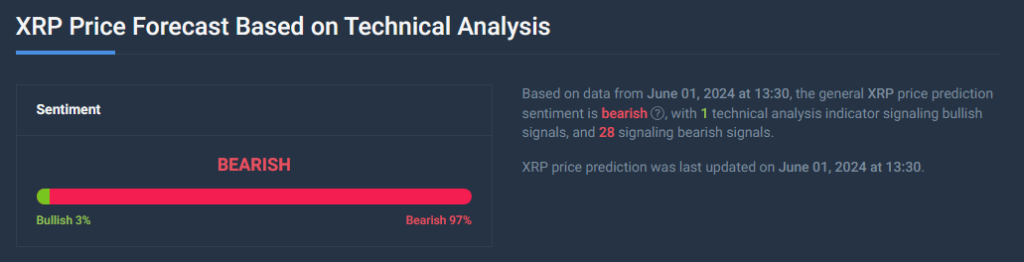

Crypto investors are maintaining a shut behold on Ripple (XRP) as technical indicators paint a touching on image for the altcoin’s designate. After closing under its 20-day exponential shifting moderate (EMA) for four consecutive days, XRP has entered what many analysts define as a bearish zone.

This technical indicator suggests a ability shift in market sentiment, with the frequent designate of XRP over the final 20 days acting as a resistance degree. With the present designate buying and selling under this key benchmark, analysts terror a decline in save a question to would be forthcoming.

At the time of writing, XRP became buying and selling at $0.52, down 0.3% and 3.1% within the final 24 hours and 7 days, respectively, recordsdata from Coingecko reveals.

Seek recordsdata from For XRP Loses Steam

Adding gas to the bearish fire are XRP’s momentum indicators, which offer insights into the energy and route of designate movements. Both the Relative Power Index (RSI) and Cash Float Index (MFI) are for the time being positioned under their unbiased substances. This implies that buying for stress leisurely XRP is waning, with investors potentially having a stumble on to dump their holdings comparatively than fetch more.

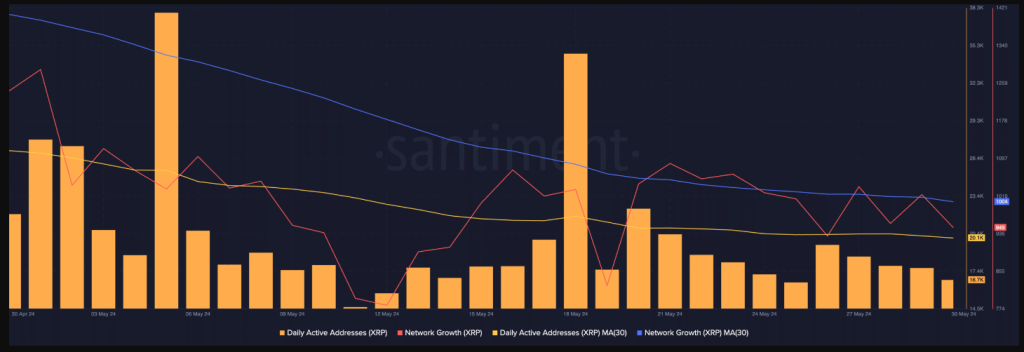

Extra dampening the mood is a first-rate descend in XRP’s energetic on-chain addresses. Based on recordsdata from Santiment, the preference of on a typical foundation energetic addresses on the XRP community has cratered by 30% over the final month. This decline is mostly viewed as a precursor to a designate walk, because it indicates a lower in total community job and particular person engagement.

Revenue Amidst The Gloom?

On the opposite hand, there are some glimmers of hope for XRP bulls. An enticing recordsdata level unearths that on a typical foundation traders are silent managing to turn a revenue. An analysis of XRP’s on a typical foundation transaction volume in revenue as compared with loss reveals that for every transaction ending in a loss, 1.16 transactions yield profits. This implies that despite the total bearish sentiment, non eternal buying and selling alternatives could exist for professional investors who can capitalize on market volatility.

MVRV Ratio Offers A Completely different Perspective

One other element that would entice some investors is the detrimental Market Tag to Realised Tag (MVRV) ratio for XRP. This metric the truth is compares the present market designate of XRP with the frequent designate at which all XRP tokens had been obtained.

A detrimental MVRV ratio suggests that XRP is for the time being undervalued, potentially presenting a buying for opportunity for investors seeking resources buying and selling under their historic designate substances.

XRP Tag Forecast

In the period in-between, the present XRP designate prediction indicates a 20% upward thrust to $0.626627 by July 1, 2024, despite a bearish market sentiment reflected by technical indicators. The Anxiousness & Greed Index at 72 reveals excessive investor greed, suggesting actual buying for behavior but moreover a risk of overbought stipulations and ability designate corrections if sentiment shifts.

Disclaimer: The records chanced on on NewsBTC is for tutorial capabilities

most attention-grabbing. It does no longer signify the opinions of NewsBTC on whether to purchase, promote or abet any

investments and naturally investing carries risks. You must very smartly be suggested to behavior your possess

analysis earlier than making any funding choices. Explain recordsdata supplied on this net jam

entirely at your possess risk.