Avalanche (AVAX) has essential relief bettering its losses on this volatile crypto market. When in contrast with various Layer-1 (L1) blockchains, AVAX consolidation would possibly per chance well moreover had been faster, raising considerations about its future performance.

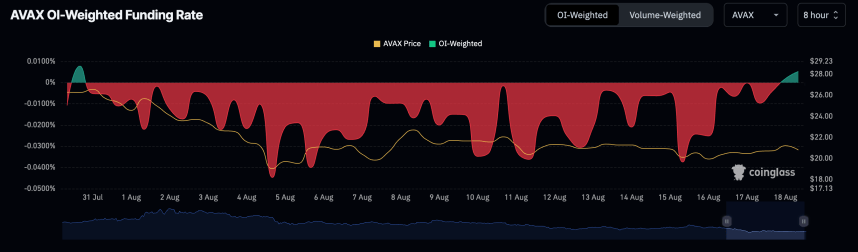

AVAX Funding Price Turns Determined

In step with Coinglass files, AVAX’s funding fee has flipped to certain territory, signaling a doable commerce in market dynamics.

A selected funding fee in futures procuring and selling in overall signifies elevated quiz for prolonged positions, as merchants are appealing to pay a top fee to withhold them. This bullish rigidity means that more merchants are having a wager on AVAX’s note rising quite than falling, a principal shift from the bearish sentiment that has dominated the market in contemporary weeks.

The most recent certain funding fee for AVAX signifies that bullish sentiment is gaining momentum, which can moreover foreshadow a breakout if bulls successfully push the worth above the essential $23 stage.

October 2023 Vs. August 2024: Avalanche AT A Turning Point?

Merchants hope a breakout above $22.79 will commerce the weekly bearish building, and some investors are having a ogle lend a hand to October 2023 for similarities.

Analysts be pleased Daghan on X await a reversal and possess in contrast the most recent market stipulations and folks in October 2023, appropriate earlier than Avalanche’s note skyrocketed from $8 to this three hundred and sixty five days’s high of $65 by March 18th.

In his comparability, Daghan explains the intensity of AVAX’s uptrends after prolonged and deep corrections, displaying how rapid its note strikes after it shifts from bearish to bullish.

At the 2nd, Avalanche is procuring and selling at $22.11 and have to ruin above this key resistance stage to issue the present zone around $22.79 and assign a contemporary greater high. If bulls can reclaim the $23 stage, it will moreover signal a broader market recovery for AVAX. Nonetheless, if the market fails to withhold above the August 5 low at $19.fifty three, there would possibly per chance be a possibility of a downside circulate, potentially retesting quiz below $17.50, with the next bearish aim at $15.

Because the funding fee indicators a conceivable shift in market sentiment, the approaching days shall be essential in figuring out whether or no longer AVAX can gash loose from its newest consolidation and resume its upward trajectory.

Duvet image from Unsplash, chart from Tradingview

Disclaimer: The easy process stumbled on on NewsBTC is for academic purposes

only. It does no longer signify the opinions of NewsBTC on whether or no longer to buy, promote or withhold any

investments and naturally investing carries dangers. You are informed to behavior your possess

analysis earlier than making any investment decisions. Exhaust knowledge supplied on this web space

fully at your possess possibility.