“Fed Peep” is a macro podcast, legal to bitcoin’s riot nature. In every episode, we ask mainstream and Bitcoin narratives by examining present events in macro from all the draw in which by the globe, with an emphasis on central banks and currencies.

Peep This Episode On YouTube Or Rumble

Hear To The Episode Right here:

In this episode, CK and I obtained the privilege to take a seat down down with David Lawant of Bitwise to focus on macro and its relation to bitcoin. We duvet Bitwise and Lawant’s defend on the present bitcoin market, imprint and ETF chance. On the macro facet, we duvet the U.Okay. emergency monetary coverage trade and China’s pivot on the Belt and Boulevard lending practices.

Bitcoin Market, Tag And ETF Scheme

We launch the podcast with talking about Bitwise and the usual narrate of the bitcoin market. Lawant describes why he is potentially the most bullish he has ever been on bitcoin.

As a leaping off level, we stare upon some charts. The first one is the each day chart and shows a give a boost to zone around $18,000 and the diagonal model line above the present imprint. This sample has been forming over a four-month timeframe, so when imprint breaks out of the downward sloping model, the switch must be slightly fleet.

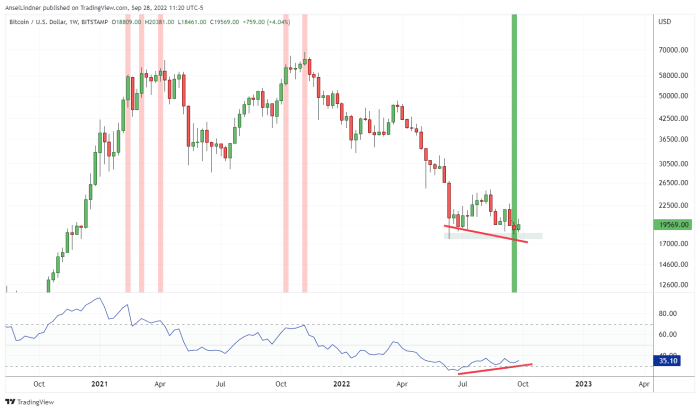

I temper the marginally bearish each day chart with the weekly chart beneath. As that you just may want to perceive, the fairway bar denotes a bullish weekly divergence. That is potentially the most important such divergence in the history of bitcoin! If imprint can shut the week above $18,810 the divergence shall be confirmed.

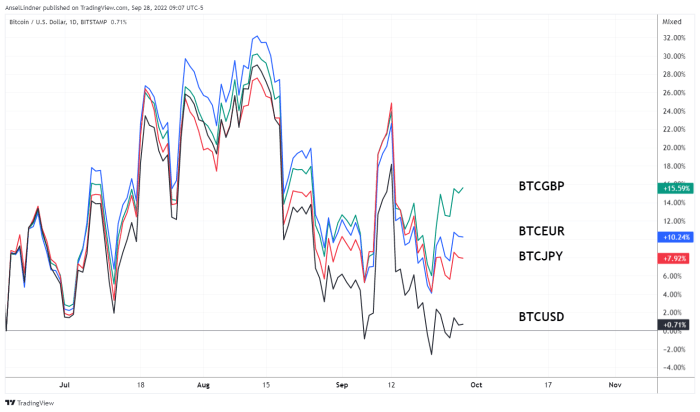

The following chart we stare upon at some level of our live plod is beneath. It shows the imprint motion of bitcoin since the June 2022 low in British pounds, euros, yen and bucks. It is an spell binding chart because bitcoin is performing each and each like a possibility-on asset, selling off in events of business disaster, and a possibility-off asset, performing simplest towards the worst currencies.

U.Okay. Emergency Monetary Protection Change

The mountainous information of the day that we duvet is the increasing downside in the U.Okay. Due to the a monetary emergency, the Bank of England restarted quantitative easing (QE) on Wednesday this week.

“In conserving with its monetary balance goal, the Bank of England stands ready to revive market functioning and decrease any risks from contagion to credit rating stipulations for U.Okay. households and companies.

“To discontinue this, the Bank will attain immediate purchases of prolonged-dated U.Okay. govt bonds from 28 September. The motive of these purchases shall be to revive neat market stipulations. The purchases shall be implemented on whatever scale is severe to achieve this final result.” — Bank of England

The attain of this emergency coverage announcement turn out to be quick. Underneath is the 30-one year U.Okay. govt bond, exhibiting a single day switch from 5.0% the total manner down to 4% — a large switch as the Bank of England addresses the acute monetary disaster. At the time of writing, this rate has stabilized at 4%.

The 30-one year gilt started the one year at barely over 1% yield, slowly making its manner greater until August 2022 when the downside turn out to be extra dire.

Our discussion covers many assorted points of the U.Okay. disaster, including whether or no longer here’s the launch of a world pivot from central banks. You’ll prefer to be all ears to hear Lawant’s and my predictions!

China’s Belt And Boulevard 2.0 Lending

The final topic we duvet this week is what the Chinese insiders are starting to name Belt and Boulevard 2.0. Leaders in the Chinese Communist Occasion indulge in started to cherish that the monetary philosophy guiding the Belt and Boulevard turn out to be sinful. They lent out $1 trillion in financing to projects that indulge in questionable profitability. Because it stands, 60% of recipient countries of Belt and Boulevard initiative loans are in monetary effort. In many cases, Chinese financiers are having a guess on the Worldwide Monetary Fund and Paris Membership loans to their debtors legal to receives a rate lend a hand. The overall thing is backfiring.

I indicate reading this text from the Wall Avenue Journal on the downside, and how China is making an try to clear up the topic.

The final thing I’ll level out on this topic is that the Chinese are selecting a time to trade their lending draw, appropriate when the sector is going staunch into a recession and these rising markets want the loans potentially the most. This can spell mountainous effort for countries that indulge in beforehand gotten closer to China and now depend on them bigger than the West for financing.

That is a customer post by Ansel Lindner. Opinions expressed are fully their very have and save no longer basically salvage these of BTC Inc. or Bitcoin Journal.