Key Takeaways

- Fantom is an Ethereum-like minded Layer 1 chain with over $8 billion locked in its DeFi protocols.

- It hosts a thriving DeFi ecosystem, at the side of several decentralized exchanges and yield farming protocols.

- DeFi on Fantom appears to be like to be to be like arena to proceed increasing, with several highly-anticipated launches on the horizon.

Fantom is a Layer 1, Proof-of-Stake community with low transaction charges and like a flash finality. Since launching in 2019, Fantom has constructed up a respectable DeFi ecosystem of each and each homegrown and Ethereum-native purposes.

What Is Fantom?

Fantom is one of several different Layer 1 blockchains that surged in reputation in 2021. Attributable to it low transaction charges, the community has attracted many customers and developers which will most definitely be priced out of the exhaust of Ethereum attributable to its excessive gas charges.

The Fantom defective chain makes exhaust of Directed Acyclic Graphs to full consensus. It secures an additional execution layer called Fantom Opera, which handles more specific and advanced beneficial properties. At the present time, Fantom Opera is what most folks are referring to when they talk about Fantom and is the home of the blockchain’s DeFi ecosystem.

Opera is the first execution layer constructed on Fantom and is like minded with the Ethereum Virtual Machine. This model that developers can write, deploy, and flee trim contracts written in solidity on Fantom, correct as they’d on Ethereum. Fantom’s compatibility with Ethereum has additionally helped foster model as builders can without grief port purposes over from Ethereum to Fantom with few changes to the underlying code.

Identical to diversified Layer 1 blockchains, Fantom makes exhaust of a Proof-of-Stake validation mechanism. There is now not any such thing as a minimal stake quantity: customers can originate rewards with most efficient 1 FTM. On the opposite hand, those staking decrease amounts must delegate their tokens to a validator node. The minimal stake to flee a node is for the time being 500,000 FTM.

Fantom validation mechanism is excessive-velocity and leaderless attributable to its Lachesis consensus algorithm. Single validators pause now not buy which transactions are respectable in every block; as an different, Fantom makes exhaust of a community-extensive consensus.

By inserting off leaders, the bulk of transaction processing doesn’t rely on the validators that build the splendid option of tokens, as is the case with diversified Proof-of-Stake chains equivalent to Solana and Avalanche. This increases Fantom’s decentralization and subsequently safety by having all validators play an equal goal when taking piece in the consensus protocol.

As Fantom is like minded with Ethereum, it could well additionally be accessed by mute Web3 wallets love MetaMask. Customers can merely add the Fantom Opera community to MetaMask to place to Fantom.

Decentralized Exchanges on Fantom

Fantom for the time being has two mute decentralized exchanges that permit customers swap sources and present liquidity. Potentially the most old among the 2 is SpookySwap. It’s for the time being the splendid native DeFi protocol on Fantom with over $1 billion in full value locked.

SpookySwap’s user interface is super and easy to esteem, making it a substantial build to launch exploring the community’s DeFi ecosystem. Swapping works noteworthy the identical formula as it does on diversified automatic market makers: customers retract the sources they dangle to swap and the amount they dangle to swap then model the commerce. The SpookySwap procuring and selling interface displays functional data equivalent to skill slippage, label affect, and charges earlier than trades are submitted. More developed customers can additionally device restrict orders for asset pairs.

Customers can originate SpookySwap’s BOO token and procuring and selling charges by offering liquidity to its pools. BOO stakers receive 0.03% of the charges from swaps, so the amount of rewards paid out increases as process on the protocol does.

Nonetheless SpookySwap doesn’t stop at procuring and selling. The platform has additionally constructed a user-friendly interface for Multichain’s Fantom bridge that integrates seamlessly with the commerce. By the bridge, customers can ship sources to and from Fantom and several diversified Ethereum-like minded Layer 1 and Layer 2 networks, at the side of Binance Smooth Chain, Polygon, Arbitrum, and Avalanche.

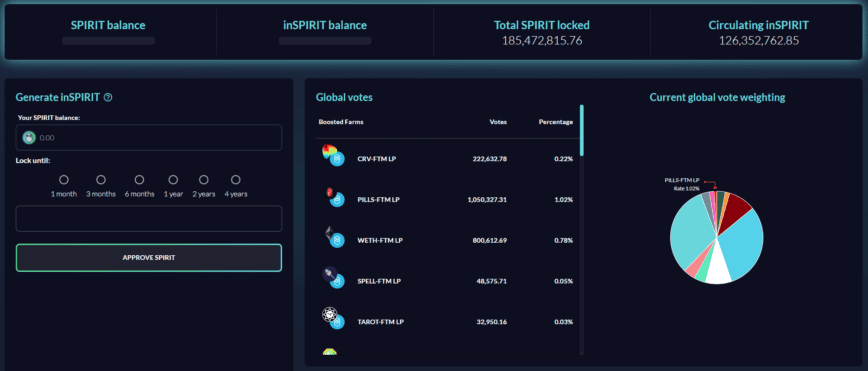

Fantom’s 2d-splendid commerce, SpiritSwap, provides identical functionality to SpookySwap and has additionally integrated Multichain’s Fantom bridge. On the opposite hand, SpritSwap’s key innovation is its inSPIRIT token system.

Liquidity companies that originate the commerce’s native SPIRIT token can lock it on the protocol and receive inSPIRIT tokens. inSPIRIT holders originate a fragment of the commerce’s charges, correct love SpookySwap’s BOO token. Particularly, they are going to additionally vote on which liquidity pools receive boosted yields.

SpiritSwap’s vesting system is expounded to the one old by Ethereum’s splendid DeFi protocol, Curve Finance. The longer holders buy to lock up their SPIRIT tokens, the more inSPIRIT tokens they’ll be distributed, giving them more vote casting energy. This model SPIRIT holders are incentivized lock up their tokens for longer periods to model more affect over which yield farms salvage boosted returns.

Lending and Borrowing

Tantalizing on from exchanges, the next key share of Fantom’s DeFi ecosystem is its fluctuate of lending and borrowing platforms. The splendid “DeFi bank” on Fantom is Geist Finance. Launched in October 2021, Geist Finance is a more most trendy entrant into Fantom’s DeFi scene but has quick received traction. Geist beneficial properties equally to the Ethereum-native lending protocols Compound and Aave and has change into Fantom’s third-splendid protocol attributable to its innovative token reward program.

Geist has successfully maintained honest yields for customers by offering rewards in its native token, GEIST. On the opposite hand, unlike diversified protocols that permit liquidity miners to sell their token rewards correct away, Geist has a three-month vesting length on all GEIST tokens earned. For the length of this length, holders launch incomes a fragment of the protocol’s revenue as if their tokens had been staked. Tokens will most definitely be withdrawn at any time at some stage in the three-month vesting length, but holders will forfeit 50% of their full tokens accumulated. These forfeited tokens are then distributed to customers who buy to lock up their GEIST for the corpulent three months, benefitting long-timeframe holders even more.

No longer far in the assist of Geist Finance is yet another lending and borrowing platform called Disclose. Paying homage to the mute fear film series of the identical name, Disclose doesn’t fluctuate noteworthy from Geist in its functionality. On the opposite hand, the protocol does strengthen lending and borrowing for a wider fluctuate of sources at the side of several smaller stablecoins equivalent to FRAX, DOLA, and TUSD.

The build Disclose does divert from Geist is in its token reward structure. It’s for the time being in the process of upgrading its SCREAM token staking system to divert 70% of all protocol revenue to token stakers, and additionally plans to ship the final 30% to a newly-formed DAO. Real over half of the DAO’s funds will seemingly be held in reserve as insurance in the case of a catastrophic event equivalent to a token computer virus or hack. The diversified half will seemingly be distributed to financing unusual merchandise, configuring incentives, and token steal-backs, arena to neighborhood vote casting.

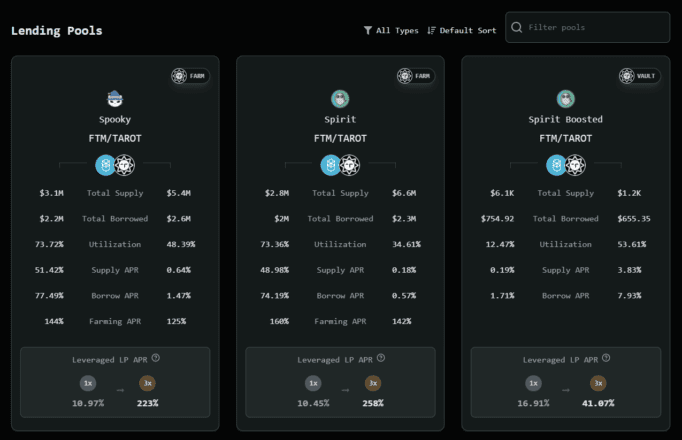

Yet any other critical lending platform on Fantom is Tarot, the 14th-ranked protocol on the community. Tarot’s arena of interest is offering leveraged yield farming, permitting liquidity companies to borrow sources from lenders to leverage up the yields generated by their positions. Whereas this formula can fabricate mammoth returns, it additionally matters contributors to the menace of getting their positions liquidated.

On the opposite hand, for folk who don’t must safe on additional menace, Tarot permits customers to deposit their sources for diversified customers to construct to work through leveraged methods. In doing so, depositors can generate glorious returns on single sources without having to be troubled about being liquidated if the market moves against them. On the opposite hand, if utilization of lent tokens is excessive, there will most definitely be a lengthen length to withdraw sources. This model that locking tokens up is a menace for customers who may per chance presumably also wish like a flash salvage admission to to their sources.

The Arrangement forward for DeFi on Fantom

The Fantom ecosystem is increasing at a presently rate, with several upcoming initiatives arena to scheme even more liquidity to the chain. One highly-anticipated characteristic arena to hit Fantom is the so-called “degenbox” formula from Daniele Sestagalli’s Abracadabra.Cash.

The formula lets customers deposit the Terra community’s UST stablecoin to borrow Abracadabra’s MIM stablecoin. As UST and MIM are each and each trusty sources, the borrowing arena will most definitely be leveraged up with a diminished menace of liquidation when in contrast with borrowing against unstable sources. On the opposite hand, the degenbox formula depends on UST inserting forward its $1 peg—if UST drops considerably below $1, leveraged positions on Abracadabra will seemingly be liquidated.

Despite the dangers enthusiastic, the degenbox formula has confirmed smartly preferred by DeFi customers on Ethereum. The formula can yield between 40 and 110% returns on stablecoins relying on the amount of leverage old. Whereas Abracadabra has already launched on Fantom, it for the time being most efficient lets customers borrow MIM against FTM tokens. On the opposite hand, it’s widely believed that Abracadabra plans to port over the degenbox formula once Terra integrates UST with the Fantom community.

In other locations, the mute “DeFi architect” Andre Cronje is constructing a peculiar DeFi protocol on Fantom with abet from Sestagalli. The offering will mix several a success DeFi beneficial properties from present protocols, equivalent to a token vesting system associated to Curve Finance and permissionless strengthen for protocol bribes, a convention made mute by Convex Finance.

In a most trendy blog submit, Cronje confirmed that the unusual protocol would act as an automatic market maker for protocols, permitting them to bootstrap liquidity and without grief provide token incentives to device a more atmosphere friendly DeFi ecosystem on Fantom.

In snarl to device an even launch for the unusual protocol, an initial distribution will seemingly be distributed to the tip 20 DeFi initiatives on Fantom with the easiest full value locked. Every protocol will buy how to distribute tokens to its customers in a narrate to verify tokens tear to basically the most active and enthusiastic DeFi customers on the community.

Fantom has already attracted over $8 billion across more than 100 protocols with a solid foundation of token exchanges and lending platforms. Attributable to its Ethereum compatibility, an rising option of developers and customers are deciding on Fantom to fabricate their protocols and deploy their sources. The community’s most trendy boost backs up this pattern. Fantom’s full value locked has elevated 109% at some stage in the final month and reveals no indicators of slowing down.

Disclosure: At the time of writing this characteristic, the author owned FTM, ETH, and several diversified cryptocurrencies. Andre Cronje is an fairness holder in Crypto Briefing.

The facts on or accessed by this online page is received from fair sources we squawk to be honest correct and legit, but Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any data on or accessed by this online page. Decentral Media, Inc. is now not an investment consultant. We pause now not give personalised investment suggestion or diversified monetary suggestion. The facts on this online page is arena to substitute without behold. Some or all of the facts on this online page may per chance presumably also change into older-long-established, or it will most definitely be or change into incomplete or mistaken. We may per chance presumably also, but are now not obligated to, replace any old-long-established, incomplete, or mistaken data.

You may per chance presumably also mute by no formula model an investment dedication on an ICO, IEO, or diversified investment basically based on the facts on this online page, and also it is seemingly you’ll presumably additionally mute by no formula clarify or in some other case rely on any of the facts on this online page as investment suggestion. We strongly advocate that you just consult an authorized investment consultant or diversified licensed monetary knowledgeable need to you are searching for investment suggestion on an ICO, IEO, or diversified investment. We pause now not win compensation in any fabricate for inspecting or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

What is a Crypto Airdrop: Why Initiatives Airdrop Crypto

Crypto airdrops occur when unusual tokens are freely distributed to diversified wallets in snarl to pressure initial boost and fabricate a neighborhood. They signify a mute advertising and marketing tactic that unusual initiatives exhaust to spread…

Andre Cronje Teases Sides for Ve(3,3) on Fantom

Andre Cronje has printed a series of blog posts teasing the beneficial properties of his upcoming ve(3,3) finishing up on Fantom. Cronje Main components Incentive Structure Cronje printed final week that he’s…

Fantom, NEAR Hunch Layer 1 Bellow Into 2022

Fantom and NEAR are two of basically the most trendy Layer 1 coins to rally. Crypto Layer 1 Bellow Continues Layer 1 hype isn’t needless yet. Several trim contract blockchains dangle considered…

Fantom Jumps 36% on Geist Finance DeFi Originate

The FTM token has attach in double-digit gains following the launch of the DeFi protocol Geist Finance. Geist Finance Originate Boosts Fantom Fantom has a good deal surprised merchants with yet another parabolic rally….