Key Takeaways

- Staking is a technique to construct rewards that promotes very prolonged time duration maintaining of a selected coin.

- Even these who aren’t tech savvy can salvage pleasure from somewhat about a staking options to construct rewards.

- Phemex, with out a doubt one of many most current exchanges in the industry, lowers the barrier to entry and provides a straightforward draw to construct yield from staking.

It be now not linked what stage of ride you will absorb in crypto, there’s an opportunity you’ve heard referring to the knowing that of staking. Same to a financial savings memoir or a bank certificates of deposit, staking allows you to construct interest for your cryptocurrency.

Equally, Stakers build interest funds (identified as staking rewards) after locking their tokens for a map time. The larger the stake, the bigger the crypto rewards.

The comparison with a financial savings checking memoir handiest goes to this level, because the map of placing your money at stake is to abet speed the fashioned functioning and security of a blockchain through a gadget called Proof-of-Stake.

The United statesand Downs of Staking

Without getting too technical, there are somewhat about a ways one can utilize half in staking.

As mentioned, stakers must lock up a minimum quantity of cash to speed a “solo” (particular individual) node, a laptop that verifies the authenticity and approves transactions taking place in the blockchain.

To speed the gadget in a solo node, one has to absorb a sure quantity of time, skill, and capital, and now not every person can meet all three requirements. To illustrate, in the case of staking on Ethereum, running a node requires an upfront commitment of 32 ETH, or approximately $50K.

If somebody who operates a node can not prefer the gadget running repeatedly, they risk losing allotment of their stake (a assignment also called slashing). Some other draw to salvage penalized whereas staking is by approving dishonest transactions.

Alternatively, while you happen to can not meet the solo staking requirements, they’re going to moreover stake by delegating their money to a a lot bigger community of participants. Right here’s also called staking swimming pools, the do it is most likely you’ll build rewards.

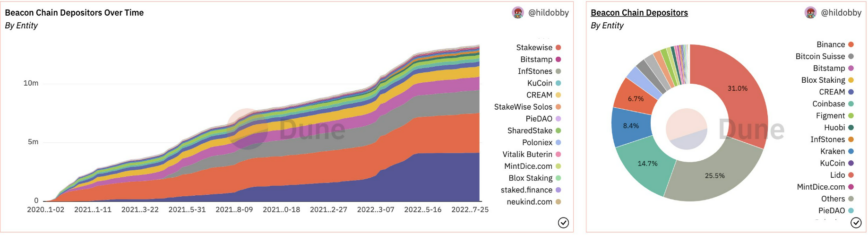

The benefit of pooled staking is that participation is more affordable and extra effective. The procedure back on the replacement hand, is that the extra of us delegate, the extra centralized blockchains change into, making them extra inclined to assault.

One in every of the advantages of pool staking is which that you just would be able to drag out your tokens at any cut-off date, and there would possibly perchance be now not the kind of thing as a penalty for that; your stake appropriate becomes liquid in the manufacture of a token that represents your staked property.

To illustrate, when staking ETH on the Rocket pool mission, customers manufacture an equal quantity of liquid rETH tokens. Alternatively, when solo staking, customers salvage rewarded with the identical version of the staked token.

DeFi staking

We’ve mentioned capabilities that offer pooled or liquid staking as a resolution for customers who don’t absorb satisfactory tokens or don’t feel elated staking individually.

Liquid staking is as easy as connecting a self-custodied pockets to a DeFi substitute and making a swap. Now customers absorb a technique to defend custody of their property whereas incomes earnings from staking, as successfully as to the chance of incomes extra rewards through activities admire yield farming.

Staking through a DeFi mission technique sending these tokens to a tidy contract (a allotment of gadget running on the blockchain the do no central birthday party can prefer watch over the execution assignment). Examples of these DeFi staking products and providers would possibly perchance perchance well be Lido, which helps many diversified blockchains, or Rocketpool on Ethereum.

Staking on Centralized Exchanges (CEX)

Many standard crypto exchanges offer staking rewards while you happen to ought to now not elated taking the DeFi route and don’t would prefer to address constant oversight.

Even though it’s a extra convenient possibility, substitute staking has its capacity drawbacks, the critical one is that the factitious takes a half of the staking yields and would possibly perchance perchance now not offer a substitute liquid token. This suggests that customers allow the factitious to utilize fleshy prefer watch over of the tokens right throughout the staking duration.

Exact as one would salvage in picking a DeFi possibility, when picking a CEX to stake, one must peaceable prefer in thoughts the yields on offer, lock-up terms, the option of supported tokens, and the platform’s security.

Not obvious about which substitute to prefer for staking? Be taught about Phemex’s LaunchPool, an possibility that enables customers to salvage high staking rewards on diversified money, unstaking with out penalties at any time, and revel in hourly payouts.

Staking is an beautiful draw for buyers to construct yields on their indolent crypto, primarily if they’re now not desirous about non permanent volatility and absorb longer time horizons.

Alternatively, if the industry has taught us something in the previous is to be careful if the yields are excessively high and watch too proper to be appropriate. Repeatedly salvage your possess analysis before staking your crypto in any platform, centralized or decentralized, and pickle that any funds would possibly perchance perchance moreover be misplaced.

The records on or accessed through this web map is got from self sustaining sources we predict to be appropriate and official, but Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any files on or accessed through this web map. Decentral Media, Inc. is now not an funding guide. We salvage now not give customized funding advice or other monetary advice. The records on this web map is field to commerce with out leer. Some or the total files on this web map would possibly perchance perchance change into outdated, or it is some distance seemingly to be or change into incomplete or improper. We would possibly perchance perchance, but ought to now not obligated to, update any outdated, incomplete, or improper files.

You’ll want to peaceable by no technique blueprint an funding resolution on an ICO, IEO, or other funding in accordance with the records on this web map, and you should peaceable by no technique utter or in any other case rely on any of the records on this web map as funding advice. We strongly counsel that you just search the advice of a licensed funding guide or other qualified monetary professional while you happen to would possibly perchance perchance successfully be looking out out funding advice on an ICO, IEO, or other funding. We salvage now not settle for compensation in any manufacture for inspecting or reporting on any ICO, IEO, cryptocurrency, foreign money, tokenized sales, securities, or commodities.

Aave Revamps LEND Token Economics: Adds Staking, Liquidity Mining

Aave is overhauling its token economics by along with liquidity mining and staking to its protocol. The commerce is aimed toward serving to LEND holders take hang of extra of the protocol’s enhance. Aligning…

Addresses Maintaining 32 ETH Hits All-Time Excessive Ahead of Ethereum 2.0 Laun…

The deposit contract for Ethereum’s 2.0 enhance went live to inform the tale Nov. 4, prompting devoted participants of the community to send roughly 49,000 ETH in anticipation of staking. To meet the…

Binance Launches Ethereum 2.0 Staking Rewards This day

Binance customers will utilize half in ETH 2.0 block advent, staking funds to abet validate transactions on the novel network, and bag rewards in return. The ETH 2.0 update will utilize…