Whereas all investing carries some chance, that doesn’t point out all chance is created equal. Learn the system to optimize your portfolio weighting for the best chance-adjusted returns the use of contemporary portfolio conception and the Sharpe ratio.

As much as the moment Portfolio Theory

To calculate the best crypto portfolio, we’re going to form basically the most of aspects of As much as the moment Portfolio Theory (MPT). The conception assumes that an investor is chance-averse and is asking to fetch the optimum ratio between theoretical good points and assumed chance. MPT does this by taking a batch of sources and calculating the best weighting for every the use of historical knowledge. From this level, we are in a position to adjust weightings to form bigger or decrease theoretical returns against the volatility of every asset.

Riskier investments ceaselessly absorb the aptitude for increased returns. Thus, contemporary portfolio conception seeks to assemble a weighted portfolio that finds the best theoretical returns for the least quantity of chance.

To illustrate, a portfolio weighting may per chance per chance presumably per chance yield a 90% return in accordance to historical knowledge but absorb an implied chance (as measured by volatility) of 0.8. One other weighting may per chance per chance presumably per chance consequence in most effective 70% returns but absorb a unheard of decrease chance, making it an even bigger chance-adjusted funding. This ratio between anticipated return and chance is more ceaselessly identified because the Sharpe ratio.

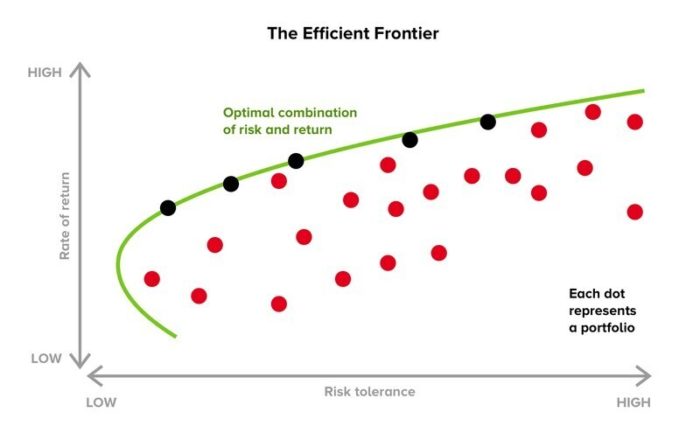

The upper an asset, or community of sources, the upper its theoretical returns are per unit of chance. By experimenting with varied asset weightings, we are in a position to fetch optimum portfolio compositions counting on how unheard of chance an investor is willing to salvage. We are in a position to use a Monte-Carlo system to generate an “efficient frontier” of portfolio compositions that maximizes chance-adjusted returns.

Every dot on the graph represents a hypothetical portfolio. Dots in shaded on the tip fringe of the location are phase of the efficient frontier. These portfolios absorb the best chance-adjusted returns, that arrangement that an investor is no longer taking on additional chance with out the chance of optimum returns.

The Sharpe Ratio and Crypto Portfolios

Whereas contemporary portfolio conception and the Sharpe ratio had been before all the pieces designed for use in dilapidated financial markets, investors can furthermore use them to optimize a crypto portfolio.

Alternatively, calculating an correct Sharpe ratio relies heavily on historical stamp knowledge. To generate a factual Sharpe ratio for portfolio allocation of a given crypto asset, we would prefer knowledge on its performance in the heart of a paunchy bull/endure cycle to assess its volatility and the next chance of retaining it.

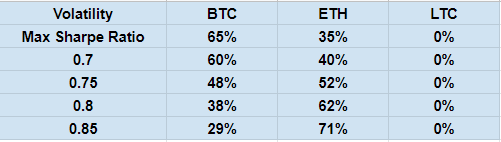

Sadly, the crypto narrate is both nascent and snappy-transferring, that arrangement that few sources with enough historical knowledge are eligible for consideration. This diagnosis will use a portfolio of Bitcoin, Ethereum, and Litecoin to display hide the best chance-adjusted returns as these sources absorb the best market capitalization with basically the most historical knowledge. The use of these three sources, the approximate perfect allocation for maximizing chance-adjusted returns comes out at 65% Bitcoin, 35% Ethereum, and zero% Litecoin.

Alternatively, transferring along the efficient frontier will teach efficient portfolios with higher chance-adjusted returns. Mainly, riskier portfolios on the frontier will substitute Bitcoin for Ethereum. Historical knowledge indicates that Ethereum can generate higher returns than Bitcoin but is furthermore more at chance of spacious drawdowns, rising its volatility and, attributable to this truth, the chance of retaining it.

Now we’ve examined how contemporary portfolio conception and the Sharpe Ratio can relieve us discontinue the best chance-adjusted returns, let’s peep at examples of low, medium, and high-chance portfolios.

Low-Risk

The lowest chance crypto portfolio with the best returns follows the efficient frontier as described beforehand. The use of most contemporary historical knowledge, low-chance investors can absorb to allocate spherical 65% to Bitcoin and 35% to Ethereum to assemble the safest portfolio with basically the most upside ability. Investors desirous to form bigger their chance-adjusted returns can are attempting allocating less to Bitcoin and more to Ethereum. At this level, all varied crypto sources are both too unsafe or absorb an identical chance profiles but worse historical returns than Bitcoin and Ethereum, such as Litecoin.

Medium-Risk

A medium-chance portfolio will calm use the efficient frontier to maximise chance-adjusted returns but moves far from a high Bitcoin allocation. 10% Bitcoin, 89% Ethereum, and presumably 1% Litecoin may per chance per chance presumably per chance be one technique to discontinue a medium-chance portfolio. The high percentage of Ethereum will form bigger theoretical returns but furthermore implied volatility. Additionally, a runt allocation of Litecoin may per chance per chance presumably simply relieve yield the next return in the priority the build it experiences significant upward stamp divergence.

High-Risk

This is the build issues win attention-grabbing. As mentioned beforehand, when calculating decrease-chance portfolios, we most effective must make use of sources that absorb stamp knowledge going lend a hand plenty of years. Alternatively, there is calm some merit to the Sharpe ratios for more moderen crypto sources, as long as we realize that doing so exposes an investor to plenty more chance.

For the next-chance portfolio, an investor can substitute an rising quantity of Ethereum for diverse crypto sources. To relieve name candidates for a high-chance allocation, we are in a position to peep on the one-one year Sharpe ratios of more than a few crypto sources and stumble on how they evaluation to Bitcoin and Ethereum.

When selecting riskier sources for a portfolio, anything with a Sharpe ratio higher than Bitcoin and Ethereum is a ability candidate. Correct throughout the tip 10 crypto sources by market capitalization, Solana and Terra absorb ratios of three.37 and 3.25, respectively, with Cardano coming in third at 2.85.

Because Solana, Terra, and Cardano absorb one-one year Sharpe ratios higher than Ethereum, they’ll also simply be factual riskier sources to purchase basically based fully purely on the historical knowledge. Alternatively, it is significant to present that varied components are significant when deciding whether to make investments in an asset. Issues such because the venture fundamentals, time since initiating, and whether or no longer the asset stamp seems to be to be overextended can absorb to all be conception of when selecting an funding.

Love earlier than, a portfolio will turn out to be riskier but potentially yield higher returns the more Ethereum is substituted for these more moderen, riskier sources.

Whether or no longer you’re searching to fetch the best low-chance allocation or willing to dive into some riskier bets, you’ll must fetch somewhere to originate your portfolio. This is the build Phemex comes in. You may per chance per chance presumably per chance presumably also non-public all the sources mentioned in this characteristic plus many more. Furthermore, the platform’s low payments and horny beef up providers form for a gargantuan selection. For these no longer ready to leap in simply but, Phemex gives simulated crypto trading the build customers can learn and take a look at varied trading suggestions, chance-free.

For more developed customers, Phemex gives perpetual contract trading on all crypto sources and inverse perpetuals on Bitcoin. By depositing and trading on Phemex, customers can originate as much as $100 and receive additional price discounts and bonuses by referring visitors. For more knowledge, verify out the reliable Phemex net dwelling.