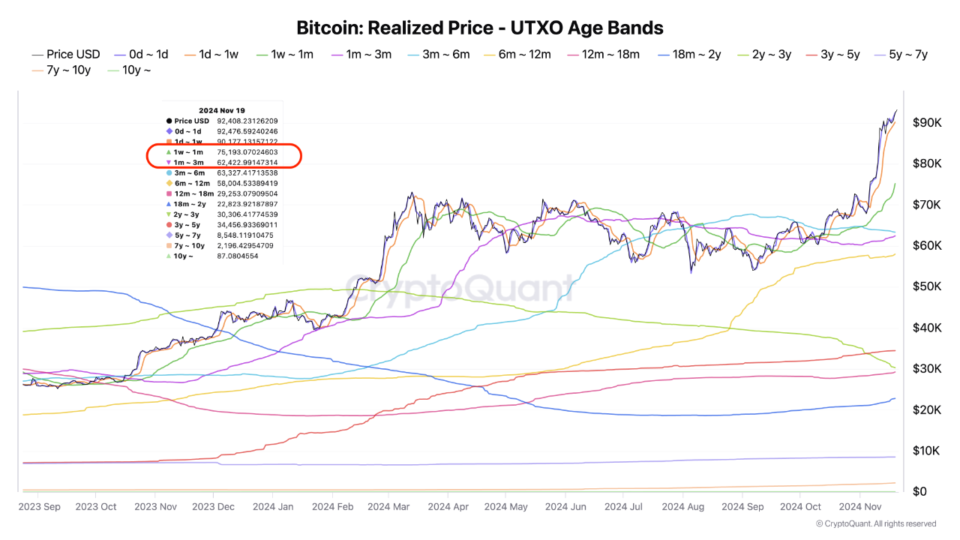

A recent diagnosis by CryptoQuant analyst tugbachain sheds gentle on a in actuality indispensable side of Bitcoin market behaviour — the UTXO Realized Mark Age Distribution.

This metric performs a well-known role in figuring out the retaining patterns of totally different investor groups and the market’s response to place fluctuations. The realized place, calculated because the Realized Cap divided by the entire offer, is pivotal for identifying place bases amongst long-time frame holders and up to the moment merchants.

According to tugbachain, the realized place stages for one-month and three-month sessions time and over again wait on as indispensable zones at some stage in bull market corrections.

These stages provide a lens in which market sentiment, especially amongst smaller investors, would possibly be analyzed, offering insights into the underlying dynamics that power buying for and selling exercise.

Key Support Levels For BTC

The analyst identifies two explicit realized place stages—$75,100 and $62,400—as key place bases for small investors. These stages are fundamental because they act as enhance zones at some stage in sessions of market volatility.

tugbachain famed that historically, when Bitcoin’s place checks these stages, it time and over again triggers buying for reactions, highlighting the psychological and financial affect of these place facets on smaller investors.

The CryptoQuant analyst also facets out that these enhance stages level to now not totally the patterns of small investors but additionally how their actions would possibly be influenced, or even manipulated, in a bull market. In bullish cycles, it’s customary for market dynamics to expand inconvenience amongst smaller investors, time and over again prompting apprehension selling.

tugbachain concluded noting:

Monitoring these stages closely can provide precious insights for making told investment choices.

Bitcoin Market Efficiency

Meanwhile, Bitcoin has factual renewed its all-time high (ATH). To this level BTC’s height stand at $94,784. Nonetheless, at the time of writing, the asset has retraced a tiny bit away from this height with a most contemporary buying and selling place of $94,523 albeit quiet up by 3.1% in yesterday.

While the asset has viewed consistent upward momentum in recent weeks, CryptoQuant has shared a charming diagnosis on whether it is time to sell or quiet defend BTC in a recent post on its legit X story. Citing well-known key metrics, CryptoQuant mentioned BTC’s MVRV ratio.

According to the on-chain recordsdata provider platform, historically, an MVRV ratio better than 3.7 means that Bitcoin has marked a market prime. Happily, most contemporary recordsdata shows BTC’s MVRV quiet stays below this level with a figure of two.62 as of November 19.

Bitcoin Hits ATH: Is It Time to Promote or Protect?

MVRV > 3.7 has historically marked market tops.

Stumble on these 4 extra key metrics to better perceive market timing and set extra told choices.

Crucial facets below 👇 pic.twitter.com/ewavOhofBR

— CryptoQuant.com (@cryptoquant_com) November 19, 2024

Featured image created with DALL-E, Chart from TradingView

Disclaimer: The recordsdata found on NewsBTC is for academic functions

totally. It would now not screech the opinions of NewsBTC on whether to buy, sell or defend any

investments and naturally investing carries dangers. That you can very effectively be told to conduct your contain

learn earlier than making any investment choices. Use recordsdata offered on this web procedure

totally at your contain pain.