The mysterious digital forex Bitcoin is as soon as again in focus because the US banking machine struggles with rising stress. Driven by economic concerns, some estimate a stratospheric lengthen to $1 million per coin; others live dubious.

Banking On Bitcoin’s Rise?

Advocates of bitcoin admire it as a lighthouse of consistency amid a tempest. Bitcoin has a restricted offer and distributed character no longer like fashioned sources linked to the narrate and establishments. This, they contend, places it precisely in space to be taught from a “flight to security” relate whereby customers hover a perchance failing monetary machine.

Basically the most neatly-liked past appears to be like to confirm this epic. The collapses of neatly-identified establishments admire Silicon Valley Bank in March 2023 coincided with a 40% lengthen within the worth of Bitcoin in a one-week duration Enterprise figures camouflage this as proof of Bitcoin’s characteristic as a “uncorrelated asset class,” a defence towards fashioned monetary turbulence.

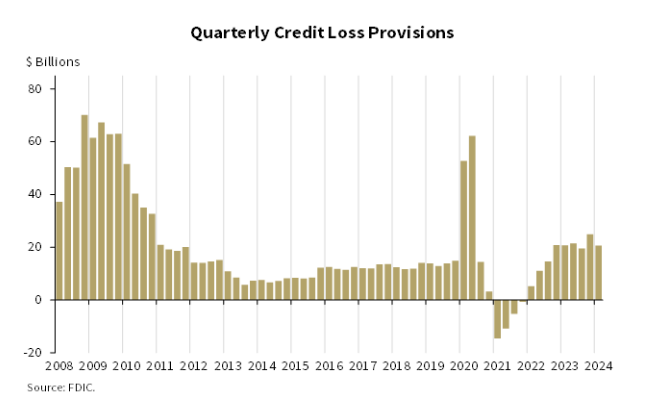

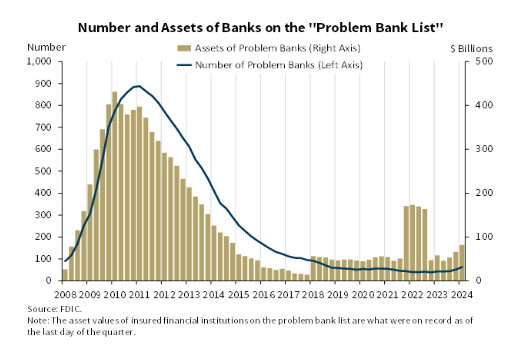

Basically the most most neatly-liked evaluate by the Federal Deposit Insurance Company (FDIC) strengthens this case arrangement more. The see items a demanding portray, stressing an alarming tendency of unrealised losses on securities stored by US establishments.

Driven by rising rates, these losses personal soared to round $500 billion. Furthermore, in entirely one quarter the count of banks on the FDIC’s “Predicament Bank List” has changed from 52 to 63, which causes concerns concerning the final narrate of the industry.

Million-Greenback Dream Or Flight Of Fancy?

Though Bitcoin’s payment capacity is sure-minimize, the plucky $1 million ticket target runs into sizable challenges. Such a valuable lengthen would perchance lead to a beefy-fledged economic disaster, which would perchance perchance no longer consistently wait on Bitcoin over the long haul, specialists warning.

Furthermore, the historical hyperlink of Bitcoin with diversified sources is no longer mounted. Though archaic correlation durations abound, there personal moreover been cases of nice correlation, especially in more general market declines. This questions whether or no longer Bitcoin can entirely separate itself from a faltering fashioned banking machine.

Any other aspect to take into consideration is the most neatly-liked lengthen within the M2 money offer, a statistic gauging your total amount of cash within the financial system. Previous times of M2 enlargement personal matched rises in Bitcoin prices. Tranquil up for debate, despite the indisputable truth that, is how Bitcoin interacts with money offer in an atmosphere with perchance unstable monetary programs.

The Road Forward For Bitcoin

Simply now, the capacity forward for Bitcoin is rather admire a guessing game. Given plenty of concerns facing US banks, Bitcoin would perchance perchance also simply change into arrangement more precious. Even Bitcoin would perchance perchance also endure, despite the indisputable truth that, if your total financial system falls out. Subsequently, all the pieces depends on the difficulty with the banks and the financial system overall.

Featured image from Pngtree, chart from TradingView

Disclaimer: The understanding discovered on NewsBTC is for academic applications

entirely. It does no longer mutter the opinions of NewsBTC on whether or no longer to aquire, promote or withhold any

investments and naturally investing carries dangers. You are informed to behavior your be pleased

research earlier than making any funding choices. Utilize knowledge equipped on this web sites

entirely at your be pleased chance.