- Bitcoin’s antagonistic price action continues, with BTC down 7.6% this week.

- Market analyst Ben Lilly informed Crypto Briefing that weakness has been creeping into the Bitcoin market since February.

- Lilly is optimistic about Ethereum attributable to its rising prominence within the aged finance world.

The plug within the crypto market continues. Bitcoin’s price fell below $35,000 to lows of $32,150 this morning. It’s now down 7.6% this week and finest 12.5% increased than its yearly opening at $28,900. In an interview with Jarvis Labs analyst Ben Lilly, Crypto Briefing makes an are trying to notice the underlying dynamics that possess moved since final 300 and sixty five days and what might per chance perhaps perhaps lie ahead for the asset.

The Market’s Main Avid gamers

Traders can’t elaborate the volatility of crypto resources on Elon Musk’s tweets or assuming that weaker fingers offered alone.

To just like the noise, there is on-chain files that can aid establish trends. Jarvis Labs has designed several on-chain gadgets that aid them dwelling short and lengthy-term trends. They deploy AI tactics and shopping and selling bots to establish the main gamers within the market. Their meticulous diagnosis finds that there is continually a chunk gap or time-lapse earlier than a trend plays.

The dominant gamers in any shopping and selling enviornment of interest are market makers. They aid the market’s liquidity by continually making an are trying for and promoting to favor spreads within the relate ebook. Market makers customarily alternate their recommendations per the market stipulations. On the entire, their strategy involves low-threat profits alternatives from the premiums paid by retail traders on crypto-linked products—as an instance, the top rate arbitrage alternate of Grayscale shares.

There are a form of classes of metaphorical fish in any market ecosystem. The supreme amongst them are whales: the good traders with deep pockets. Then there are market movers, otherwise identified as sharks. Market movers are energetic traders and traders who feed on the weaknesses of the market. Indirectly, there is the market itself: the ocean, which includes all a form of traders within the ecosystem. When Crypto Briefing spoke to Jarvis Labs analyst Ben Lilly, he started the dialog by explaining how market movers possess impacted the leisure of the ecosystem.

“Basically the most influential market movers appear to be tied not essentially to one but every other, but with the media,” he outlined. “Tracking enlighten wallets and their actions can customarily aid us predict news drops or regulatory announcements. This is a runt bit of a alternate from what we saw in 2018 when pods of whales had been more general.”

Bitcoin is shopping and selling at around $32,150 on the present time—roughly 50% off its all-time high. In accordance to Lilly, the present tumble is the demolish end result of sharks “attacking the softness within the market that used to be building up from whales and miners promoting.” The weakness within the market is also traced support to gradual February when the quiz for Bitcoin started to silly.

Bitcoin’s Hold Assign-Up

Lilly added that the early stage of the bull cycle thru gradual 2020 and early 2021 used to be carefully entertaining by the dwelling market. “In gradual 2020, it used to be all about the dwelling market,” he acknowledged. “Due to this we saw such fabulous price action that spilled over into 2021. Nonetheless with this price action came some bigger gamers unloading a pair of of their Bitcoin. This is a standard activity.”

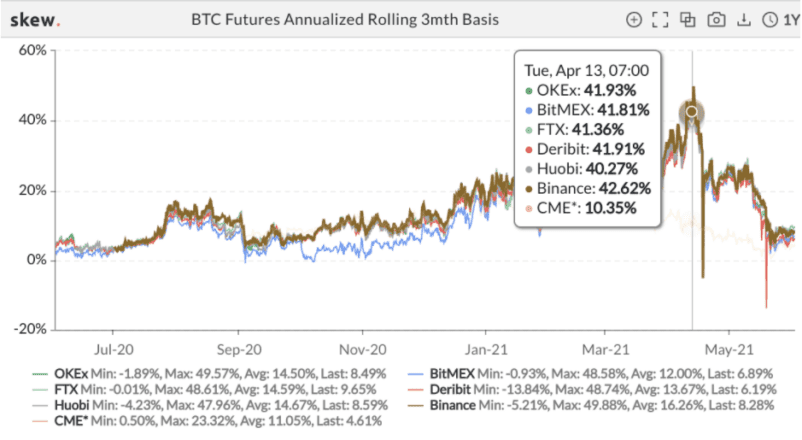

The decline within the dwelling market dwelling the stage for derivatives to shine, which ended in a surge within the futures market. Lilly outlined that the high spreads within the futures market had been an part within the market’s slowdown on yarn of loads capital used to be allocated to derivatives moderately than dwelling buys for Bitcoin or any a form of asset. He acknowledged:

“The quiz within the dwelling market slowed a runt bit, and we saw the derivatives market divulge over all over every other time. This used to be on stout display, with spreads within the futures market growing to more than 40%. With this unfold, bigger companies started to allocate capital in direction of this unfold. It’s a pleasant alternate as companies can withhold a fair map relative to rate and favor that 40%+ unfold. The alternate-off used to be capital used to be not being frail to procure bitcoin, pick altcoins, or any a form of instrument. It used to be being frail to favor this unfold. This contributed to the market losing upside momentum.”

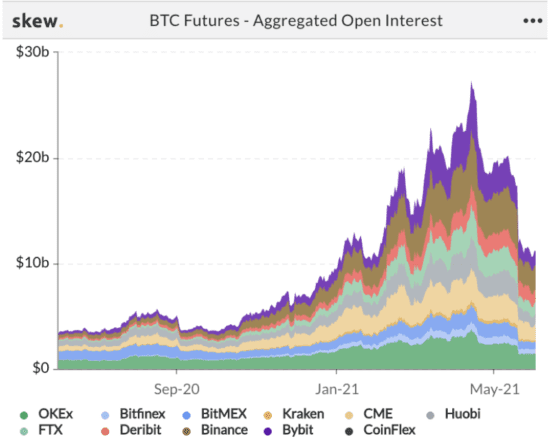

Lilly added that the height in beginning passion on futures matched the height within the unfold. As whales started to distribute their capital, the dwelling market misplaced a pair of of its strength.

“A telltale sign this used to be taking dwelling used to be the rising amount of capital being frail within the futures market,” he acknowledged. “Level to how the height in Launch Interest pairs up with the height within the unfold. So in Q2, we had the dwelling market losing a runt bit of momentum with whales distributing and an increasing form of capital getting tied up into a alternate, taking advantage of the market getting overheated thru more shorting. Indirectly, these spreads compressed, and the momentum shifted to the downside.”

Market Movers Plucked the Spoil

The market suffered an extraordinarily sturdy blow in some unspecified time in the future of Would per chance merely. On Would per chance merely 12, Elon Musk revealed that Tesla would discontinue accepting Bitcoin payments citing environmental issues. China also doubled down on mining bans and pledged that it would tighten crypto guidelines.

The worst blow came on Would per chance merely 19 when three self-regulatory organizations in China clarifying the nation’s stance on cryptocurrencies, reiterating bans from 2013 and 2017 that blocked payments companies from providing crypto companies and ICOs. On the same day, it used to be revealed that Inside Mongolia had dwelling up a hotline for reporting Bitcoin miners (the map had banned mining in April). Bitcoin’s price dropped 30% to lows of $30,000 from $42,800. This used to be when the market movers struck to launch the downtrend, Lilly says.

“It’s crucial to mark quite loads of these inflows weren’t precise a one-off from the ban,” he outlined. “We saw miners promoting extra money than they generated since Would per chance merely 5, effectively earlier than the selloff. Nonetheless what’s entertaining is with this tumble, we had more than one areas of crypto excited by promoting. Miners had been one community. We also had market movers taking phase.”

Lilly added that Binance is steadily the dominant alternate market movers and miners expend for promoting, adding that “the most contemporary selloff used to be no exception.” Even supposing there used to be some activity in a form of China-pleasant exchanges following the miner ban, the selloffs paled when put next with Binance. Jarvis Labs recorded essential inflows from market movers they’d tracked earlier than and in some unspecified time in the future of the crash.

Is the Bull Market Over?

Since the selloffs, many crypto enthusiasts possess begun to quiz “Is the bull market over?” Lilly identified that as spreads possess returned to come fair, the dwelling market might per chance perhaps perhaps be due for an uplift. He acknowledged:

“Now here we are with just about fair spreads. This form it’s now time for the dwelling market to compose momentum for but every other breeze increased. It’ll divulge a runt bit of time.”

The institutional inflows of Q2 2020 possess completely dried out in 2021. Tesla, Ruffer, and loads others possess booked earnings from their BTC funding above $50,000. Grayscale’s quiz has also reduced with premiums mostly within the antagonistic since February. Peaceful, Lilly is mildly optimistic about the return of premiums and Grayscale getting an ETF approval. He added:

“The stay of unlockings in 2020 created an immense amount of latest GBTC shares within the market. This original injection of supply takes time to web eaten up. And to be precise, it’s taken longer than I expected. An very honest valid formula to factor in here is fancy a halving tournament. It takes a runt bit of time earlier than the tumble in original supply issuance impacts price.”

He also acknowledged that this might per chance perhaps very effectively be some time earlier than the original equilibrium works itself out, explaining that the present tumble sped the course of up, and “acted as a leisure for the Belief.” He added that when the discount strikes closer to a top rate, “the influence GBTC has on dwelling costs is seemingly to reach as non-public traders gain BTC on the dwelling to allocate in direction of the Belief.”

Bitcoin vs. Ethereum

Lilly also shared his recommendations on the 2d-greatest cryptocurrency by market cap, Ethereum. He commented on the blockchain’s strengthening memoir amongst institutional traders and key gamers within the aged finance world. Ethereum futures went are living on CME Group in February, while files reveals that whales had been gathering ETH. “I don’t watch this slowing down,” Lilly acknowledged.

Lilly added that he thinks it “makes more sense” to many traders within the aged finance condo to make investments in ETH over BTC. He acknowledged:

“I know I’m flying against the wind on this one, but in case you stay in aged finance and realize the dance regulators and Bitcoin are having, the “threat” Ethereum poses to the U.S. dollar is less. Which is never to claim Bitcoin is in effort or the leisure fancy that. Ethereum is precise less.”

Lilly expanded on his thesis by explaining that Ethereum’s community construct is notion of as one of its key strengths. Ethereum has lengthy established itself because the dwelling of DeFi and NFTs this 300 and sixty five days, with billions of bucks in price locked in some unspecified time in the future of protocols fancy Aave, Uniswap, and MakerDAO. He added that while Bitcoin acts as a competitor to aged currencies, Ethereum might per chance perhaps perhaps complement a executive’s plans, explaining:

“[Ethereum] is growing extra into aged FinTech channels than Bitcoin. To me, here is something I’ve heard from investing professionals that stare the asset as having more expend cases from a monetary plumbing point of stare. It’s not competing as a currency fancy Bitcoin is. Ethereum acts more fancy a facilitator to a nation’s world agenda, not as a competitor.”

Lilly also identified that Ethereum has EIP-1559, its extremely anticipated “ETH buyback” rate burning proposal, on the horizon. EIP-1559, attributable to ship on Jul. 14, might per chance perhaps perhaps put ETH a deflationary asset if the community sees satisfactory activity. Lilly acknowledged that he expects Ethereum’s funding memoir to grow “within the impending months” as EIP-1559 approaches.

In conclusion, crypto’s bullish and bearish phases within the final two quarters possess highlighted the rising and falling in quiz since Q2 2020. Consolidation is seemingly to launch amongst whales and market movers in a comparatively real price vary. Furthermore, these inflows and the eventual ruin-out will divulge time to build.

The certainty on or accessed thru this websites is obtained from fair sources we specialize in to be correct and official, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any knowledge on or accessed thru this websites. Decentral Media, Inc. isn’t an funding manual. We attain not give personalized funding advice or a form of monetary advice. The certainty on this websites is discipline to alternate without survey. Some or all of the working out on this websites might per chance perhaps perhaps change into outdated, or it might per chance perhaps perhaps very effectively be or change into incomplete or incorrect. We might per chance perhaps perhaps, but aren’t obligated to, change any outdated, incomplete, or incorrect knowledge.

That you simply can perhaps perhaps per chance still never put an funding decision on an ICO, IEO, or a form of funding per the working out on this websites, and as well it’s possible you’ll perhaps perhaps still never make clear or otherwise rely on any of the working out on this websites as funding advice. We strongly counsel that you seek the advice of a certified funding manual or a form of certified monetary skilled if you’re making an are trying for funding advice on an ICO, IEO, or a form of funding. We attain not web compensation in any web for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

Gaze stout phrases and conditions.

MicroStrategy to Elevate Every other $400M in Debt for Bitcoin

MicroStrategy has announced the sale of $400 million in senior secured notes due 2028 in a non-public providing to certified institutional traders. The $400 million sum can be frail to…

What is Kusama? How Polkadot’s playground accommodates blockchain de…

Kusama is moderately young and used to be founded in 2019 by Dr. Gavin Wood, who also founded the Web3 Foundation and co-founded Ethereum. The team within the support of Kusama is largely the same…

Bitcoin “on Track to Hit Six Figures in 2021”: Bloomberg

Bitcoin to six figures? Bloomberg thinks it’s seemingly to happen this 300 and sixty five days. Bloomberg Shares Crypto Forecast Bitcoin might per chance perhaps perhaps ruin $100,000 this 300 and sixty five days, per Bloomberg. In a June crypto outlook…

Bitcoin Closing in on Ultimate Month-to-month Dip Since 2011

Bitcoin is down over 36% in Would per chance merely with hours left until the monthly closing. Ethereum has dipped 9% this month. Bitcoin’s Important Correction Bitcoin appears to be like to be like fancy it’s about to shut…