday, Jehudi Castro Sierre, an consultant to the President of Colombia called bitcoin the “most just appropriate share of system ever” main many to speculate this would possibly per chance well lead to the South American nation taking a survey to undertake bitcoin as either loyal comfortable, or an investment, worthy fancy El Salvador. Nothing to this make has been presented, or even rumoured, however the markets fancy to speculate.

❸ On Tuesday, news emerged that the UK’s excellent retail bank, Lloyds Banking Neighborhood, is hiring a “Digital Currency Supervisor.” The bank has over 30 million clients in the UK and appears to be like to be to be in offering services and products catering to elevated search data from for crypto and bitcoin particularly.

❹ Also on Tuesday, Fidelity, one in every of essentially the most necessary monetary services and products firm which manages $10 trillion in resources acknowledged that bitcoin is a key focal level for them now because it is miles emerging as a proper asset class, revealing that 90% of Fidelity’s excellent clients are asking about bitcoin.

❺ On Wednesday, news emerged that billionaire Peter Thiel’s firm, Palantir Applied sciences, is now accepting bitcoin. Thiel has welcomed bitcoin as a hedge against fiat currency inflation, then another time cautioned that “try and be ready for a future with more sad swan events.”

❻ Also on Wednesday, legendary investor, Bill Miller, printed that he’s been buying bitcoin because it turned into as soon as $200. The 71 yr-frail investor has been making a bet expansive on investments in system this yr and presented that he’s received a stake in Coinbase, showing to dwell bullish on bitcoin.

❼ Thursday turned into as soon as a busy day for bullish news as Mitsubishi UFJ Financial Neighborhood (MUFG), Japan’s excellent bank struck a contend with Coinbase that can allow its 40 million clients to compile bitcoin. Japan has one of the most absolute most realistic bitcoin trading quantity on this planet and the federal government has been very launch in direction of cryptocurrencies.

❽ Also on Thursday, banking giants Wells Fargo and J.P. Morgan both filed for deepest bitcoin funds. Each institutions were against bitcoin in the previous, however it surely’s turned into an asset that’s exhausting to brush off.Their pursuit of bitcoin-essentially based merchandise has surely been in phase influenced by search data from from clients.

❾ Wrapping up Thursday’s bullish news, payments massive Worldline partnered with Bitcoin Suisse to permit 85,000 retailers in Switzerland to settle for bitcoin, paving the potential for wider adoption in the nation with over 8.5 million inhabitants.

❿ Sooner or later on Friday, the realm’s excellent asset manager, BlackRock, printed that it’s pursuing investments in bitcoin mining, becoming a member of the likes of Fidelity and Vanguard. The firm invested over $382 million in shares of Marathon Digital Holdings and Riot Blockchain.

Have confidence FUD And Criminals

Genuine because nothing hit the headlines doesn’t imply there hasn’t been any negativity in direction of bitcoin over the final week. Jake Klein, executive chairman of Australian gold mining firm, Evolution Mining, made some misguided claims, announcing that bitcoin’s volatility will force merchants help to gold.

Criminals had been also in the highlight over the final week, as Helix operator, Larry Dean Harmon, forfeited 4,400 BTC to the U.S. Justice Division as phase of a guilty plea to laundering prices. The Swedish government turned into as soon as also forced to pay a jailed drug dealer 33 BTC, after it equipped his holdings when he turned into as soon as arrested. This would possibly per chance well seemingly continue the “crypto is for criminals” narrative wrongly being pushed by many.

Then there’s the persevered FUD about bitcoin mining’s make on the federal government. This week Fortune published a share about how CO2 emissions from bitcoin mining will exceed that of Mexico or Brazil would possibly per chance well aloof bitcoin hit $500,000, however doesn’t withhold in mind that the upper bitcoin goes, the more incentive there shall be for greener mining operations. Pieces fancy these continue pushing a story that bitcoin can’t “walk green” or in truth received’t, when the reverse is loyal.

Total it’s correct that the bearish news appears to be like to be to be slowly fading to the so called “help pages,” however there aloof appears to be like to be to be a push by archaic media to search out detrimental angles to conceal or detrimental voices to produce a platform to.

A Bullish Verdict

I’ve acknowledged for weeks now that bitcoin is slack for a breakout, and the final month’s constructing upwards confirms that bitcoin is poised to commence a silent plug. The final week has been overwhelmingly bullish, even if the value didn’t essentially “moon.” Extra banks, institutional merchants and others have gotten a member of the fray. Bitcoin is becoming horrible as a sturdy investment and with the effects of the COVID-19 pandemic continuing, it’s horrible that the realm economic system is going to endure for just a few years.

Bitcoin stands out as a hedge against inflation, and since the money printers continue in overdrive at some level of the globe, it’s becoming an increasingly foremost investment automobile must you will want to uplift themselves from the so-called monetary tyranny of the fiat currency system.