Despite having fallen by nearly 30% since its November all-time high, Bitcoin is in a consolidating bull market and on its option to $100,000, according to a Bloomberg Intelligence document. The paper said it is some distance unlikely that BTC’s bull lunge has come to a quit and predicts the fastened offer to sustain rising prices.

“The key place a query to going thru Bitcoin nearing the onset of 2022 is whether or now now not it’s peaking or just a consolidating bull market,” the document said. “We obtain it’s the latter, and stare the benchmark crypto well on its option to changing into global digital collateral in a world going that design.”

The document also highlighted how this one year’s corrections non-public made the asset stronger and its bull market extra healthy, as Bitcoin persisted and acquired previous China’s mining ban to fabricate new highs. Apart from to breaching old tops to realize $69,000 in November, the Bitcoin community hash charge also just just nowadays made a brand new all-time high, showcasing a deep resilience of its consensus protocol.

“Bitcoin appears to be on a trajectory for $100,000. We stare it as extra of a spot a query to of time, notably resulting from the financial basics of accelerating quiz vs. reducing offer,” the document said.

Additional mainstream adoption will consequence in increased quiz for bitcoin, and developments in new change-traded funds and futures and accurate comfy web online page in El Salvador are examples of this course of. Consistent with the document, as BTC issuance declines and its awareness increases, prices are expected to leap and volatility to diminish.

Better regulatory readability in the U.S. for Bitcoin may possibly well additionally lengthen its acceptance among obvious kinds of traders and encourage fulfill an finest increased quiz for the asset. The document said next one year may possibly be pivotal in that sense, because the country looks build to embrace cryptocurrencies with extra detailed legislation and a higher notion of the applied sciences from authorities officials.

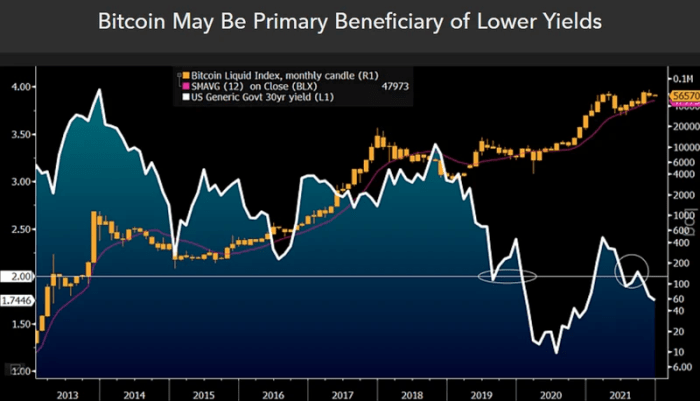

Monetary coverage may possibly well additionally play its phase, especially if tightening measures by the Federal Reserve quit up resulting in a crashing stock market, prompting the central bank to creep the ship the unsuitable design.

“A indispensable power to reverse expectations for Federal Reserve tightening in 2022 is a tumble in the stock market, that would even be a chunk of a have interaction-have interaction for Bitcoin,” the document said, in conjunction with that Bitcoin is “well on its option to changing correct into a digital store of payment.”

“Bitcoin will face initial headwinds if the stock market drops, but to the extent that declining equity prices stress bond yields and incentivize extra central-bank liquidity, the crypto also can come out a indispensable beneficiary,” per the document.

The document also mentioned the U.S. Treasury long bond’s incapacity to sustain above 2% no topic frequent consensus for increased yields, a phenomenon that would also consequence in a deflationary surroundings next one year, favoring Bitcoin.

Bloomberg Intelligence defined that funds had been spirited remote from “routine analog gold” and toward Bitcoin.

“The place a query to for 2022 services on reversal or acceleration of those flows. With bond yields in decline, our bias is toward the latter,” per the document.

Bloomberg added that Bitcoin’s fastened offer, enforced thru a diminishing issuance each four years, also can encourage it outperform shares again next one year, striking it at a bonus against a protracted stock market that hasn’t had a 10% correction for the reason that 2020 rupture.