As a Bitcoin trader, the hazards but additionally rewards are quite high, making it a spell binding endeavor for those willing to delve into the field of digital foreign money shopping and selling. Bitcoin’s unparalleled combination of volatility and doable for critical returns has captured the attention of merchants globally. On this complete recordsdata, we are able to explore alternate Bitcoin effectively, guaranteeing you is at possibility of be effectively-equipped with the understanding to navigate this dynamic market. From the basics of Bitcoin shopping and selling suggestions to figuring out the simplest platform to alternate Bitcoins, we are able to quilt it all.

What Is A Bitcoin Trader?

A Bitcoin trader is an particular individual who participates within the cryptocurrency market by shopping and promoting Bitcoin with the aim of making a earnings. Not like lengthy-term merchants who may perhaps perhaps possess resources for longer sessions, Bitcoin merchants usually engage in more frequent transactions. This may occasionally range from lengthy-term positions, the build they possess Bitcoin with the expectation of worth appreciation, to a temporary day-alternate, the build they capitalize on the market’s volatility.

Being a Bitcoin trader entails a deep understanding of the market traits, analysis of technical and foremost indicators, and an ability to originate suggested selections in step with most up to date market situations. Profitable Bitcoin merchants utilize a glorious deal of suggestions love day-shopping and selling, scalping, swing shopping and selling, and command shopping and selling, every requiring utterly different skill sets and ranges of market engagement.

Furthermore, being a Bitcoin trader technique staying up up to now with essentially the most up to date news and trends within the cryptocurrency world, as these can significantly affect market prices. Also, threat management is a critical aspect of shopping and selling Bitcoin, because the market is identified for its rapidly worth fluctuations.

Why Trade Bitcoin?

Trading Bitcoin has turn out to be increasingly more in model for a whole lot of compelling causes. On the foundation, Bitcoin provides distinctive volatility, which, while unsafe, provides unparalleled opportunities for gigantic profits. Secondly, Bitcoin operates 24/7, not like historic stock markets. This spherical-the-clock shopping and selling permits merchants to react straight to market news and global events.

One other reason to alternate Bitcoin is its doable for prime returns. Bitcoin has shown a excellent ability to amplify in cost over time, outperforming historic investments over the past better than 14 years (since inception). Traders who can skillfully navigate the market’s americaand downs stand to assemble significantly.

Bitcoin’s decentralized nature additionally provides a level of freedom from historic financial institutions. This independence from central banks and governments appeals to merchants who see picks to historic financial techniques.

Furthermore, the increasing mainstream acceptance and adoption of Bitcoin by big companies love MicroStrategy or financial service companies love BlackRock, Fidelity and Invesco bear added legitimacy to its shopping and selling. As more of us utilize and put money into Bitcoin, its market grows, offering more shopping and selling opportunities and liquidity.

How To Trade Bitcoin: The whole lot You Need To Know

Trading Bitcoin effectively requires a solid understanding of the market and a effectively-notion-out technique. The technique begins with constructing a shopping and selling memoir on a cryptocurrency substitute or platform. Once your memoir is determined up and funded, that you may maybe maybe originate up shopping and selling. Right here’s a in model overview:

- Market Diagnosis: Sooner than any alternate, it’s critical to review the market. This entails discovering out worth charts, understanding market traits, and conserving up-to-date with essentially the most up to date news that will affect Bitcoin’s worth.

- Picking A Trading Draw: Relying on your targets and threat tolerance, settle a shopping and selling technique that suits you simplest. This may occasionally be day shopping and selling, swing shopping and selling, scalping, or lengthy-term investing.

- Risk Management: Make a name on your threat tolerance and space discontinuance-loss orders to restrict doable losses. Effective threat management is key to sustainable shopping and selling.

- Executing Trades: Per your analysis and technique, buy or promote Bitcoin. This would be executed through market orders (buy/promote at most up to date worth) or restrict orders (buy/promote at a predetermined worth).

- Monitoring And Adjusting: Persistently video show the market and adjust your suggestions as critical. Bitcoin’s market can alternate all immediately, and suppleness every so often is a critical advantage.

- Discovering out And Evolving: Repeatedly be begin to discovering out. The Bitcoin market is continually evolving, and staying suggested is critical for a hit shopping and selling.

Bitcoin Trading Techniques

When it comes to shopping and selling Bitcoin, employing the factual technique is critical for achievement. Every trader’s design may perhaps perhaps vary in step with their threat plug for food, funding size, and shopping and selling targets. On this part, we’ll introduce a glorious deal of Bitcoin shopping and selling suggestions that are ceaselessly faded available within the market.

Day-Trade Bitcoin

Day-shopping and selling Bitcoin is a immediate-paced technique inquisitive about taking merit of Bitcoin’s temporary worth movements within a single shopping and selling day. It requires a deep understanding of market traits and the flexibility to like a flash make clear technical analysis, at the side of chart patterns and shopping and selling indicators.

Success in day shopping and selling hinges on suggested decision-making and educated-stage knowledge of chart patterns and technical indicators.. Effective threat management is key, with strict adherence to discontinuance-loss orders to mitigate doable losses. Day merchants need to additionally cease constantly suggested about market situations and news to originate effectively timed, suggested selections.

Bitcoin Scalping

Bitcoin scalping is a meticulous shopping and selling design the build merchants capitalize on minute worth fluctuations within the Bitcoin market. This technique entails making a glorious deal of trades over short sessions, in most cases correct a few minutes, to salvage diminutive but frequent profits.

Scalping demands an distinctive stage of market analysis, precision, and fast execution. Scalpers need to cease intensely focused, usually dedicating a whole lot of hours to monitoring market movements carefully. They rely carefully on technical analysis tools and exact-time recordsdata to establish a hit alternate opportunities, the utilize of utterly different scalping suggestions.

Due to the the high frequency of trades, managing costs and conserving a disciplined technique to lead away from critical losses is critical in Bitcoin scalping.

Swing Trading

Swing shopping and selling within the Bitcoin market entails preserving positions for a whole lot of days or weeks to capitalize on expected directional moves or worth ‘swings’. This technique requires a mix of foremost and technical analysis to foretell doable worth movements.

Swing merchants tackle bigger worth movements than day merchants, contemplating a more relaxed shopping and selling traipse. The key to success in swing shopping and selling is figuring out traits and momentum in Bitcoin’s worth, which usually entails understanding market sentiment and macroeconomic elements influencing the cryptocurrency market.

Bitcoin merchants who originate essentially the most of this technique may perhaps perhaps tranquil be affected person, as preserving positions for longer sessions can mean enduring some volatility. On the other hand, this technique can yield gigantic returns if market traits are accurately anticipated.

Bitcoin Discipline Trading

Discipline shopping and selling in Bitcoin is a lengthy-term technique the build merchants possess their positions for extended sessions, usually weeks, months, or even years. This design is much less regarding the temporary fluctuations and more regarding the lengthy-term boost doable of Bitcoin.

The Bitcoin merchants inferior their selections on intensive foremost analysis, inquisitive about elements love market traits, upcoming technological trends, and doable regulatory adjustments within the cryptocurrency landscape. Not like day shopping and selling or scalping, command shopping and selling requires much less time devoted to frequent market monitoring but demands an intensive understanding of the broader economic and technological elements affecting the market.

Persistence and a solid perception in Bitcoin’s lengthy-term doable are critical for command shopping and selling, because it entails weathering temporary market volatility with an peer on lengthy-term beneficial properties.

Step-By-Step Data: How To Trade Bitcoin

Trading Bitcoin can appear daunting on the foundation, but by following a structured design, that you may maybe maybe navigate the market effectively. Right here is a step-by-step recordsdata to permit you originate up your Bitcoin shopping and selling scramble:

- Educate Yourself: Sooner than diving into shopping and selling, it’s critical to familiarize your self with the basics of blockchain technology, Bitcoin, and its historical market traits.

- Settle A Official Trading Platform: Opt out a reputable Bitcoin substitute or shopping and selling platform. Gaze platforms with solid safety features, individual-friendly interfaces, and cheap costs. Take under consideration elements love liquidity, accessible shopping and selling pairs, and customer enhance.

- Set of abode Up And Stable Your Yarn: Plot your shopping and selling memoir. Be definite you utilize solid passwords and permit all accessible security capabilities love two-component authentication.

- Deposit Funds: Fund your memoir with fiat foreign money, which that you may maybe maybe then utilize to buy Bitcoin.

- Model A Trading Draw: Make a name on your shopping and selling model (day shopping and selling, swing shopping and selling, scalping, or command shopping and selling). Take under consideration your threat tolerance and space clear targets.

- Conduct Market Diagnosis: Use both technical and foremost analysis to enlighten your shopping and selling selections. No longer sleep up to now with essentially the most up to date Bitcoin news and market traits.

- Birth Trading: Birth with diminutive trades to salvage a in actuality feel for the market. That you just may maybe maybe both command market orders (buy/promote at most up to date prices) or restrict orders (buy/promote at a predetermined worth).

- Be conscious Your Trades And Take care of Risks: Assign a shut peer on your trades. Use threat management tools love discontinuance-loss orders to provide protection to your funding.

- Overview And Be taught: Generally review your shopping and selling exercise and be taught from both successes and mess ups. Adjust your suggestions and cease suggested about elements that will affect the Bitcoin worth.

How To Trade Bitcoin And Model Profit

Achieving profitability as a Bitcoin trader hinges on a nuanced understanding of market dynamics and disciplined technique execution. Success entails figuring out and capitalizing on Bitcoin’s worth movements, underpinned by a tough steal of market traits and drivers.

Key to profiting is the utility of evolved technical analysis, incorporating chart patterns and predictive indicators to gauge future worth movements. Furthermore, astute threat management, characterised by calculated command sizing and the actually apt utilize of discontinuance-loss orders, plays a pivotal role in safeguarding against market volatility.

Seasoned merchants usually emphasize the importance of emotional self-discipline, warding off impulsive selections pushed by market euphoria or apprehension.

How To Trade Bitcoins For Learners (Space Market)

For newby Bitcoin merchants, the gap market is an ultimate initiating level. In the gap market, merchants buy and promote Bitcoin for instantaneous shipping, reflecting exact-time supply and search recordsdata from. The instantaneous shopping and selling actions of merchants straight settle Bitcoin’s worth on this market. It provides an instantaneous and clear shopping and selling design, with transactions settled straight at prevailing market prices.

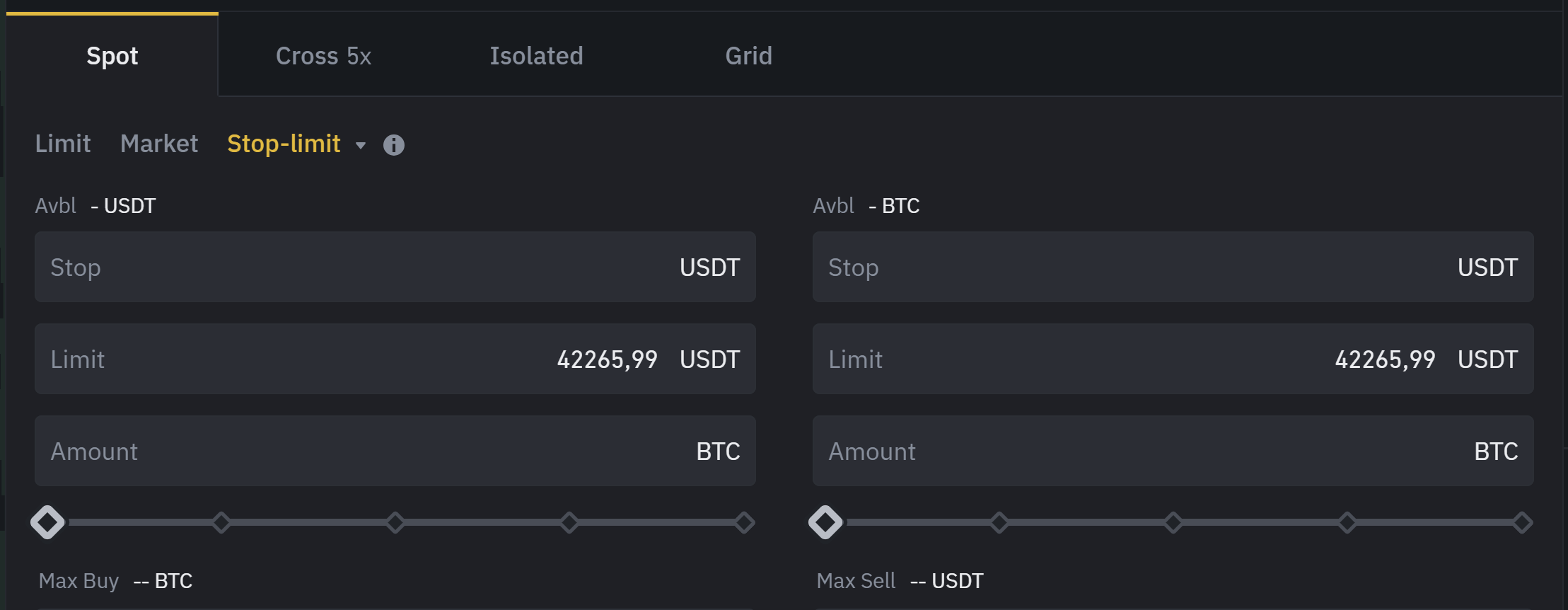

Forms Of Orders Outlined

- Market Orders: These orders are accomplished straight at essentially the most up to date market worth. As an illustration, if Bitcoin is listed at $30,000 and you command a market expose to buy, you’ll buy it on the closest accessible worth to $30,000.

- Limit Orders: These allow you to space a advise worth at which it’s top to buy or promote Bitcoin. For example, that you may maybe maybe command a restrict expose to buy Bitcoin when its worth drops to $28,000, guaranteeing you simplest buy at this worth or decrease.

- Quit Orders: Generally faded as a threat management tool, a discontinuance expose triggers a buy or promote action as soon as Bitcoin reaches a predetermined worth. As an illustration, atmosphere a discontinuance expose to promote at $27,000 can relieve restrict doable losses if the market drops.

How To Trade Bitcoins On The Space Market

Learners may perhaps perhaps tranquil opt shopping and selling platforms identified for his or her ease of utilize, tough security capabilities, and academic resources. Gaze platforms with a high reputation and low Bitcoin shopping and selling costs.

Navigating the expose book is at possibility of be critical. The expose book is a exact-time ledger of all buy and promote orders available within the market. It presentations the depth of the market, indicating how many orders exist at a glorious deal of worth ranges. Learners can utilize this to gauge market sentiment and doable worth circulate instructions.

Learners may perhaps perhaps tranquil originate up with diminutive investments to minimize doable losses. Definitely worth the volatility of the Bitcoin market and be willing for worth fluctuations. Use discontinuance-loss orders to robotically promote your Bitcoin if the worth falls to a definite stage, thus limiting your loss.

How To Trade Bitcoin Futures

Trading Bitcoin futures basically entails facing perpetual contracts, a optimistic selection of futures contract with out an expiry date. This allows merchants to possess positions indefinitely, offering more flexibility in contrast to historic futures. Right here’s a recordsdata on alternate Bitcoin futures:

- Notion Perpetual Contracts: Perpetual futures contracts, not like historic futures, salvage not bear any expiration date, enabling merchants to possess positions indefinitely. This indefinite preserving length is counterbalanced by the funding charge mechanism.

- Leverage In Depth: Leverage permits merchants to abet a watch on big positions with a barely diminutive amount of capital. For example, with 10x leverage, that you may maybe maybe abet a watch on a command worth 10 cases your initial margin. While this may magnify profits, it additionally amplifies doable losses, making threat management critical.

- Mechanics Of Liquidation: Liquidation occurs when your non-public home’s cost falls to a stage the build it’ll no longer enhance the leveraged amount. As an illustration, in a extremely leveraged command, even a diminutive descend in Bitcoin’s worth can trigger liquidation, ensuing within the lack of your initial margin. It’s vital to realize the substitute’s liquidation job and margin requirements.

- Deciding on The Handsome Trade: Settle an substitute that offers complete capabilities for shopping and selling perpetual Bitcoin futures (e. G. Binance, BitMEX or Bitget), at the side of clear liquidation protocols, competitive funding rates, and tough platform security.

- Risk Management: Given the high risks related to leverage, employing efficient threat management suggestions is critical. Use discontinuance-loss orders to provide protection to your positions, and steal into consideration decrease leverage ranges to diminish the threat of liquidation.

How To Trade Bitcoin Alternatives

Bitcoin alternatives are financial derivatives that give the holder the factual, but not the duty, to buy or promote Bitcoin at a predetermined worth sooner than a definite expiration date. Right here’s a recordsdata on alternate Bitcoin alternatives:

Alternatives Forms: Definitely worth the two sorts of alternatives – ‘Call alternatives’ allow shopping Bitcoin at a advise worth, while ‘Put alternatives’ allow promoting it at a space worth.

- Strike Value And Expiration Date: Every likelihood has a strike worth and an expiration date. The strike worth determines the worth at which Bitcoin is at possibility of be bought or equipped, while the expiration date marks when the likelihood turns into void.

- Opt out A Trading Platform: Settle a platform that offers Bitcoin alternatives shopping and selling (Deribit is the largest). Be definite it provides ample security, liquidity, and tools for analysis.

- Premiums: Alternatives are bought for a top charge, which is the worth paid for the likelihood itself. The highest charge varies in step with elements love the strike worth, most up to date Bitcoin worth, and time except expiration.

- Market Diagnosis: Such as futures, shopping and selling alternatives requires an intensive analysis of the market. Predict whether Bitcoin’s worth will race up or down sooner than the likelihood expires.

- Risk Evaluate: Alternatives is at possibility of be much less unsafe than futures because the utmost doable loss is the highest charge paid. On the other hand, it’s tranquil critical to realize the volatility of the market and to make utilize of threat management suggestions.

- Strategic Use: Alternatives is at possibility of be faded for a glorious deal of suggestions, from straightforward speculation to advanced combos love spreads, straddles, and collars for threat management.

Picking The Most animated Platform To Trade Bitcoins

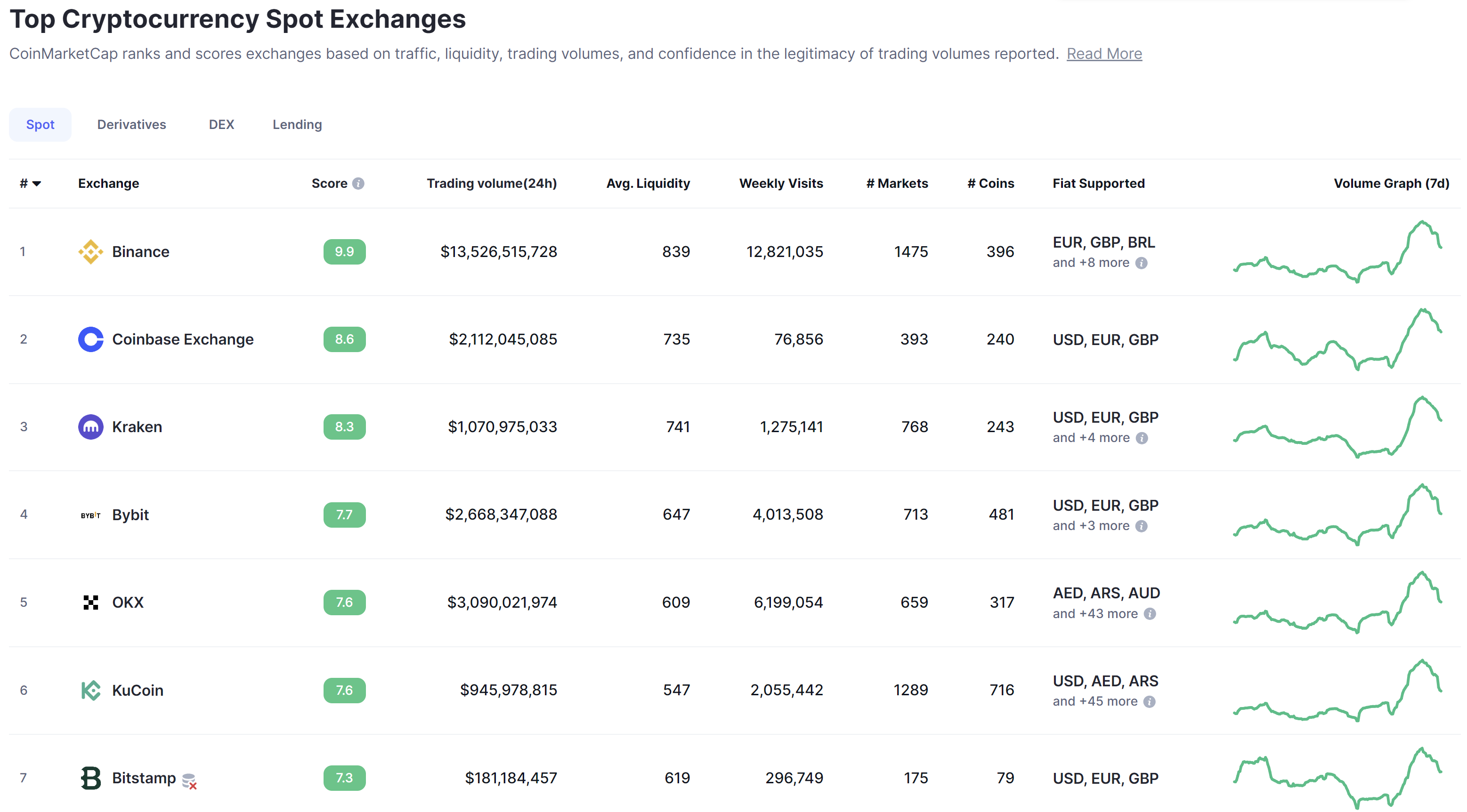

Picking the glorious platform to alternate Bitcoins requires inquisitive just a few great deal of issues equivalent to security, individual interface, costs, liquidity, and accessible capabilities. Per essentially the most up to date recordsdata from CoinMarketCap regarding space shopping and selling volume, listed right here are among the terminate cryptocurrency exchanges:

- Binance: Known for its high shopping and selling volume and intensive list of accessible cryptocurrencies, Binance provides a tough platform with competitive costs and solid safety features. It supports more than one fiat currencies love EUR, GBP, and BRL.

- Coinbase: Current in particular within the US, Coinbase is identified for its individual-friendly interface and solid regulatory compliance. It supports vital fiat currencies equivalent to USD, EUR, and GBP, making it a helpful likelihood for merchants in those areas.

- Kraken: Kraken is identified for its complete security capabilities and range of supported cryptocurrencies. It additionally supports more than one fiat currencies at the side of USD, EUR, and GBP, and is identified for its detailed and informative individual interface.

- Bybit: This substitute is notorious for its evolved shopping and selling capabilities and is a current replacement for derivative shopping and selling. Bybit supports more than one fiat currencies at the side of USD, EUR, GBP, amongst others.

- OKX: OKX provides a giant range of cryptocurrencies and is identified for its evolved shopping and selling capabilities. It supports a diversity of fiat currencies at the side of AED, ARS, AUD, and more, catering to a world individual inferior.

- KuCoin: KuCoin is identified for its giant need of supported cryptocurrencies and individual-friendly interface. It supports more than one fiat currencies at the side of USD, AED, ARS, and more, making it a flexible replacement for global merchants.

The build To Trade Bitcoin? Key Requirements

Deciding on the factual platform is a critical step on your Bitcoin shopping and selling scramble. The most animated platform for shopping and selling Bitcoins not simplest aligns along with your shopping and selling model and targets but additionally provides security, performance, and reliability. Right here are key elements to steal into consideration when selecting your shopping and selling platform:

- Security: The platform’s security capabilities must be given prime precedence. Gaze platforms with a solid track document of security, the utilize of measures love two-component authentication, encryption, and cold storage of funds.

- User Interface And Abilities: The platform may perhaps perhaps tranquil provide a individual-friendly interface, in particular for newbies. It must be intuitive, with straightforward-to-utilize shopping and selling tools and accessible customer enhance.

- Prices And Prices: Definitely worth the cost structure of the platform. This involves shopping and selling costs, withdrawal costs, and any other hidden prices. Lower costs can significantly affect your general profitability, in particular while you happen to is at possibility of be sexy in frequent trades.

- Liquidity: Excessive liquidity is critical for executing trades like a flash and at trim prices. A platform with a high shopping and selling volume usually provides better liquidity, ensuing in tighter spreads and more environment friendly alternate execution.

- Range Of Ingredients And Tools: Gaze platforms that provide a range of capabilities equivalent to evolved charting tools, a diversity of expose sorts, and threat management tools.

- Leverage and Margin Trading Alternatives: Have to you is at possibility of be in shopping and selling with leverage, take a look at the accessible leverage alternatives on the platform. Endure in mind that shopping and selling with leverage carries greater risks.

- Regulatory Compliance: Settle platforms that are compliant with related regulatory standards on your nation. This compliance can present an further layer of security and legitimacy.

- Market Diversity: A correct platform may perhaps perhaps tranquil provide a diversity of markets, not correct Bitcoin.

How To Trade Bitcoin? Key Indicators

Profitable Bitcoin shopping and selling usually hinges on the utilize of key indicators to originate suggested selections. These indicators present insights into market traits and doable future movements. Right here are some critical indicators faded in Bitcoin shopping and selling:

- Provocative Averages: They tender out worth recordsdata over a specified timeframe, aiding merchants in figuring out the boost route. The most frequently faded are the Easy Provocative Moderate (SMA) and the Exponential Provocative Moderate (EMA).

- Relative Strength Index (RSI): RSI is a momentum indicator that measures the charge and alternate of worth movements. It helps establish overbought or oversold situations available within the market.

- MACD (Provocative Moderate Convergence Divergence): This tool identifies doable buy and promote signals by monitoring the convergence and divergence of temporary and lengthy-term exciting averages.

- Quantity: The alternate volume of Bitcoin is a critical indicator of market strength and sentiment. Excessive volumes usually signal a solid market hobby, both bullish or bearish.

- Bollinger Bands: These bands present a graphical representation of market volatility. Narrowing bands counsel low market volatility, while widening bands show increased volatility.

- Fibonacci Retracement: This tool identifies doable enhance and resistance ranges the utilize of Fibonacci ratios derived from worth adjustments.

- Stochastic Oscillator: This momentum indicator compares the closing worth of Bitcoin to its budget over a definite length, aiding in figuring out doable reversal aspects.

Trade Bitcoin With On-Chain-Indicators

To boot to historic technical indicators, on-chain indicators advise to Bitcoin present deep insights into the underlying blockchain dynamics, helping merchants originate suggested selections. Glassnode, a number one blockchain recordsdata and intelligence platform, highlights a whole lot of key on-chain indicators:

- Bitcoin Community Hash Charge: Indicates the effectively being and security of the blockchain. A rising hash charge suggests increased network security and miner self assurance.

- Moving Addresses: The sequence of unparalleled addresses actively transacting on the network. A growing sequence of entertaining addresses may perhaps perhaps show increased individual adoption and network exercise.

- P.c Of Total Offer In Profit: Watching the availability distribution, in particular at some stage in undergo markets, can signal a gigantic-scale supply redistribution. It indicates when the p.c of supply in earnings for more moderen merchants surpasses that of lengthy-term holders.

- Realized Profit/Loss Ratio: It tracks whether the aggregate volume of realized profits exceeds that of realized losses. When the 30-day SMA of this ratio returns above 1.0, it indicates a macro boost shift towards a hit on-chain volume.

- aSOPR (Adjusted Spent Output Profit Ratio): This indicator, in particular its 90-day SMA, helps establish a hit on-chain spending, indicating broader market profitability.

Combining these on-chain indicators with historic technical tools provides a complete technique to shopping and selling Bitcoin, permitting merchants to salvage insights from both market sentiment and foremost blockchain recordsdata.

Trade Bitcoin: Risks And Rewards

Trading Bitcoin, love every financial challenge, comes with its bear space of risks and rewards. Notion and balancing these aspects is critical for a hit shopping and selling.

Managing Risks As Bitcoin Trader

- Volatility: Bitcoin’s worth is at possibility of be extraordinarily volatile, ensuing in rapidly and critical worth adjustments. Managing this threat entails atmosphere discontinuance-loss orders, not overleveraging, and simplest investing funds that you may maybe maybe come up with the cash for to lose.

- Security Risks: The digital nature of Bitcoin makes it inclined to hacking and fraud. Use stable shopping and selling platforms, allow two-component authentication, and apply safe storage.

- Regulatory Adjustments: Bitcoin’s factual situation varies by nation and is enviornment to altering guidelines, which is able to affect its cost and legality of shopping and selling.

- Market Data: Lack of technology of the Bitcoin market can lead to unhappy shopping and selling selections. Continuous discovering out and staying up up to now with market traits is key.

The Reward Potential In Bitcoin Trade

- Excessive Return Potential: Bitcoin has viewed sessions of powerful worth will enhance, offering high return doable for savvy merchants.

- Market Accessibility: Bitcoin shopping and selling is accessible 24/7, offering flexibility and real opportunities for merchants worldwide.

- Modern Market: Being part of the Bitcoin market technique sexy with reducing-edge blockchain technology, which has the aptitude to present contemporary shopping and selling opportunities and reshape financial techniques.

- Diversification: Bitcoin provides an replacement funding likelihood, which every so often is a part of a diversified funding portfolio.

How To Day Trade Bitcoin?

Day shopping and selling Bitcoin entails executing temporary trades to capitalize on worth fluctuations within a single day. It requires an intensive understanding of market traits, technical analysis, and disciplined threat management.

How To Trade Bitcoin and Model Profit?

Profitable Bitcoin shopping and selling entails a deep understanding of market traits, the utilize of efficient shopping and selling suggestions, and employing tough threat management to mitigate risks while capitalizing on market opportunities.

The build To Trade Bitcoin?

Bitcoin is at possibility of be traded on a glorious deal of cryptocurrency exchanges and platforms. Current exchanges consist of Binance, Coinbase, Kraken, Bybit, OKX, and KuCoin.

How Manufacture You Trade In Bitcoins?

Trading in Bitcoins entails shopping and promoting on a cryptocurrency substitute, the utilize of utterly different shopping and selling suggestions love day shopping and selling, swing shopping and selling, or command shopping and selling.

Can You Day Trade Bitcoin?

Yes, that you may maybe maybe day alternate Bitcoin. It entails making more than one trades within a single day, taking merit of Bitcoin’s worth volatility.

How To Trade Bitcoins?

Trading Bitcoins entails selecting a legitimate shopping and selling platform, examining the market, executing trades in step along with your technique, and managing your risks.

How To Trade In Bitcoin?

To alternate in Bitcoin, space up an memoir on a cryptocurrency substitute, deposit funds, settle on a shopping and selling technique, and originate executing buy or promote orders in step with market analysis.

How To Trade Bitcoin Alternatives?

Trading Bitcoin alternatives entails shopping or promoting alternatives contracts on Bitcoin, predicting future worth movements. It requires understanding of alternatives shopping and selling and market analysis.

How To Trade Bitcoins For Money?

That you just may maybe maybe alternate Bitcoins for cash by shopping and promoting your Bitcoin on a cryptocurrency substitute.

How Manufacture You Trade Bitcoin?

Trading Bitcoin entails examining the market, constructing a alternate on a cryptocurrency substitute, and managing the alternate with correct threat management tactics.

How To Trade Bitcoin Futures?

Bitcoin futures shopping and selling entails coming into contracts to buy or promote Bitcoin at a future date at a predetermined worth. It requires knowledge of futures markets and threat management.

Trade Bitcoins For Learners?

Learners may perhaps perhaps tranquil originate up by understanding the basics of Bitcoin, selecting a individual-friendly shopping and selling platform, practising with diminutive quantities, and the utilize of easy shopping and selling suggestions on the gap market.

How To Trade Bitcoins For Profit?

To alternate Bitcoins for earnings, put in power a effectively-researched shopping and selling technique. You additionally want to rearrange risks effectively, and cease suggested about market traits and news.

How To Trade Bitcoins Online?

Trading Bitcoins online entails registering on a cryptocurrency substitute, depositing funds, conducting market analysis, and executing trades during the platform’s interface.

How To Trade Bitcoins To Model Money?

To originate cash shopping and selling Bitcoins, model a solid shopping and selling technique, originate essentially the most of technical analysis, put together risks wisely, and cease adaptive to market adjustments.

Featured advise from Shutterstock

Disclaimer: The article is equipped for academic functions simplest. It does not portray the opinions of NewsBTC on whether to buy, promote or possess any investments and naturally investing carries risks. You are instructed to habits your bear review sooner than making any funding selections. Use knowledge equipped on this web web assert online entirely at your bear threat.