The below is an excerpt from a recent model of Bitcoin Magazine Professional, Bitcoin Magazine’s top class markets newsletter. To be amongst the first to make a choice up these insights and different on-chain bitcoin market prognosis straight to your inbox, subscribe now.

Realized Market Capitalization Trends

Today time, we’re offering an in-depth breakdown of realized market capitalization. Aged asset classes alongside with bitcoin itself are continually quoted by their market capitalization, which is calculated by discovering the created from mark and circulating supply. With bitcoin, and the introduction of a entirely clear space of property rights, you must to maybe maybe well well calculate the realized market capitalization, which values every unit of supply on the associated price it used to be final moved across the network.The realized market capitalization of bitcoin is one among the loyal methods to quantify the monetization technique of the asset, as the incorrect volatility of the asset is interestingly handiest occurring to the upside. The fluctuations in the alternate rate aren’t nearly as unstable as the gradual-then-sudden appreciation of the realized market price of the asset.

The realized market capitalization of bitcoin is one among the loyal methods to quantify the monetization technique of the asset, as the incorrect volatility of the asset is interestingly handiest occurring to the upside. The fluctuations in the alternate rate aren’t nearly as unstable as the gradual-then-sudden appreciation of the realized market price of the asset.

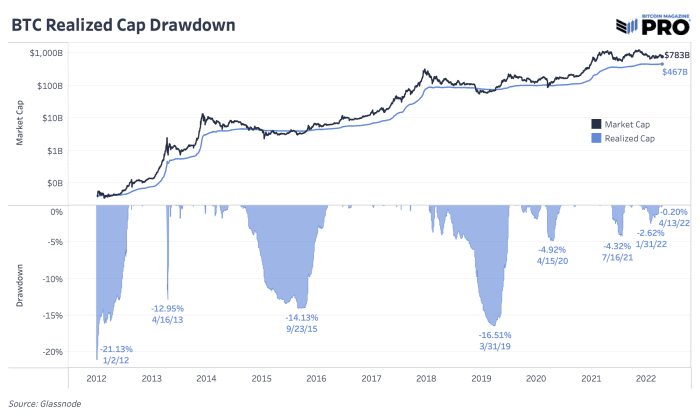

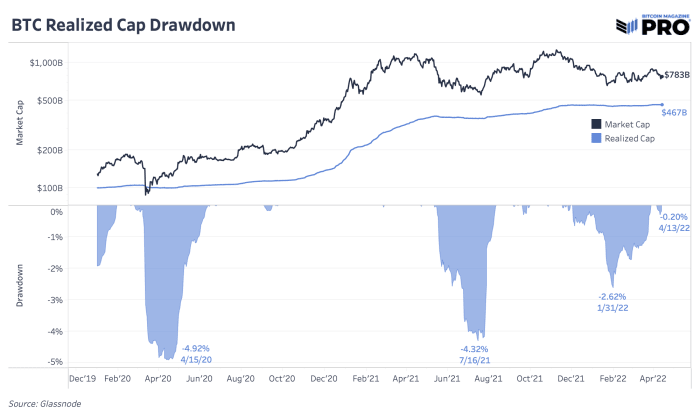

For the time being the realized cap of bitcoin is $467 billion, a mere 0.20% off of its all-time high. Despite falling by more than 50% off of the highs since November, the realized market price of bitcoin has handiest fallen from peak to trough by 2.62%.

A thread written in December 2021 covers this dynamic extensively, citing the patterns of realized mark for the length of bitcoin market cycles.

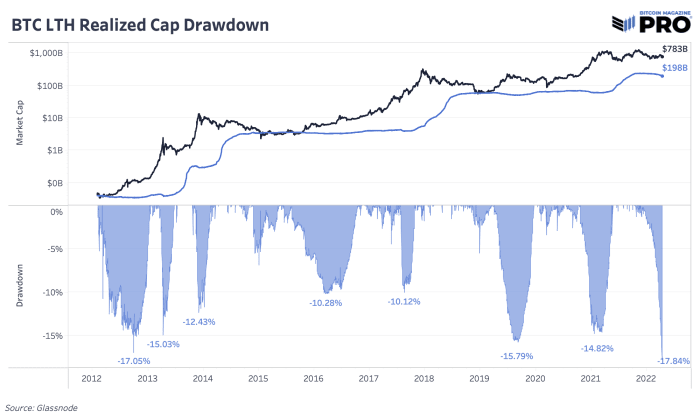

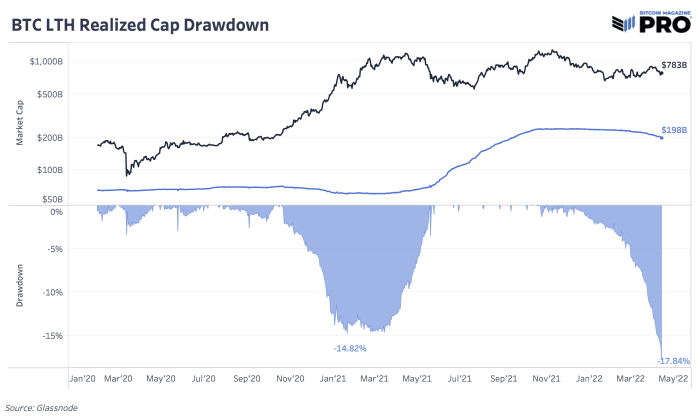

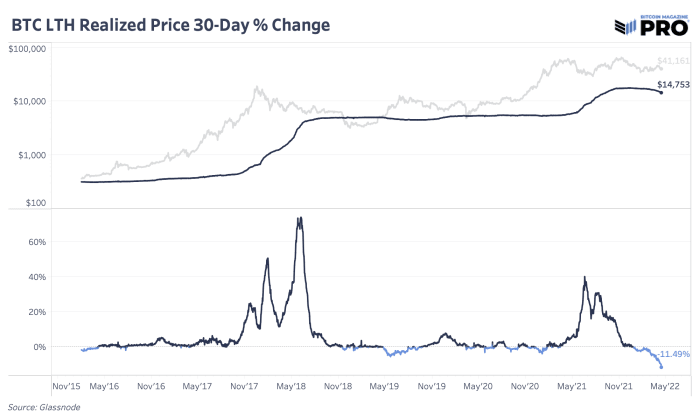

We can also ruin down realized capitalization into different cohorts alongside side lengthy- and quick holders. Under the bottom, we’re seeing the superb drawdown in lengthy-term holder realized capitalization in bitcoin’s history.

Though lengthy-term holder supply is quite neutral for the explanation that start of the 300 and sixty five days, up 0.6% as accumulation and coins aging into this neighborhood continues, the info reveals that there’s been hundreds of marketing too. Lengthy-term holders realized capitalization and realized mark falls as coins with increased price basis are bought. This lowers the overall average price basis which is down 11.49% over the final 30 days.

With this data and the technique in which lengthy-term holders are quantified, the class of 2021 holders that recently broken-down into the cohort are these transferring their holdings.

Re-accumulation has been our rotten case for the explanation that start of Q1 2022, and the relate of these metrics proceed to enhance that market outlook in spite of the most contemporary rise in lengthy-term holder selling force.