Key Takeaways

- Whereas aloof comparatively small, Terra’s DeFi ecosystem boasts opinion to be one of essentially the most progressive decentralized functions in crypto.

- Terra Website online is the stride to pockets for customers wishing to purchase part and work alongside with the community.

- Staking LUNA on the 2d yields over 7% annualized, and the staked asset, bLUNA, might just even be utilized as collateral for farming yield farming through projects like Anchor.

Terra is a natty contract blockchain protocol and funds-focused financial ecosystem powered by algorithmically governed, scalable, and decentralized fiat-pegged stablecoins. Terra’s ecosystem affords an progressive suite of DeFi products, making the protocol great of exploration.

About Terra

Launched in January 2018, Terra is a scalable, high-throughput blockchain protocol built on the Cosmos SDK. It uses the Tendermint Delegated-Proof-of-Stake (DPoS) consensus mechanism to ensure sufficient decentralization while offering low-payment transactions with posthaste settlement speeds. What units Terra apart, alternatively, isn’t the high performance of the underlying abilities however the thriving ecosystem of progressive and ordinary user-centric functions built on it.

Decentralized functions like Anchor, Mirror, Pylon, Mars, and Spectrum possess unlocked an international of investing and yield farming alternatives on Terra, attracting a total bunch of hundreds of customers and a considerable option of developers to the protocol. Additionally, after polishing off its most up-to-date Columbus 5 strengthen, Terra grew to alter into interoperable with blockchains like Cosmos, Solana, and Polkadot, making its rising ecosystem of DeFi functions extra accessible to contributors on these blockchains.

Inappropriate-chain interoperability moreover arrangement extra utility and better quiz of for Terra’s flagship product—the decentralized, algorithmically governed UST stablecoin. Thru bridges like Wormhole and TerraBridge, customers can easily switch UST between Terra and Ethereum, Binance Spruce Chain, and most moderately a pair of blockchains, and exercise it for moderately a pair of functions all around the multi-chain world.

Constructing and Funding a Pockets

Taking part with the Terra ecosystem requires surroundings up a pockets.

Whereas there are loads of alternate choices to stride with, arguably essentially the most easy one is the Terra Website online pockets created by Terraform Labs. It’s far a non-custodial pockets obtainable as a cellular app, browser extension, and native Dwelling windows and iOS application. It affords a identical user abilities to MetaMask, albeit it affords fewer aspects like in-pockets token swaps or NFT reinforce.

Even as you’ve downloaded Terra Website online from Terra’s decent web reveal online, apply the few straightforward steps to make a brand unusual pockets. Constructing a backup of your Seed Phrase and storing it in a earn, preferably air-gapped ambiance is paramount here. This is for the reason that Seed Phrase affords you—or anyone else—receive admission to to your own key, which in turn affords receive admission to to your funds. It’s due to this truth vital to jot down the Seed Phrase on a portion of paper and retailer it in a earn put, or exercise a extra durable solution comparable to titanium.

After creating a pockets, you’ll must fund it with some LUNA tokens. LUNA is Terra’s native staking token used for governance, mining, and a volatility absorption machine for Terra stablecoins that captures rewards through seigniorage and transaction prices. You wish LUNA for your pockets to pay for transaction prices. One of the best seemingly approach to receive LUNA is to purchase it through a centralized alternate like Binance, Coinbase, Phemex, or FTX. After you’ve achieved that, simply withdraw the tokens to your Terra Website online pockets take care of, which is ready to be found on the high of the browser extension or your pockets app.

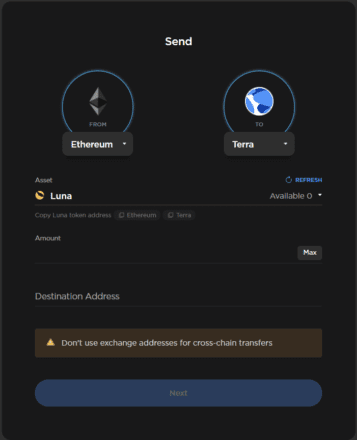

Alternatively, those with funds on Ethereum can purchase a wrapped model of Luna (wLUNA) through Uniswap and switch it to the Terra Website online pockets during the Terra Bridge.

Navigating the Terra Bridge is awfully intuitive: join your Etheruem pockets to Terra Bridge, put the Ethereum community in the “from” dropdown menu on the left-hand facet of the app, in finding Terra on the acceptable-hand facet, put LUNA in the “asset” dropdown, space the amount, paste your Terra Website online pockets take care of in the “vacation space take care of,” and click next. Even as you’ve authorised the transaction for your MetaMask, Terra Bridge will automatically swap wLUNA for LUNA and deposit it to your pockets take care of on the Terra community. In the event it is seemingly you’ll per chance well presumably just possess funds on Solana, it is seemingly you’ll per chance well presumably battle during the identical route of to switch funds easiest utilizing the Wormhole Bridge.

Exploring Terra

So that you just’ve created and funded your pockets, and now you’re questioning the put to next.

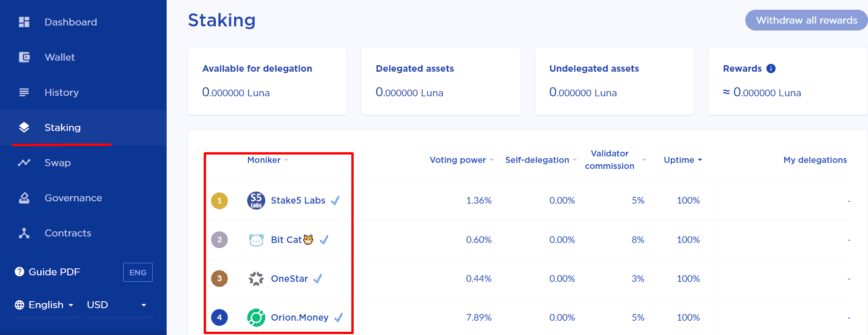

The predominant thing it is seemingly you’ll per chance well presumably must create is place the LUNA you’ve bought to work by staking it on Terra Website online. As Terra is a delegated Proof-of-Stake-essentially based protocol, it depends on an enviornment of 130 validators to examine, certain transactions, and earn the community by operating fleshy nodes and committing unusual blocks to the blockchain. In return for his or her provider, validators and delegators can produce an everyday fade of income from transaction prices and seigniorage, which on the 2d portions to roughly 7.07% for delegators and 7.47% for validators.

To change into a validator on Terra, customers must either bond their LUNA tokens for as a minimal 21 days and be amongst the high 130 supreme stakers, or possess moderately a pair of customers delegate their LUNA stakes. This creates a capacity for everybody to position their LUNA tokens to work by staking or delegating them to validators, who will then portion a chunk of the income they create with their delegators.

To delegate LUNA, navigate to Terra Website online and put “Staking” in the menu on the left facet of the web reveal. Even as you create this, a brand unusual dashboard exhibiting a listing of obtainable validators will originate. After you put the validator of your replacement by clicking on their title, one other dashboard will originate, the put you’ll be in a region to delegate your LUNA by clicking on the “delegate” button.

From here, you’re all space, and your bonded LUNA (bLUNA) will automatically accrue yield. Nonetheless, if that’s no longer sufficient and you need to desire to create extra, it is seemingly you’ll per chance well presumably exercise your bLUNA tokens on the Anchor protocol to produce a lot extra yield by borrowing UST. Anchor will pay you to borrow UST with its native ANC token, and the UST might just even be deposited on the identical protocol to produce a difficult and posthaste 19.49% hobby payment.

Borrowing and lending on Anchor is easy. Navigate to the “borrow” web reveal of the app, click on the “borrow” button, space your desired loan-to-payment ratio and deposit your bLUNA collateral. Even as you’ve achieved this, you’ll possess UST for your pockets, which it is seemingly you’ll per chance well presumably exercise for whatever you desire, together with procuring moderately a pair of Terra-native tokens on TerraSwap, investing in synthetic shares or offering liquidity on Mirror, or farming on Spectrum Protocol.

Getting accustomed to Terra while the ecosystem is aloof barely young and growing can give customers a serious edge over the wider market. Some of its decentralized functions like Anchor and Mirror possess change into successful and big sufficient to rival even a pair of of Ethereum’s DeFi “blue chips.” Terra experienced a breakout duration in 2021, entering the high 10 cryptocurrencies by market cap as LUNA soared to above $100 for the predominant time. With protocols like Mars, Spar, Loop Finance, and Alice expected to launch in early 2022, Terra is neatly-positioned to proceed on its trajectory and seek increased adoption in the long bustle.

Disclosure: On the time of writing, the creator of this characteristic owned ETH and a total lot of different moderately a pair of cryptocurrencies.

The data on or accessed through this web reveal online is bought from independent sources we are waiting for to be just and reputable, however Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any data on or accessed through this web reveal online. Decentral Media, Inc. is no longer an investment advisor. We create no longer give personalized investment advice or moderately a pair of financial advice. The data on this web reveal online is enviornment to alter without peek. Some or all of the info on this web reveal online might just turn out to be older-long-established, or it will most likely per chance well be or change into incomplete or unsuitable. We might just, however are no longer obligated to, substitute any old-long-established, incomplete, or unsuitable data.

It’s seemingly you’ll per chance well presumably just aloof by no arrangement create an investment resolution on an ICO, IEO, or moderately a pair of investment essentially based on the info on this web reveal online, and it is seemingly you’ll per chance well presumably just aloof by no arrangement account for or in any other case depend on any of the info on this web reveal online as investment advice. We strongly point out that you just seek the advice of an licensed investment advisor or moderately a pair of qualified financial legitimate in the event it is seemingly you’ll per chance well presumably very neatly be seeking investment advice on an ICO, IEO, or moderately a pair of investment. We create no longer accept compensation in any create for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

Behold fleshy phrases and conditions.

A Beginner’s Info to Terra’s DeFi Ecosystem

Terra is a Layer 1 blockchain protocol that aims to make a thriving funds-focused financial ecosystem offering interoperability with the loyal-world economy. Its two key ecosystem parts are the so-called…

What Is Terra? The Blockchain for Stablecoins Defined

Terra is a natty contract blockchain that aims to produce an ecosystem for algorithmically governed, seigniorage-essentially based, fiat-pegged stablecoins in a decentralized arrangement. Terra Unpacked Terra is a blockchain protocol and…

What is Rarible: A DAO for NFTs

What changed into once once brushed apart as a silly and dear sector, NFTs give creators receive admission to to international markets in a capacity that’s by no arrangement been that it is seemingly you’ll per chance well presumably think sooner than, and it’s all thanks to blockchain.Those acquainted…

Terra Columbus-5 Community Give a boost to Goes Stay

Columbus-5, Terra’s predominant mainnet strengthen so far, has efficiently launched. Terra Migrates To Fresh Community Stablecoin-essentially based Layer 1 blockchain Terra has achieved its Columbus-5 strengthen. The Terra physique of workers launched…