The Algorand ecosystem has considered unheard of ranges of adoption. The network has been rising in recognition as traders take into narrative a sustainable and fee-surroundings friendly substitute to the costly and slower blockchains.

Algoracle, a project created to offer Algorand with a native oracle provider was once created to bootstrap the ecosystem’s expansion. This can finest switch forward by connecting its decentralized applications (dApps) to the actual world.

Algoracle facilitates this course of by providing the network with a decentralized bridge to connect orderly contracts with real-world recordsdata. This provider is serious for the expansion of any blockchain-based ecosystem.

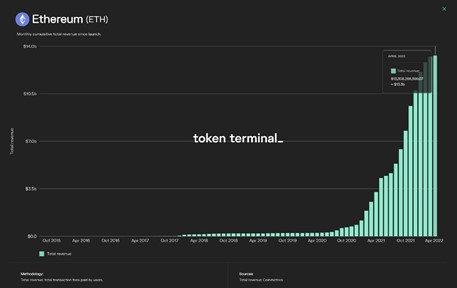

Data from Token Terminal signifies that Ethereum, one of many finest networks by system of dApps numbers, seen an explosion in its month-to-month earnings. This enhance was once recorded from April 2020 when it stood under $1 billion to its contemporary $14 billion.

The most crucial driver for this enhance has been the adoption of its decentralized finance (DeFi) protocols and non-fungible tokens (NFTs). Conversely, these dApps require an oracle provider to characteristic, offer a product or spend case, course of transactions, and onboard more users.

Merely place without an oracle, there isn’t the kind of thing as a enhance. At its yearly high, Algorand seen as many as 1.8 million energetic addresses. These users will toughen the network’s next expertise of adoption, but they need the tools and companies that can enable it. Algoracle is the bridge that can produce it happen.

Algoracle Can Enable A Recent Generation Of Direct Cases

Not like aggressive companies, Algoracle leverages Algorand’s abnormal consensus algorithm. Known as Pure Proof-of-Stake (PPoS), it permits Algoracle to characteristic as a fully decentralized provider without the constraints of a old oracle.

In that sense, Algoracle is a step forward for oracle because it can provide more contemporary and more complex dApps with a native Verifiable Random Aim (VRF) mechanism. This improves the oracle’s performance, efficiency, scalability, and uptime.

Algoracle and the VRF mechanism aspects will enable the provider to energy a brand contemporary department of spend conditions. As an illustration, orderly contracts will more than doubtless be in a position to receive recordsdata, and their upgraded infrastructure will enable them to send recordsdata into the actual world.

In that system, a user may per chance per chance per chance receive notifications from their NFT market, receive or send recordsdata on a decentralized trade (DEX), and more. It is miles the next generation in DeFi and orderly contract interaction. This may per chance per chance per chance per chance enable dApps working with Algoracle to talk and potentially toughen disagreeable-chain transactions.

Algoracle Supports A form of Initiatives On Algorand

Over the last twelve months, Algoracle has partnered with Dauntless Recent Coin, Kaiko, Nomics, AlgoGuard, Equito Finance, Glitter Finance, and numerous others. Their collaboration with Glitter Finance has enabled them to energy their DeFi companies produced from a yield generation resolution, a disagreeable-chain bridge, and a disagreeable-chain NFT market.

This goes to repeat the significance of an oracle resolution for the Algorand ecosystem and its spacious array of spend conditions. When the partnership was once announced, David Dobrovitsky, founder and CEO of Glitter Finance said:

The Glitter Finance technical crew, working in stay performance with the technical crew of Algoracle has developed contemporary enhancements that can vastly improve and trade the model blockchain and disagreeable-chain bridges work and may per chance per chance per chance enable for worthy higher solidity and steadiness for the Glitter Protocol (…).