The under is an excerpt from a most traditional edition of Bitcoin Magazine Legit, Bitcoin Magazine’s top charge markets publication. To be among the first to receive these insights and other on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

Whereas it’s dawdle this day that the dominant driver within the bitcoin market is its correlation to fairness markets, we deem that a sexy decoupling will favor goal in a roundabout method, and the seeds of that decoupling doubtless is at threat of be sown within the derivatives market.

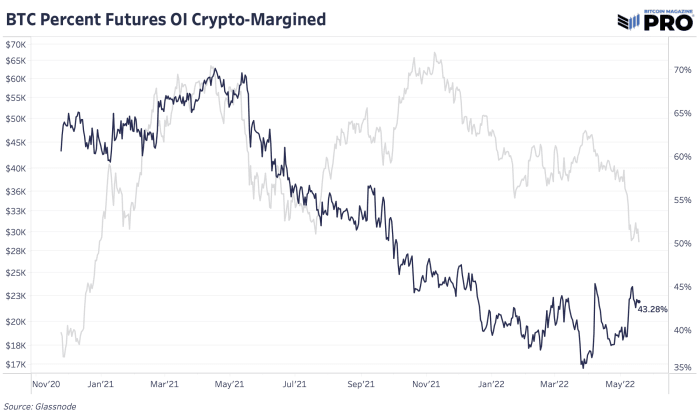

First off, a first-rate divulge over the final two years has been the “dollarization” of collateral form within the derivatives market, taking out indispensable of the scheme back convexity that comes with a majority of collateral being bitcoin itself.

Whereas a ultimate-wanting liquidation occasion within the bitcoin market is less doubtless than March 2020 basically basically based purely on the collateral make-up within the market this day moreover to the positioning of the contracts (shown under), it’s dawdle that world fairness and credit ranking markets are in free fall. With this in mind, and the truth that place markets own absorbed a big quantity of promoting tension in most traditional weeks, one could possibly presumably be wise to salvage a shut stare on the derivatives market going forward.

Remaining Trace

The Federal Reserve is on a mission to reverse engineer the putrid wealth plot, with the premise that falling asset costs will dampen client self perception and spending, and slack down the unheard of inflation being witnessed around the field.

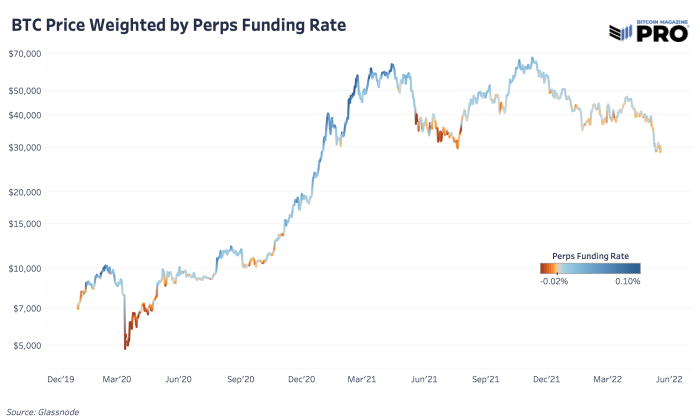

If world markets are headed for a brink, you doubtlessly can query bitcoin to face steep tension as successfully. What isn’t known is how many bitcoin merchants/speculators are mild within the market left to apprehension, and whether the selling that could possibly come could possibly presumably be through place markets or more predominantly through shorting through bitcoin derivatives.

In either yell, it’s doubtless that a horde of backside shorters will pile on making an are trying to force bitcoin into the grime (this could have the capacity to be viewed through a deeply adverse perpetual futures funding charge).

This could possibly presumably in a roundabout method lead to a ultimate-wanting rebound within the cost of bitcoin, and doubtless a decoupling/outperformance of alternative threat resources which were so tightly correlated with bitcoin in most traditional months.

Opportunity lies forward.