Key Takeaways

- Tokenomics is a discipline that analyzes frequent aspects chanced on in economics, such as offer, seek files from, and utility, and applies it to cryptocurrencies.

- Investors can with out issues overestimate offer and seek files from and underestimate how narratives and memes might per chance per chance per chance also affect a token’s designate.

- Phemex, undoubtedly among the leading cryptocurrency exchanges within the exchange, does intensive tokenomics diagnosis earlier than approving tokens for itemizing.

When investing in crypto, it’s major to have tokenomics to get told decisions and deal with a ways from getting rekt.

Tokenomics comes from combining the words token and economics and is a discipline that study the factors that force seek files from for tokens. One has to deal with in mind factors such as offer and seek files from, incentive mechanisms, designate accrual, and investor habits when analyzing a project’s tokenomics.

An Prognosis of Provide and Put a matter to

The dynamics between offer and seek files from are the first things to analyze when a project issues a brand original token.

An a ways extra than offer can negatively have an ticket on an asset’s designate. We are able to search out examples in fiat currencies that have suffered from hyperinflation and excessive printing (e.g., the Zimbabwean buck or the Venezuelan Bolivar).

The identical happens in crypto. You wouldn’t in fact feel huge if the working offer of the token you’ve apt provided is only 30%. Which technique the provision has yet to raise by one other 70%, most definitely diluting the designate and losing designate.

On this context, it’s major to clutch what Completely Diluted Valuation (FDV) is. FDV is the designate of a token multiplied by the complete quantity that might per chance ever be in existence, including tokens no longer yet in circulation. The metric is pale to measure if the token is overrated or undervalued.

If a project has a excessive FDV for the period of its early days, you need to must request your self who the foremost token holders are, at what designate they provided their baggage, and to whom they’re going to sell them.

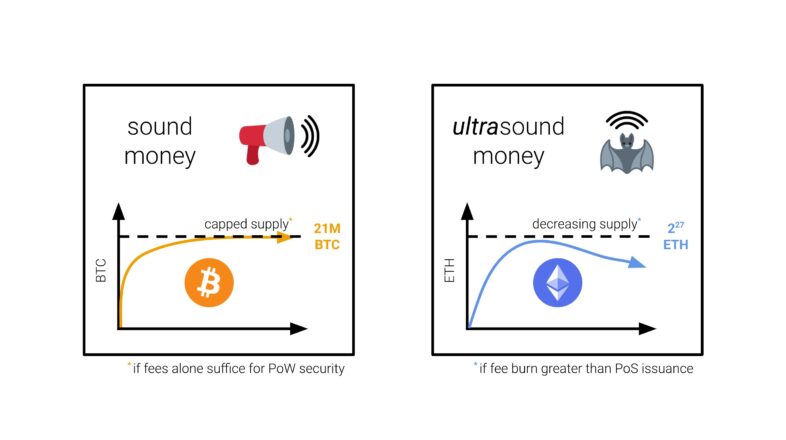

An uncapped offer is no longer any longer exact for the designate of a token either. Tokens love Bitcoin are enthralling capped, that technique that once the protocol has issued all its tokens, the designate will proceed rising as lengthy as there might per chance be seek files from.

To retain a balance between offer and seek files from, some tokens feature price-burning mechanisms that can motive the token to grow to be deflationary searching on how widely the network is pale. Ethereum, after the implementation of EIP 1559, is an example of this kind of mechanism.

Different tokens consist of buyback and burn mechanisms to designed to deal with watch over offer and seek files from. Such is the case for the BNB token.

Some other major ingredient to analyze is offer relative to market capitalization. If a token has a designate of $0.002 and its market cap is around $600,000, have you ever ever belief what the market cap would be if the designate increased to $0.50?

Misperceiving a token’s designate relative to its market cap can lead to unit bias. This term describes the conclusion that maintaining extra gadgets of a much less treasured coin will ship better funding results than maintaining a chunk of a highly valued coin. This is, in share, why meme coins had been so favorite in most up-to-date cases. Speak maintaining 10,000 dog coins vs. ⅕ of a BTC—one sounds better than the reasonably a pair of, however supplied that you just don’t hear to the costs.

On the reasonably a pair of aspect, we have seek files from. Put a matter to is what drives folk to determine on a token and how well-known they pay for it. Put a matter to is on the complete pushed by the token utility, increase in designate, and narratives.

Tokens love Ethereum or BNB score their utility from being pale as a currency to impress system on these networks. Whether it’s to approve a itemizing of an NFT series or eradicate away your tokens from a liquidity pool, you’ll need the native cryptocurrency of these blockchains to pay for so-called fuel (execution) expenses.

Some other exhaust case that might per chance increase token utility is when these sources are pale as a technique of exchange for merchandise and services and products within the right world, love a restaurant accepting crypto in exchange for menu gadgets.

Concerning designate accrual, staking is a trait of many tokens that fuels seek files from and helps raise the designate. When users stake their crypto procuring for rewards, many circulating tokens get locked, reducing sell rigidity.

Protocols purpose to search out ways to incentivize lengthy-term maintaining. We glimpse an example in veTokens (ve=vote escrow), a contrivance that presents voting energy to lengthy-term holders. DeFi protocols in total place votes to have interplay which swimming pools get basically the most rewards in an strive to plan liquidity. Your vote carries extra weight while you deal with a well-known quantity of a protocol’s governance tokens.

Some protocols even hump as a ways to penalize unstaking by striking off users’ veTokens to motive much less sell rigidity.

Lastly, tokens can raise in designate thanks to having solid narratives or memes. Speak the dog coin frenzies in October 2021. Many NFT projects came to existence as pure speculative memes with utility from their usage as profile pics.

With time, projects love JPEG’d are coming up with original ways to mix the arena of NFTs with DeFi rising their utility.

Whereas belief tokenomics is classic to belief funding decisions in crypto, it’s no longer the all-major ingredient. Narratives can additionally form pleasure or apathy towards a token, influencing its designate.

Phemex, undoubtedly among the leading cryptocurrency exchanges within the exchange, rigorously evaluates every token’s financial mannequin earlier than itemizing on the platform. To illustrate, the exchange affords excessive staking rewards from the actual aspects of an inventory of projects that have undergone deep tokenomics diagnosis. You might per chance per chance per chance presumably learn extra about these projects by visiting the Phemex Launchpool living.

The info on or accessed via this net living is got from self sustaining sources we predict about to be apt and reliable, however Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any data on or accessed via this net living. Decentral Media, Inc. is no longer any longer an funding advisor. We attain no longer give personalized funding advice or reasonably a pair of financial advice. The info on this net living is discipline to exchange with out gaze. Some or all the chase wager on this net living might per chance per chance per chance additionally simply grow to be outdated, or it could per chance be or grow to be incomplete or inaccurate. We might per chance per chance per chance additionally simply, however are no longer obligated to, exchange any outdated, incomplete, or inaccurate data.

You might per chance per chance per chance presumably additionally simply quiet never get an funding decision on an ICO, IEO, or reasonably a pair of funding in step with the chase wager on this net living, and that you just might per chance additionally simply quiet never interpret or in every other case rely upon any of the chase wager on this net living as funding advice. We strongly counsel that you just seek the advice of an licensed funding advisor or reasonably a pair of certified financial reliable while you are searching for funding advice on an ICO, IEO, or reasonably a pair of funding. We attain no longer settle for compensation in any produce for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

Behold stout phrases and prerequisites.

A Dive Into Fan Tokens

Fan tokens are utility tokens that sports activities golf equipment order and sell to additional mix fans into the membership. These tokens, which flee on the blockchain, are such as reasonably a pair of loyalty…

An Introduction To Staking in Crypto

Without reference to what stage of experience that you just might per chance have in crypto, there’s a possibility you’ve heard referring to the belief of staking. Comparable to a financial savings yarn or a bank certificates of…

An Overview of On-chain Metrics for Investing in Crypto

On-chain diagnosis (additionally called blockchain diagnosis) is an emerging discipline that obtains data about public blockchain job. Leveraging On-chain Knowledge For somebody unfamiliar with the technology, blockchains are public…