Goal nowadays we had been tragically exposed to a concept task of one Eero Heinäluoma, a Socialist member of the European Parliament. Whereas it doesn’t seem appreciate there’s in actuality any proposal to ban bitcoin mining at this moment, it’s safe to include that this form of proposal is real a subject of time.

The Battle On Truth

The provocative concept of Mr. Heinäluoma is to “pause the use of the underlying skills” of Bitcoin, that formula banning proof-of-work. This misinformed stance is obviously adopted by a call for cryptocurrencies to fling to a more “climate pleasant” consensus in the create of proof-of-stake.

Disclose.

Does it even subject if we repeat for a thousandth time that proof-of-work is the significant step forward of Bitcoin, ensuring the neutral, predictable monetary protection that is so sorely lacking in on the present time’s fiat-infested world? It doesn’t appear to subject to those other folks; it’s as if they’re waging a war on actuality.

When the crusaders of governmental action equivalent to Mr. Heinäluoma net to work, facts fly out the window. They desire to sell an precise-making an try memoir. And the memoir in the context of bitcoin mining is that it’s corrupt to the atmosphere and somebody would possibly presumably bear to amassed stop something about it, that formula the authorities would possibly presumably bear to amassed ban it, because it in general goes.

The real recordsdata is that Bitcoiners bear facts on their aspect.

Primarily primarily based on Michael Saylor’s Bitcoin Mining Council (BMC) and its Q2 Global Bitcoin Mining Data Review, these are the most up-to-date findings on the nature of bitcoin mining:

- The strength mixture of the Bitcoin Mining Council participants, who articulate around 32% of the global Bitcoin hash price, includes 67% sustainable electricity skills (sustainable outlined as: renewables plus nuclear plus carbon-primarily based completely mostly with net carbon credit ranking).

- The above metric is then extrapolated to around 56% of sustainable strength usage to your total bitcoin mining network.

Outdated estimates on the renewable/sustainable strength percentage in bitcoin mining vary between 39% (College of Cambridge study) and 73% (Coinshares study). Unlike the BMC file, these two stories stop no longer encompass nuclear strength or carbon offsetting in their calculations. All in all, around 50 percent in sustainable strength appears to be like plausible, particularly when we realize the incentives at play: miners naturally belief basically the most cost-efficient source of strength, which is in general in any other case unused renewable strength (hydro, solar, wind in the peak times) or so-known as stranded strength, appreciate flared natural gas from oil rigs.

So how does the European Union overview to Bitcoin, sustainable strength-incandescent?

Primarily primarily based on the loyal Eurostat strength statistics, the European Union utilizes 15% in renewables and 13% in nuclear strength, for a total of 28% in sustainable strength skills.

Here’s mighty lower than Bitcoin’s lower-sure estimate of 39% in renewables (which excludes nuclear) and half of of the BMC estimate of 56% (which comprises nuclear).

Bitcoin mining is mighty greener than your total European Union.

The beautiful part is that whereas for the European Union the increasing part of renewables is completed thru a high-down, politically-motivated program that comes at enormous costs and elevated grid instability, for Bitcoin it’s real a natural of financial incentives. Bitcoin is environmentally-pleasant as a aspect stop, with out somebody wanting to push for it.

Set Frankenstein’s Monster To Rest

Because the podcaster Marty Crooked functions out, no ratio of renewable/sustainable strength will appease the powers that be. Even when bitcoin used to be mined exclusively with hydro, photo voltaic, gas flares and volcanoes, it would amassed be criticized for losing strength. It’s no longer a ask of strength statistics, but somewhat of perceived legitimacy. Politicians and diversified fiat maximalists merely desire to paint bitcoin as unnecessary and corrupt, and they’ll use any story that does the job, be it strength shatter, terrorist financing, drug alternate, malware, inequality or any diversified FUD.

The real fact is that bitcoin is a traumatic reflection on the fiat establishment. Contrary to heaps of of predictions, bitcoin is flourishing after 12 years of existence, with one nation already adopting it as a correct mushy with others making an try on, and users being in a predicament to kind global, rapid, advance-costless transactions (by strategy of the Lightning Community) in spite of various claims of bitcoin’s unscalability.

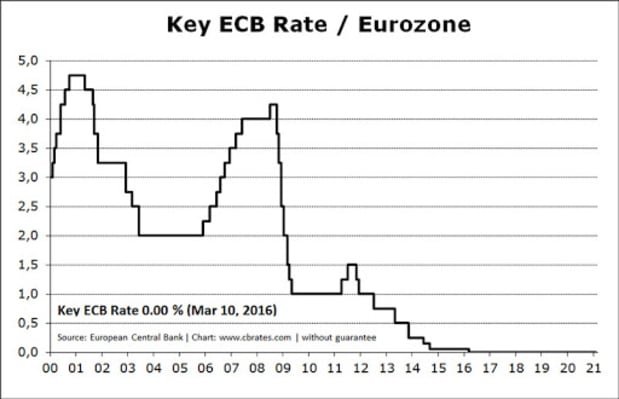

Bitcoin is the money that Europe deserves after 20 years below a slapped-collectively monetary regime that has been disintegrating on memoir of the initiate. The euro used to be launched in 2002, and already by 2008 had gone thru a major crisis, when Greece wished to be bailed out. The problem there used to be that the one monetary protection acted as one enormous subsidy to fiscally irresponsible worldwide locations. Greece, alongside with diversified PIIGS, frail to be a unhealthy nation to mortgage to, however the one monetary protection allowed such worldwide locations to net artificially cheap credit ranking. The tip result used to be that the nation effectively went bankrupt when interest charges went up throughout the monetary crisis. Since German banks were the primary creditors of the Greek authorities, your total plan wished to be bailed out so that the eurozone didn’t give plan, lower than a decade after the euro’s inception.

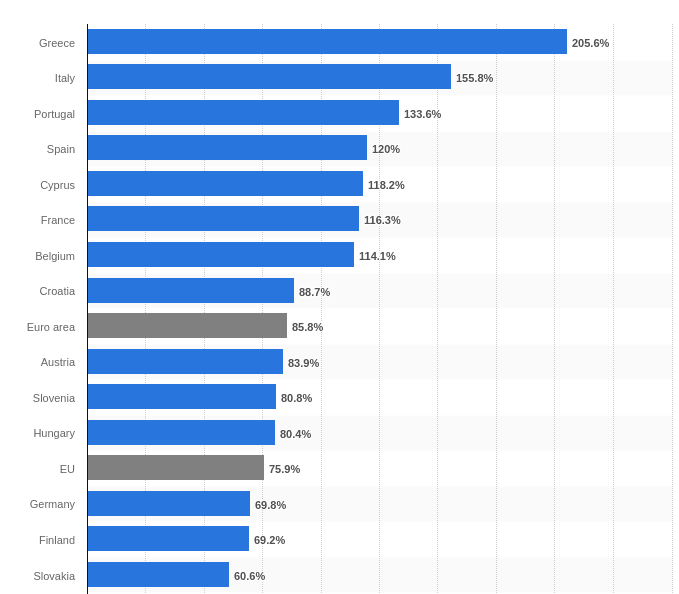

Your total eurozone has been saved on zero-interest lifestyles improve since then. The perpetually easy-money protection had a disastrous stop on the general public finance of the member worldwide locations. To on the muse adopt the euro, candidate worldwide locations needed to meet the Maastricht criteria, one of them being preserving the general public debt beneath 60% of the nation’s Unfriendly Domestic Product.

Here’s how the debt-to-GDP metric checked out the tip of 2020:

The euro home includes nineteen worldwide locations. Twelve of those worldwide locations would now no longer fling the Maastricht debt-to-GDP criteria, and don’t fulfill the “fundamental” Steadiness and Voice Pact necessities.

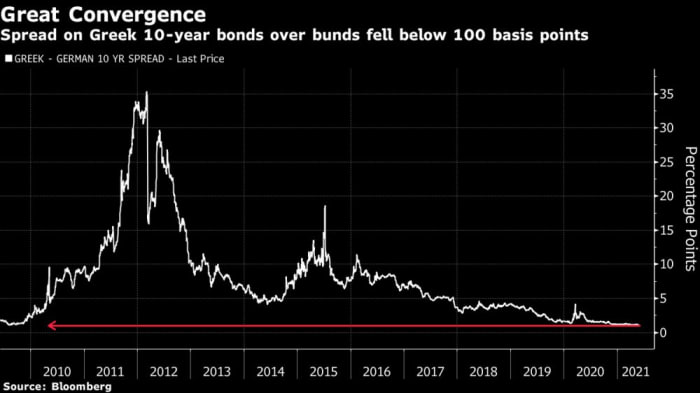

Nonetheless the ideal joke of all is that Greece’s authorities debt is now priced almost the a similar as German bonds – that formula it seemingly doesn’t elevate more risk than the German bonds, despite the incontrovertible fact that the nation went almost bankrupt a decade ago and is up to its ears in debt.

This isn’t a criticism of Greece or any diversified direct nation. The politicians in these worldwide locations are real following incentives. And the incentives are to YOLO into wide amounts of debt. Why no longer? The market doesn’t care, as some distance as we can effect on the bond unfold chart. It doesn’t care on memoir of of the true hazard stop: Greece went into default earlier than, and it used to be bailed out. The novel monetary protection is much more free than a decade ago, if anything.

As some had feared when the euro used to be being launched, the euro works more appreciate an Italian lira than the German ticket. This used to be inevitable, because the man made political constructs appreciate the eurozone necessarily desire to cater to the weakest participants, lest it give plan rapidly.

The euro thus creates zombie worldwide locations and zombie economies, where all that issues is the free credit ranking to attach the point out running. Nonetheless all money owed must be settled in the tip, one formula or one other – both by strategy of cascading bankruptcies, or thru total dilution of novel euro holders (aka hyperinflation).

It sounds as if it’s the euro that has a sustainability negate.

And the powers that be look like attentive to this. When the passe instruments of financial protection appreciate the interest charges are depleted, central bankers desire to net ingenious. With novel fiat money, opposed interest charges or helicopter money are unfathomable. That’s why the Orwellian digital euro is being actively developed by the European Central Bank.

The digital euro obviously doesn’t trade the monetary protection pattern in any respect. In Bitcoiner lingo, it would rightly be known as a shitcoin: centralized and unpredictable monetary protection with a huge cap, primarily based completely mostly on proof-of-authority, premined, permissioned and perpetually surveilled. It will honest lengthen the lifestyles of the Frankenstein’s monster that is the euro by about a years, but such abomination won’t continue to exist for lengthy nonetheless. And confidently your total premise of a fiat monetary regime will die with it.

[T]he strength needs of the [digital euro] infrastructure would possibly presumably perchance be negligible in contrast with the facility consumption and environmental footprint of crypto-resources, equivalent to bitcoin.–ECB

And that’s precisely the problem: fiat money would possibly presumably honest even be produced from skinny air. The strength needs would possibly presumably honest be negligible, but so is the lengthy-duration of time effect.

No Competitors In The Fiat Land

If the environmental concerns were correct, bitcoin mining would possibly presumably perchance be warmly welcomed in Europe, as bitcoin mining makes that it’s most likely you’ll presumably perchance imagine the industrial use of in any other case wasted strength sources, and has the aptitude to stabilize the grid by utilizing the occasional over-skills of renewables. As has been argued many times over.

The precise diagram here is more prosaic: preserving one’s include turf. The money monopoly is sacred for the drawl and desires to be safe, particularly when it would possibly most likely most likely presumably perchance no longer stand on its include deserves. Already the central bankers are shedding the fight of tips – real check the feedback on any most up-to-date Global Money Fund, Bank of Global Settlements, Federal Reserve, or European Central Bank tweet; it’s most likely you’ll presumably be exhausting-pressed to gain a single particular acknowledge. Makes an try at tarnishing Bitcoin’s recognition by strategy of unfounded environmental concerns would possibly presumably honest match as a distraction for a whereas, but they won’t resolve the euro’s underlying complications.

Europeans will peek an an increasing kind of stark contrast in the arriving years: ever more decided attempts to salvage the monetary union and ever more loyal monetary protection of Bitcoin. The smear marketing campaign will continue and with out doubt shall be some distance more adverse than on the present time. Expectantly the general public shall be in a predicament to expose fact from fiction and adopt sound money by themselves, despite the loyal story.