In a modern picture inspecting the second quarter (Q2) performance of the Layer 1 (L1) blockchain Algorand (ALGO), data analytics firm Messari highlighted lots of necessary milestones completed by the community all the design in which by the period, with a chronicle in transactions being undoubtedly one of the most necessary ones.

Swiftly Community Boost

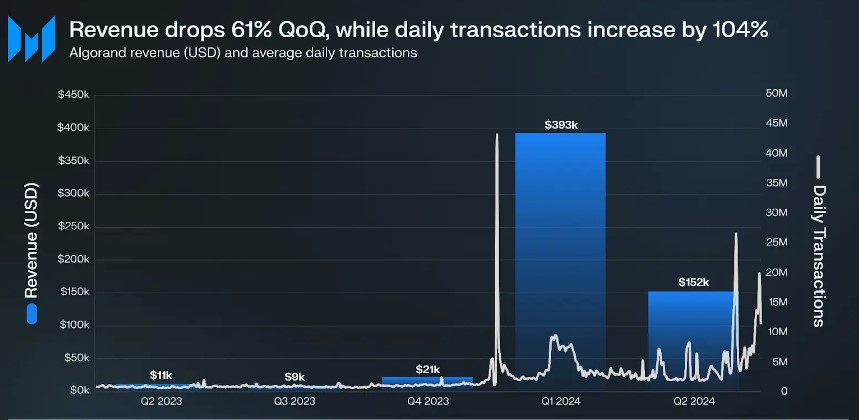

One of many principle metrics that stood out used to be the surge in Algorand’s moderate every single day transactions, which skyrocketed by 104% to reach 4.7 million. The total transactions recorded a extra modest 6% quarter-over-quarter (QoQ) originate bigger, reaching 425 million.

Regardless of this heightened transaction volume, Algorand’s revenue took a hit, declining by 61% to $152,000. The picture attributed this to a 46% depreciation within the price of ALGO against the US dollar when compared with the outdated quarter. Even if the moderate transaction charge rose by 44%, the total dollar revenue quiet declined.

The 61% decrease in quarterly revenue used to be also traced to a correction following ALGO’s 1,747% surge in Q1, driven by a one-day spike of 43 million transactions linked to the ORA memecoin mission.

Alternatively, on a yr-over-yr (YoY) foundation, Algorand’s revenue seen a huge 1,241% originate bigger, hiking from $11,000 to $152,000.

On a definite exclaim, Algorand reached a necessary milestone of two billion transactions all the design in which by the quarter, showcasing the community’s progress and adoption. Particularly, the community took four years to create its first billion transactions, while the second billion used to be reached inner correct one yr.

Algorand Staking Drops To Lowest Stage In A one year

In Q2 2024, the amount of ALGO staked on the Algorand community declined 38% YoY and 6% QoQ, reaching its lowest level at 1.6 billion ALGO staked in a yr. Messari believes this is in all chance attributable to the lowering rewards allocated per governance period.

The share of Algorand’s eligible offer that used to be staked reduced by 4.7% QoQ and now stands at 20.2%. Meanwhile, Algorand’s circulating offer elevated by 1.2% to 8.2 billion ALGO.

Lastly, data reveals that the market cap for stablecoins on Algorand elevated by 15% QoQ, rising from $73 million to $85 million, primarily driven by a 32% originate bigger in Circle’s USDC stablecoin market cap, which now accounts for 78% of the complete stablecoin market cap on Algorand.

Conversely, Tether’s USDT market cap dropped by 22%, making up 21% of Algorand’s stablecoin market fragment. EURD’s market cap remained at a 1% fragment of Algorand’s stablecoin market cap.

ALGO Ticket Faces Make-Or-Ruin 2nd

The ALGO token has requisite sign beneficial properties in modern weeks after a entertaining Q2 for the price and the broader market. CoinGecko data reveals that the token has considered a 14% sign originate bigger within the final two weeks and 12% within the final seven days by myself.

This has resulted in ALGO trading at $0.1357, correct below its 200-day exponential difficult moderate (EMA), marked by the yellow line on the ALGO/USDT every single day chart below, which for the time being acts as a wall of resistance for the token.

That is in all chance compulsory to constructive this hurdle for a capability continuation of the price’s uptrend within the arriving days and to set the equal discontinuance to-term abet within the match of a correction.

Featured image from DALL-E, chart from TradingView.com

Disclaimer: The suggestions chanced on on NewsBTC is for academic purposes

handiest. It would no longer signify the opinions of NewsBTC on whether to buy, sell or retain any

investments and naturally investing carries risks. You is in all chance in fact helpful to behavior your possess

study earlier than making any funding choices. Expend data supplied on this web assert

entirely at your possess threat.